Ethereum (ETH) Price Prediction: Ethereum Eyes $7K–$8K Surge as Post-Halving Patterns Mirr

October 26, 2025

Ethereum (ETH) is showing signs of a potential major upswing as analysts and market enthusiasts compare its current trajectory to Bitcoin’s post-halving rally in 2024.

With the cryptocurrency trading around $3,960 USD as of October 26, 2025, projections suggest Ethereum could reach between $7,000 and $8,000 by December—a potential 75–100% upside from current levels.

Historical Patterns Suggest a Bullish Run

Kamran Asghar, a crypto analyst, noted on X, “Ethereum is mirroring Bitcoin’s post-halving surge from last year. If patterns hold, $ETH could hit $7,000–$8,000 by December! Who’s ready for the ride?”

Ethereum follows Bitcoin’s post-halving surge, aiming for $7K–$8K by December. Source: @Karman_1s via X

The comparison overlays Ethereum’s 2025 price action onto Bitcoin’s 2024 post-halving recovery. Both coins experienced summer lows followed by strong rebounds, a pattern often seen in historical crypto cycles. Financial journals and past market analyses highlight that such post-halving rallies can be fueled by investor sentiment, ETF inflows, and macroeconomic factors, making pattern-based predictions relevant for traders.

Whale Activity Fuels Speculation

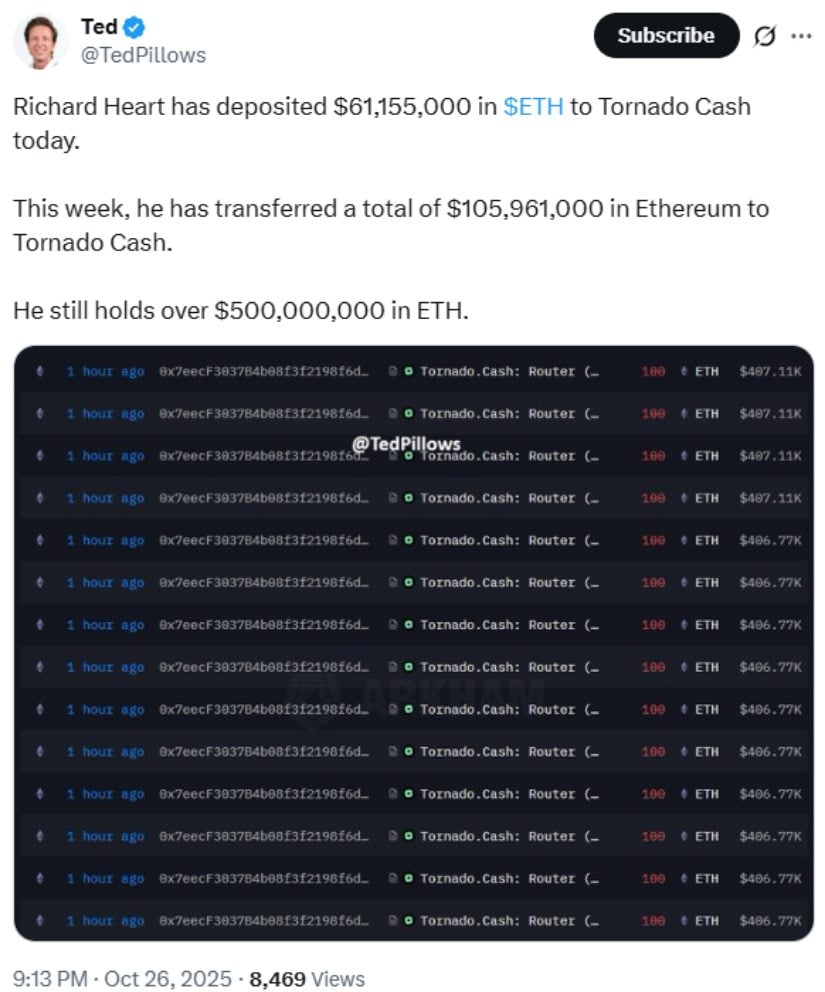

Recent on-chain data has intensified speculation around Ethereum’s near-term price movement. Richard Heart, founder of HEX and PulseChain, reportedly transferred $61.15 million in ETH to Tornado Cash today, bringing his total deposits for the week to over $105 million. Heart still retains more than $500 million in Ethereum holdings.

Richard Heart moves $61M in Ethereum to Tornado Cash today, with $106M transferred this week, still holding over $500M in ETH. Source: @TedPillows via X

These large-scale movements, tracked via Arkham Intelligence, suggest strategic repositioning rather than full liquidation. Analysts note that Tornado Cash, sanctioned by the U.S. Treasury in 2022, raises questions about the timing and purpose of these transfers. However, in a bullish environment where Ethereum recently hovered above $4,000, such whale activity could indicate confidence in higher price targets.

Technical Analysis Points to Potential Upside

Crypto trader and analyst @Crypto_Twittier shared insights into Ethereum’s technical chart, emphasizing short- and mid-term bullish potential. “If the price can recover from the current dip and break above the daily supply zone, I expect at least another leg up toward $5,900,” the analyst noted, highlighting the 0.5 Fibonacci retracement level as a critical target.

Bulls stay optimistic as Ethereum tests key RSI and 50-day EMA levels. Source: @Crypto_Twittier via X

The weekly chart shows Ethereum closing above a key resistance line, maintaining a bullish outlook for now. Meanwhile, daily support levels, such as the purple trendline, are crucial to sustaining upward momentum. Analysts stress that staying above these support zones is vital for Ethereum to maintain its bullish structure and achieve higher targets in the coming weeks.

Market Sentiment and Ethereum ETF Developments

Market sentiment continues to play a pivotal role in Ethereum’s price movements. Positive investor outlook, fueled by growing interest in Ethereum ETFs and institutional accumulation, could support further upside. These developments often increase market confidence and attract more participants, adding momentum to the cryptocurrency’s trajectory.

Ethereum eyes $5,900 as it holds key support and readies for the next bullish leg. Source: Kiu_Coin on TradingView

Historically, the introduction of regulated financial products like ETFs has boosted liquidity and credibility in the crypto market, frequently aligning with significant price rallies. As Ethereum navigates this period, the combined influence of investor optimism and structured financial instruments may reinforce its bullish potential, making it an essential factor for traders and investors to watch closely.

Final Thoughts

Ethereum appears to be entering a critical phase where historical patterns, whale activity, and technical indicators converge to suggest a possible surge to $7,000–$8,000 by December 2025. While macroeconomic variables and market sentiment remain uncertain, the combination of on-chain analytics and technical signals makes this one of the most closely watched periods in Ethereum’s history.

Ethereum (ETH) was trading at around $4,066, up 3.47% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

For investors and traders, monitoring key support and resistance levels, as well as whale transactions, will be essential to navigating the potential bullish momentum in the Ethereum market.

Search

RECENT PRESS RELEASES

Related Post