Ethereum (ETH) Price Prediction: Ethereum Holds $4.3K as Tom Lee’s BitMine Treasury Fuels

September 8, 2025

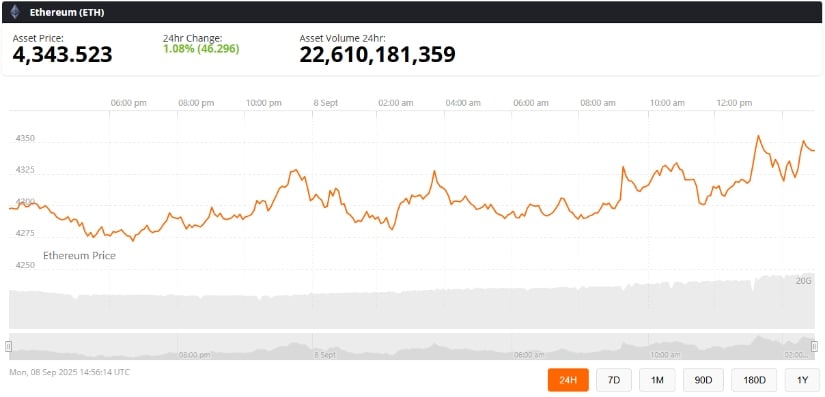

Ethereum (ETH) is holding firm around $4,350, showing resilience as traders eye technical patterns and institutional signals pointing toward a $6,000 rally.

After weeks of range-bound trading, ETH is consolidating around key support and resistance levels. Recent news of Tom Lee’s BitMine Treasury surpassing 2 million ETH, worth over $8.5 billion, has reinforced optimism among market participants. Analysts suggest that a combination of on-chain accumulation, ETF-driven inflows, and institutional confidence could set the stage for Ethereum’s next major price movement.

Ethereum Consolidates Around $4,300

Ethereum’s current trading range is tightly bound between $4,200 and $4,500, with short-term resistance at $4,370–$4,500 and support holding near $4,200–$4,250. Technical indicators, including the Relative Strength Index (RSI) and Parabolic SAR, point to a neutral momentum phase, showing neither buyers nor sellers have a decisive advantage.

Ethereum (ETH) was trading at around $4,343, up 1.08% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Analysts note that Ethereum is in a “wait-and-see” mode, where pullbacks continue to attract buyers while rallies fade quickly. This pattern underscores the market’s cautious tone, with traders monitoring whether ETH will break out or continue consolidating.

On-Chain Flows Indicate Accumulation

On-chain data reveals that over $26 million in Ethereum left exchanges on September 8, pointing to accumulation by long-term holders. However, alternating inflows during dips indicate that opportunistic selling continues.

This mixed flow reflects a fragile balance: while institutional and long-term investors are securing positions, short-term traders are quick to capitalize on price fluctuations. Analysts note that Ethereum staking, alongside rising interest in Ethereum ETFs, could provide the liquidity and demand needed for a decisive breakout.

BitMine Treasury Tops 2 Million ETH

Institutional developments further reinforce the bullish outlook. BitMine Immersion Technologies, chaired by Wall Street strategist Thomas “Tom” Lee, now holds more than 2 million ETH, worth over $8.5 billion. The company’s total crypto and cash holdings exceed $9 billion, making it the largest Ethereum treasury globally and the second-largest crypto treasury overall.

Tom Lee’s BitMine Treasury surpasses 2 million ETH, valued at $8.5 billion. Source: @johnmorganFL via X

“BitMine has surpassed the 2 million ETH milestone,” Lee stated. “The convergence of Wall Street entering the blockchain space and AI-driven token economies is creating a supercycle for Ethereum. Large holders stand to benefit the most, which is why we’re pursuing the ‘alchemy of 5%.’”

BitMine also announced a $20 million strategic investment in Eightco Holdings as part of its broader “Moonshot” strategy, aiming to strengthen the Ethereum ecosystem. Institutional backing comes from notable investors, including Cathie Wood’s ARK, Founders Fund, Pantera, Kraken, and Galaxy Digital, further solidifying confidence in Ethereum.

Technical Outlook and $6K Potential

Despite current consolidation, technical patterns hint at a significant potential move. Analysts highlight a broadening wedge forming on the 4-hour chart, a pattern historically associated with heightened volatility and breakout opportunities. If Ethereum clears resistance at $4,500, momentum could accelerate toward $6,000, assuming continued accumulation and supportive market conditions.

Ethereum is coiling for a major move—when $ETH breaks out, $6K could come quickly. Source: @MerlijnTrader via X

Market sentiment remains split. Short-term traders monitor whether support at $4,200 holds, while longer-term investors focus on the breakout potential.

Final Thoughts

Ethereum’s near-term trajectory depends on maintaining support at $4,200 and breaking resistance at $4,500. Institutional buying from BitMine and increased whale accumulation laid the groundwork for a bullish tilt, despite spot market price action. Since Ethereum is still at the forefront of DeFi, NFTs, and enterprise adoption, the rally to $6,000 is still plausible, provided momentum accelerates and new order flow enters the picture.

For investors and traders, the coming weeks will decide if Ethereum enters a new bull cycle or keeps consolidating before its next big move.

Search

RECENT PRESS RELEASES

Related Post