Ethereum (ETH) Price Prediction: Ethereum Eyes $7,800 Breakout After Flipping Key Resistan

October 31, 2025

Ethereum (ETH) has broken above a key horizontal resistance zone on the daily chart, signaling a potential rally toward $7,800 if the breakout holds.

Analysts describe the move as a “classic breakout-retest pattern,” setting the stage for what could be a significant upward leg for the second-largest cryptocurrency.

ETH Flips Resistance Into Support

Chart analyst Merlijn The Trader highlighted the breakout, stating, “ETHEREUM JUST FLIPPED RESISTANCE INTO SUPPORT. The red box was the final boss. Now a clean breakout + bullish retest.” According to Merlijn, the daily chart setup signals the start of what he describes as “monster moves,” implying that Ethereum may be preparing for a substantial rally in the near term.

Ethereum flips key resistance into support — a classic breakout setup signaling the start of a potential “monster move” toward $7,800. Source: @MerlijnTrader via X

The market response has been mixed. Some traders are encouraged by the breakout, citing volume confirmation and historical price behavior as evidence that ETH could reach $7,800 or higher. Others remain cautious, warning that if the support level fails to hold, short-term retracements could occur. Overall, community engagement suggests moderate optimism as Ethereum embarks on this critical phase.

Institutional Momentum Supporting ETH

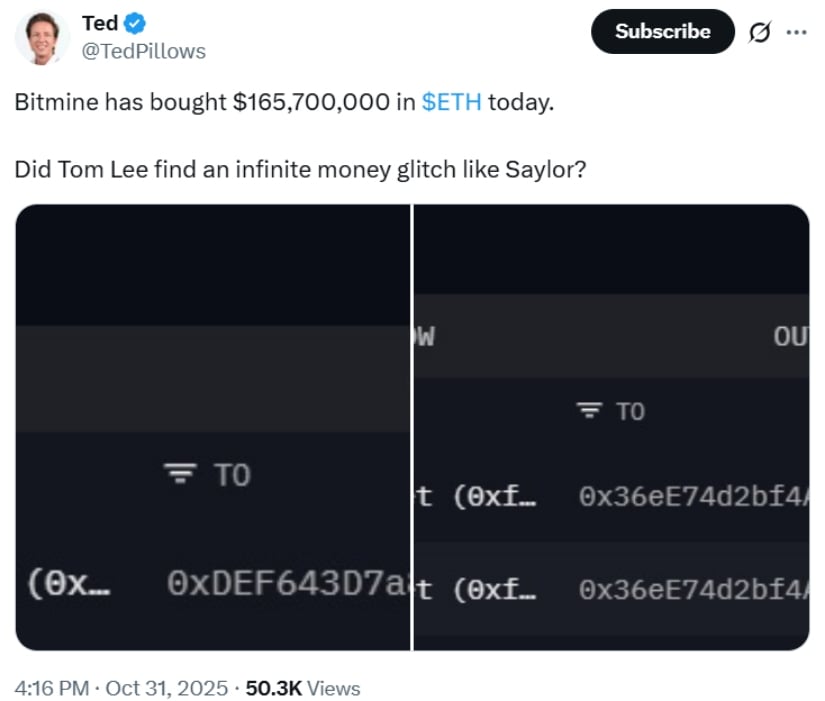

Institutional interest is playing a growing role in Ethereum’s bullish narrative. Tom Lee, founder of Fundstrat, has repeatedly emphasized that Ethereum is “significantly undervalued,” particularly given the platform’s role in tokenizing assets and hosting stablecoins. Lee believes ETH could surpass $10,000 if network adoption continues to expand, with some projections placing it near $15,000 by the end of 2025.

Bitmine snaps up $165.7M in Ethereum — sparking buzz that Tom Lee may have found his own “infinite money glitch” moment. Source: @TedPillows via X

Beyond price predictions, institutional flows are increasing. Large entities, such as BitMine Immersion Technologies, have been accumulating Ethereum, reflecting confidence in the network’s long-term potential. This growing participation may provide additional stability and upward momentum as the market continues to digest the breakout.

ETH Price Technical Outlook

Ethereum’s current chart pattern is relatively straightforward but significant. First, the long-standing resistance at $4,000–$4,500 has been cleared. Second, the price is retesting the breakout level, which is now acting as support. Finally, a sustained hold above this zone could enable the next leg up toward higher targets, reinforcing the bullish case.

Wave analysis suggests a possible early November sell-off for ETH, followed by upward momentum, with potential declines after Christmas — for educational purposes only. Source: traderisso on TradingView

Analysts are eyeing the $7,000–$8,000 range as a realistic short-term objective. If the momentum continues, Ethereum could test levels above $10,000, assuming broader market conditions remain favorable. Technical indicators support the notion that ETH’s breakout structure is historically consistent with significant upward moves in the cryptocurrency space.

Risks and Market Considerations

Despite the optimistic technical setup, Ethereum is not without risks. The newly established support must hold to maintain the bullish structure. If ETH drops below this zone, the breakout could fail, prompting potential retracements.

Broader market sentiment also plays a crucial role. Bitcoin’s movements and general risk appetite in crypto markets remain important drivers. Additionally, Ethereum still faces network-level challenges, including scalability limitations and gas fees, which could restrict short-term price acceleration if left unresolved.

Final Thoughts

With key resistance levels successfully flipped into support and institutional participation increasing, Ethereum is entering a pivotal phase. If the breakout holds, ETH could reach $7,800 in the near term, while long-term projections remain ambitious. Adoption trends, network upgrades, and broader crypto market dynamics will continue to influence Ethereum’s trajectory in the months ahead.

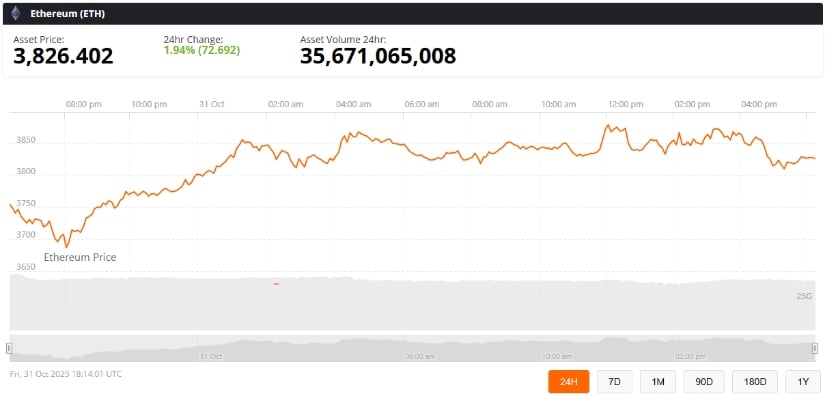

Ethereum (ETH) was trading at around $3,826, up 1.94% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Investors and traders should closely monitor both technical levels and market sentiment to gauge the sustainability of this breakout. While the bullish case is compelling, caution remains essential in a market known for volatility and rapid shifts.

Search

RECENT PRESS RELEASES

Related Post