Ethereum (ETH) Price Prediction: Ethereum Eyes $5K as RSI Turns Bullish After Triangle Bre

October 24, 2025

Ethereum (ETH) is reigniting bullish sentiment across the crypto market as the price breaks out of a descending triangle pattern above the $3,900 level, signaling a potential trend reversal toward $5,000.

The recent move has sparked optimism among traders and analysts alike, supported by a strengthening RSI, increasing institutional inflows, and growing confidence in Ethereum’s broader market structure. As momentum builds, ETH appears to be positioning for its next major leg higher amid improving on-chain and technical indicators.

Ethereum Breaks Out Above Key Support

Ethereum (ETH) is showing early signs of a potential trend reversal after reclaiming the $3,900 support zone and breaking above a descending triangle formation. The move comes as momentum indicators turn bullish, hinting that Ethereum could be preparing for a rally toward the $5,000 psychological mark.

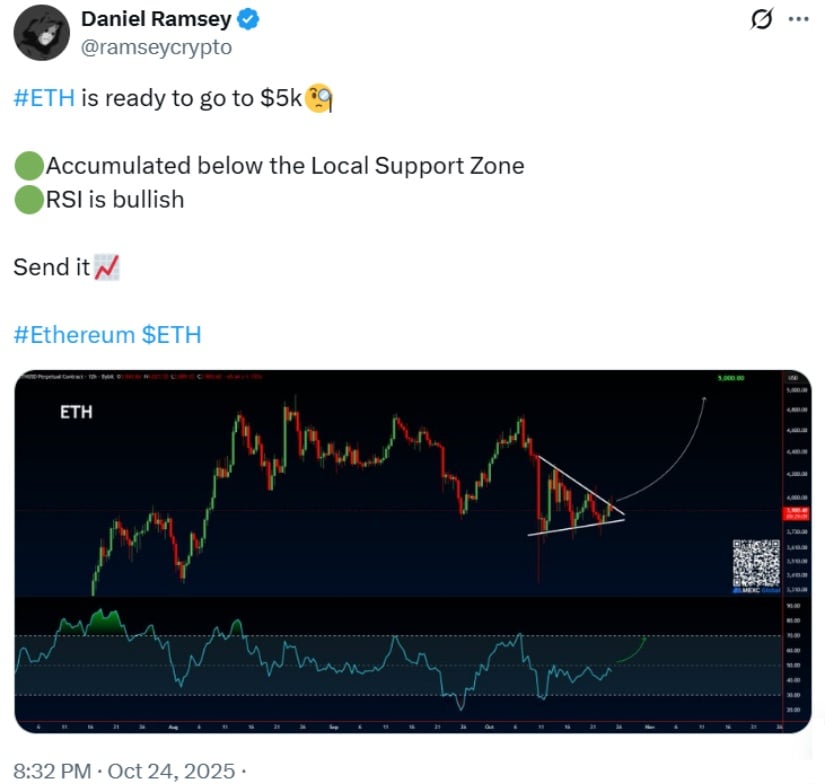

Ethereum (ETH) breaks out with bullish RSI momentum—gearing up for a potential run toward $5K. Source: @ramseycrypto via X

Crypto trader Daniel Ramsey (@ramseycrypto) highlighted the setup on X, writing that “#ETH is ready to go to $5K—RSI is bullish.” His accompanying TradingView chart shows Ethereum consolidating above local support, with the Relative Strength Index (RSI) holding near 60, reflecting renewed buying pressure.

At the time of writing, Ethereum trades around $3,950, marking a modest 1.4% daily gain and recovering from recent lows near $3,800. The breakout has drawn attention from both traders and analysts watching for confirmation of a broader bullish reversal.

Technical Structure Points to Uptrend Continuation

A descending triangle pattern typically signals bearish continuation; however, when the price breaks upward, it often indicates a shift in market sentiment. Ethereum’s breakout above $3,900 suggests that selling momentum is fading while buyers are beginning to regain control.

Ethereum (ETH) eyes $4,700 resistance as traders watch for a potential wedge breakout. Source: @Karman_1s via X

The RSI above 60 supports this outlook, reflecting steady accumulation rather than overextension. If the bullish structure holds, Ethereum could test higher resistance levels near $4,700 before potentially targeting $5,000.

According to crypto trader Kamran Asghar (@Karman_1s), “The $4,700 resistance awaits. Can ETH finally break the wedge?” His chart analysis shows a descending wedge breakout supported by rising momentum, which often precedes sustained price expansion.

Institutional Interest Strengthens Ethereum’s Outlook

Ethereum’s recent price recovery is also underpinned by growing institutional participation. Data shared by Altcoin Buzz (@Altcoinbuzzio) via CryptoQuant shows that CME Ethereum futures open interest surged 27% since early October, reaching 48,600 contracts—worth more than $10.6 billion in notional value.

Institutions flock to Ethereum, signaling growing market confidence and bullish momentum. Source: @Altcoinbuzzio via X

This rise coincides with robust inflows into Ethereum ETFs, which totaled $141.7 million on October 21, led by BlackRock and Fidelity, according to CoinDesk reports. Such institutional activity reflects a strengthening conviction among large investors, even amid short-term volatility across the crypto market.

Broader Market Context

Ethereum’s bullish signals align with overall crypto sentiment stabilizing after Bitcoin’s consolidation at the $110,000 level. As ETH gas prices continue moderate levels and Ethereum staking participation at all-time highs, on-chain fundamentals are also medium-term bullish.

Nevertheless, macro environments—like U.S. rate policy and ETF regulatory announcements—have the potential to impact near-term volatility. Traders are monitoring these catalysts closely for direction on Ethereum’s next step.

Final Thoughts

Ethereum’s break above a critical technical pattern, ascending RSI, and increasing institutional exposure all portend bullish momentum is resuming. A confirmed break above $4,700 can open the long-awaited $5,000 level.

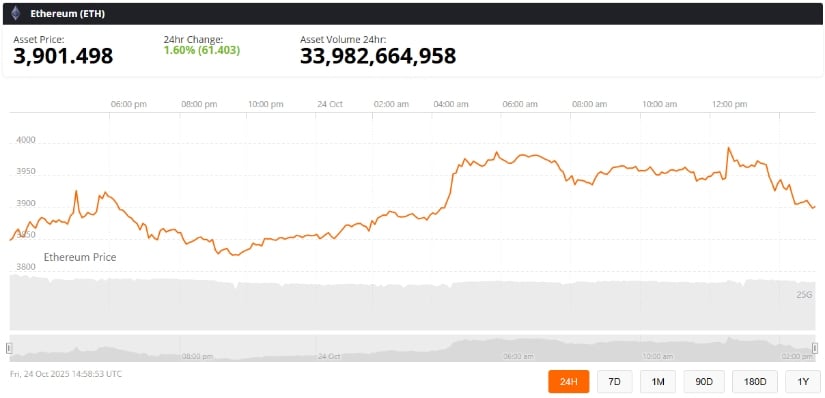

Ethereum (ETH) was trading at around $3,901, up 1.60% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Despite the risks, the recent revival of CME futures and ETF inflows demonstrates Ethereum’s attractiveness to institutional investors is far from diminishing—and could have a defining role in the next stage of its price cycle.

Search

RECENT PRESS RELEASES

Related Post