Ethereum (ETH) Price Prediction: Ethereum Eyes $4,600 Breakout as Weighted MA Pullback and

November 1, 2025

Ethereum (ETH) is showing renewed strength as technical and on-chain indicators converge toward a potential breakout.

The second-largest cryptocurrency by market capitalization appears to be preparing for an upward move toward $4,600, supported by a Weighted Moving Average (WMA) pullback and consistent institutional accumulation.

Weighted MA Pullback Signals Accumulation Zone

Analyst The-Thief on TradingView outlined what he calls the “Liquidity Thief” strategy—a blueprint that identifies Ethereum’s pullback retracement phases as opportunities for accumulation rather than weakness.

Ethereum’s stealth accumulation play: smart money scoops discounts on weighted MA pullbacks before the $4,600 breakout. Source: The-Thief on TradingView

The setup highlights three strategic entry zones between $3,700, $3,800, and $3,900, aligning with ETH’s WMA support levels. According to the analyst, these levels represent discount zones where “smart money” tends to accumulate before the next impulsive rally.

“We’re essentially stealing liquidity at discount prices during these inefficiency windows,” The-Thief explained, emphasizing the strategy’s focus on gradual, layered entries rather than aggressive market orders.

The bullish bias remains valid as long as the WMA continues to act as dynamic support. A decisive break below $3,500 would invalidate the setup, while a sustained push above resistance near $4,100 could open the door to the $4,600 target zone.

Institutional Accumulation Strengthens Bullish Outlook

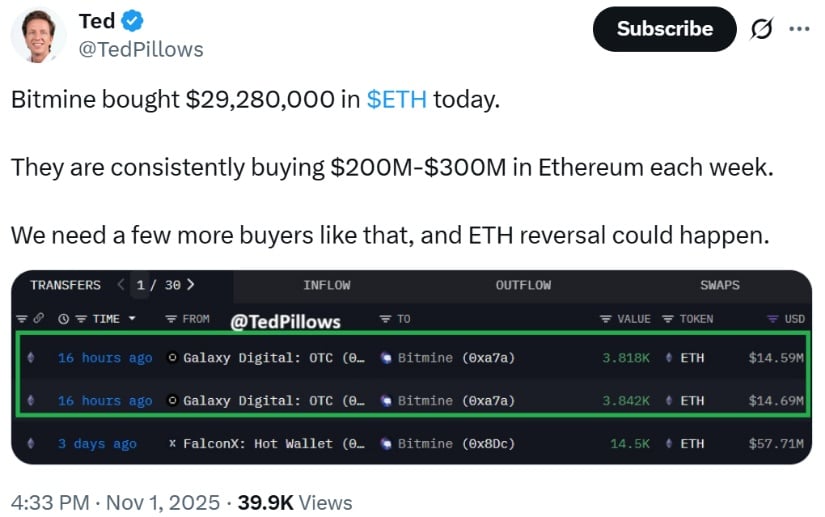

Institutional activity continues to play a crucial role in Ethereum’s price dynamics. Blockchain data shared by analyst @TedPillows revealed that Bitmine Immersion Technologies purchased approximately 7,652 ETH—worth $29.28 million—in a single day via Galaxy Digital’s OTC desk.

Bitmine quietly stacks another $29M in ETH, keeping its $200M–$300M weekly accumulation streak alive as Ethereum eyes a major reversal. Source: @TedPillows via X

According to the post, Bitmine has been accumulating $200–$300 million in Ethereum each week, a pace that underscores growing institutional conviction despite recent volatility. On-chain trackers such as Arkham Intelligence also show consistent inflows to Bitmine-labeled wallets, suggesting ongoing position building.

“We need a few more buyers like that, and ETH reversal could happen,” TedPillows added, pointing to large-scale inflows as a potential catalyst for renewed bullish momentum.

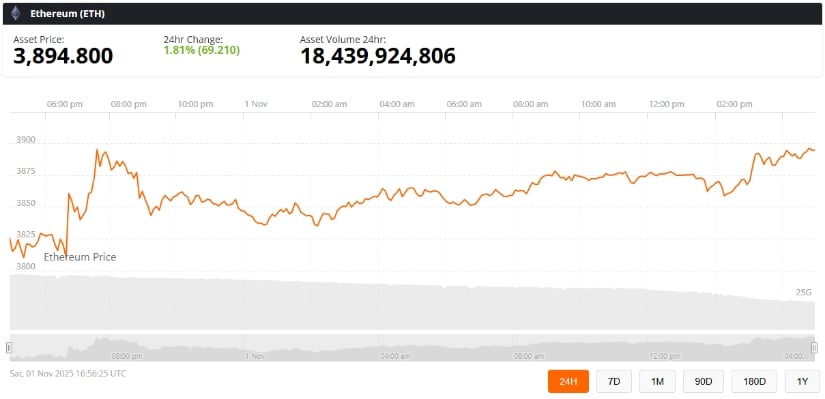

As of November 1, 2025, Ethereum trades around $3,894, marking a 1.8% daily gain with $18.4 billion in 24-hour trading volume, according to Brave New Coin data.

Long-Term Technical Structure Remains Intact

Market participants are also paying close attention to Ethereum’s broader technical setup. Crypto analyst @Sykodelic_ emphasized that ETH’s macro chart remains structurally bullish following a 4.5-year descending wedge breakout—a pattern often associated with long-term trend reversals. “There is not a single bearish thing about this,” he wrote on X, highlighting a clean breakout and retest structure with a monthly RSI still far from overbought levels.

Ethereum breaks a 4.5-year wedge with a clean retest and calm RSI, as Bitmine and liquidity tailwinds fuel unstoppable bullish momentum. Source: @Sykodelic via X

The chart suggests Ethereum has completed its post-breakout retest and could be gearing up for a continuation phase if momentum holds. This structure aligns with the accumulation patterns described by The-Thief, where institutional liquidity and technical confluence are paving the way for higher targets.

Looking Ahead: Eyes on $4,600 Resistance

With both technical and fundamental conditions aligning, Ethereum appears poised for a potential move toward $4,600, provided that current support levels hold and buying pressure continues. The combination of weighted MA support, institutional accumulation, and macro correlation strength paints a constructive short- to mid-term picture.

Ethereum (ETH) was trading at around $3,894, up 1.81% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

However, traders should remain cautious near resistance zones, where profit-taking and volatility could increase. If momentum persists, a breakout above $4,600 could mark the start of a renewed bullish phase heading into year-end.

Search

RECENT PRESS RELEASES

Related Post