Ethereum (ETH) Price Prediction: Ethereum Mirrors Bitcoin’s 2020 Setup as $1.3B ETF Inflow

October 5, 2025

Ethereum is entering a potential expansion phase, drawing strong parallels to Bitcoin’s 2020 rally as institutional inflows surge and technical patterns point to a bullish breakout.

After a long consolidation period, analysts say Ethereum (ETH) may be gearing up for its next major move. The cryptocurrency recently reclaimed the $4,500 mark, supported by rising ETF inflows and improving on-chain indicators. Market sentiment is turning optimistic, with traders comparing Ethereum’s structure to Bitcoin’s pre-rally setup in 2020—suggesting the next leg higher may be approaching if resistance levels are cleared.

Accumulation to Expansion: A Familiar Template

Recent commentary from crypto analysts points to a striking parallel: Ethereum (ETH) appears to be tracing a path reminiscent of Bitcoin’s 2020 rally. As @galaxyBTC observer put it, “Ethereum now, feels like BTC at $10k”, highlighting the visual similarity between Ethereum’s 2021–2025 trend and Bitcoin’s 2017–2021 breakout phases.

Ethereum ignites its expansion phase, signaling the start of a powerful rally toward new all-time highs. Source: @misterrcrypto via X

Mister Crypto (@misterrcrypto) argues that ETH has completed a prolonged accumulation phase spanning 2021 to 2025 and is now entering an expansion phase, where “new ATHs are inevitable.” The implication: if Ethereum follows a similar trajectory to Bitcoin’s past surges, a deep push higher may be in its cards.

Resistance Under Pressure: Repeated Trendline Rejections

Despite the bullish narrative, Ethereum is not without technical hurdles. Analyst Ali (@ali_charts) notes that ETH has faced four consecutive rejections at a descending trendline since September 2025. This kind of persistent resistance suggests that while momentum is building, a step back or consolidation is possible before a true breakout.

Ethereum faces four consecutive trendline rejections, building tension before a potential breakout. Source: @ali_charts via X

Historically, trendlines have served as meaningful inflection points in volatile crypto markets—successful breaks often presage sustained upward trends when reinforced by strong fundamentals.

ETF Inflows Revive Institutional Interest

Ethereum’s bullish outlook is being reinforced by a strong rebound in ETF activity. Spot Ethereum ETFs attracted around $1.3 billion in weekly inflows, marking a sharp turnaround after prior redemptions. This surge pushed cumulative inflows to approximately $14.42 billion, inching closer to the significant $15 billion mark. Analysts view this recovery as a sign of renewed institutional confidence in Ethereum, especially as market conditions stabilize and the crypto market regains momentum.

Ethereum’s bullish momentum strengthens as spot ETFs see a $1.3 billion rebound in weekly inflows, signaling renewed institutional interest. Source: SoSoValue

BlackRock’s ETHA ETF continues to dominate the landscape, contributing heavily to the recent inflows. In one day alone, spot Ethereum ETFs drew in nearly $444 million, surpassing Bitcoin ETF activity, according to The Block.

Additional data from TradingView and CoinDesk show weekly net inflows exceeding $700 million across major funds, suggesting sustained institutional accumulation. This momentum signals that Ethereum is increasingly being treated as a legitimate and regulated gateway for large-scale investors seeking long-term exposure to the crypto ecosystem.

Looking Ahead: A Bullish Call With Conditions

Ethereum’s current price action carries echoes of Bitcoin’s breakout path in 2020. The confluence of trendline compression, renewed ETF inflows, and positive on-chain metrics suggests that ETH is building toward a possible breakout.

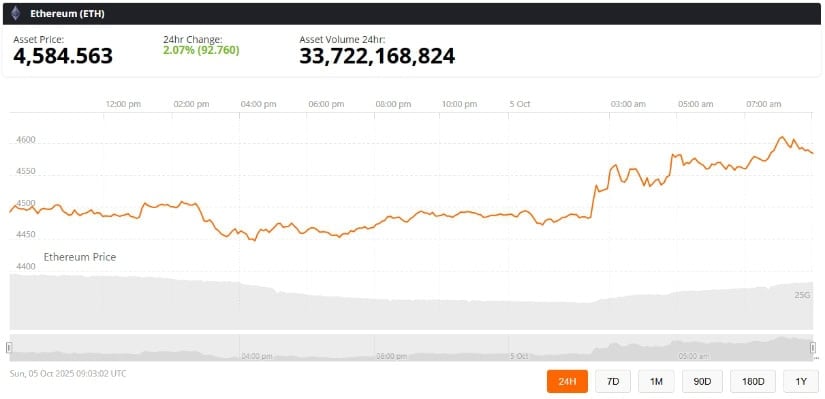

Ethereum (ETH) was trading at around $4,584, up 2.07% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

A clean break above resistance could unlock a run toward $5,000 or more. But until that happens, traders should watch for further confirmations and maintain caution in the face of volatility. In every move, fundamentals and flow dynamics will likely decide if Ethereum can truly replicate Bitcoin’s previous triumph.

Search

RECENT PRESS RELEASES

Related Post