Ethereum (ETH) Price Prediction: Ethereum Eyes $5,500 Breakout as ETF Inflows Boost Bullis

October 29, 2025

Ethereum (ETH) is gaining strong bullish traction as traders eye a potential breakout toward the $5,500 level, fueled by surging ETF inflows and improving market sentiment.

After a period of consolidation near the $4,000 zone, Ethereum is showing signs of renewed strength as institutional interest returns to the market. Recent data reveals record-breaking inflows into spot Ethereum ETFs led by BlackRock and Fidelity, reinforcing investor confidence and signaling a possible shift toward a new bullish phase for the world’s second-largest cryptocurrency.

Ethereum Tests Key Technical Breakout Zone

Ethereum is once again commanding market attention as it approaches a critical juncture in its price structure. The world’s second-largest cryptocurrency is testing a major descending trendline, with analysts suggesting that a confirmed breakout above this resistance could signal a strong bullish reversal.

Ethereum nears a key breakout point, with traders eyeing a bullish reversal and a potential surge toward the $5,500 resistance zone. Source: MMBTtrader on TradingView

Crypto trader MMBTtrader noted that “a decisive breakout above this trendline, confirmed by a sustained close and supported by high trading volume, would mark a shift in momentum from bearish to bullish.” According to classical Ethereum technical analysis, such a breakout often leads to strong impulse moves marked by large green candles and surging trading volume—signs of renewed buyer conviction.

Based on measured move projections from Ethereum’s recent consolidation range, MMBTtrader forecasts an initial upside target near $5,500, identifying it as a key resistance zone and the first major objective in the next potential bullish phase.

Institutional Confidence Grows as ETH ETF Inflows Surge

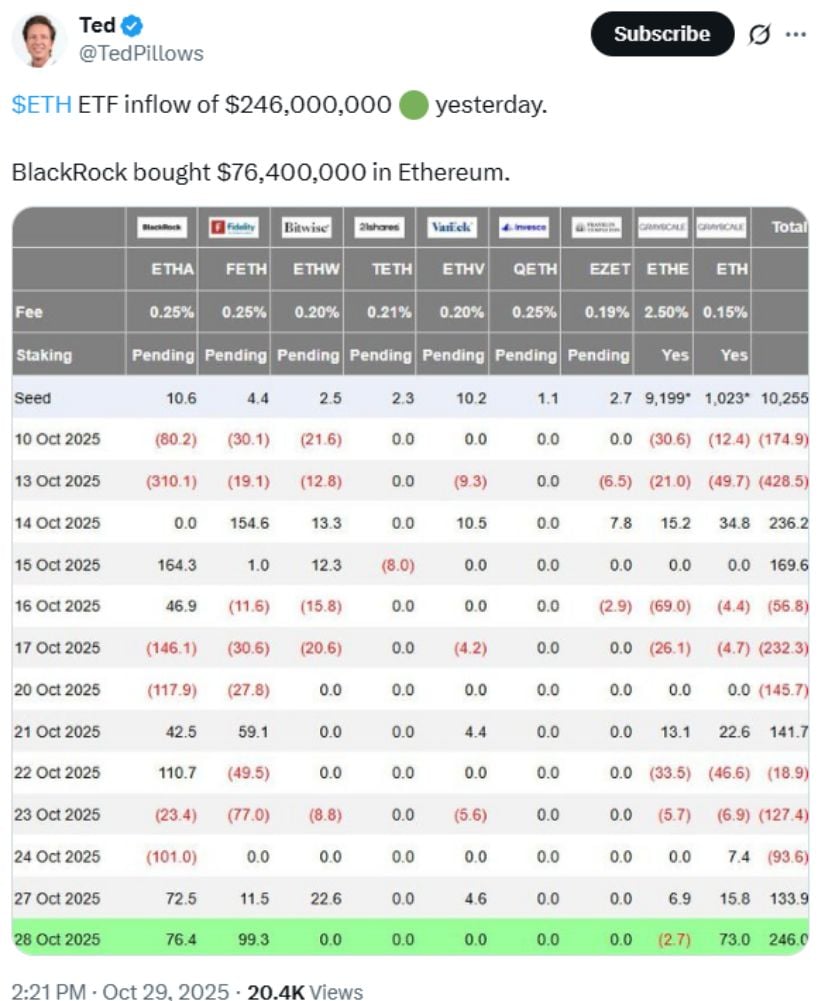

Adding to the optimism, Ethereum has seen a surge in institutional inflows through spot Ethereum ETFs. According to crypto analyst @TedPillows, Ethereum ETFs recorded a $246 million net inflow on October 28, 2025, marking the largest single-day increase of the month.

Massive $246M inflow hits Ethereum ETFs as BlackRock leads with a $76.4M purchase, signaling renewed institutional confidence in ETH. Source: @TedPillows via X

The inflow data shows BlackRock purchasing $76.4 million worth of Ethereum through its ETHA fund, while Fidelity added approximately $99.3 million to its FETH product. Other funds like Bitwise ETHW and Grayscale’s ETHE also contributed to the strong inflow trend.

Ethereum Maintains Key $4,000 Support Zone

Meanwhile, Ethereum’s spot price continues to trade near $4,000–$4,200, holding above a critical support range. Prominent crypto influencer @AkaBull_ commented, “As long as the $3.8K–$4K zone holds, there’s no reason to be bearish on Ethereum. I still think ETH has a big leg up left, which could send it above $8,000 this cycle.”

Ethereum rebounds above $4,000, with analysts eyeing further upside as long as the $3.8K–$4K support zone holds strong. Source: @AkaBull via X

This sentiment aligns with long-term bullish patterns seen after previous Bitcoin halving events, where Ethereum has historically shown delayed but amplified rallies. The current trading setup reflects a healthy balance between cautious optimism and growing investor participation.

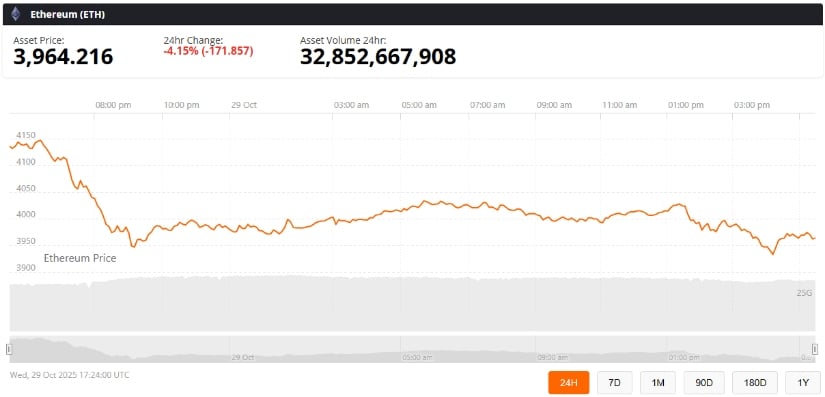

At the time of writing, Ethereum’s price stands around $3,964, according to Brave New Coin, down 4.15% over the past 24 hours, with a daily trading volume of over $32.8 billion. Despite minor corrections, analysts suggest Ethereum’s structure remains intact for a potential upside continuation if the $4,000 level continues to hold.

Ethereum’s Broader Outlook and Key Resistance Levels

While short-term volatility may persist, Ethereum’s medium-term outlook appears promising. A successful breakout above the descending trendline could trigger a measured move toward $5,500 and potentially open the door for a retest of the $6,000–$8,000 zone later in the market cycle.

Ethereum (ETH) was trading at around $3,964, down 4.15% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Several analysts believe the Ethereum ETF momentum and institutional interest could act as a strong tailwind. With companies like BlackRock and Fidelity reinforcing exposure, Ethereum’s growing integration into mainstream investment products may strengthen its position as the leading smart contract platform.

Search

RECENT PRESS RELEASES

Related Post