Ethereum (ETH) Price Prediction: Ethereum Momentum Builds With ETF Inflows and MACD Bullis

September 29, 2025

Ethereum’s recent pullback has done little to shake bullish sentiment, as analysts argue ETF inflows and rare technical signals could propel the world’s second-largest crypto toward $10,000.

Despite a 10% weekly decline, Ethereum (ETH) continues to attract institutional interest and retail speculation. Traders are closely watching critical resistance levels and technical indicators that may determine whether the current ETH price is setting up for its next major rally.

Ethereum Price Under Pressure But Long-Term Optimism Remains

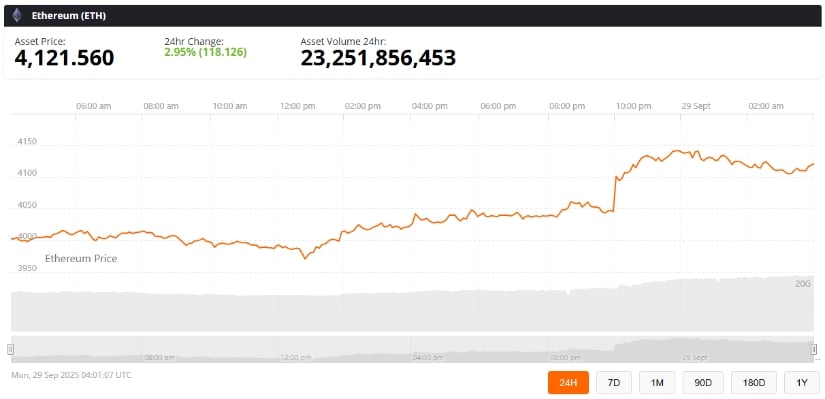

The price of Ethereum is currently trading around $4,121, up 2.95% in the last 24 hours, according to Brave New Coin data. The market remains volatile following September’s turbulence, but analysts stress that Ethereum is still on track for a significant rally that could push it into five-digit territory.

Ethereum’s brief correction may end soon, setting the stage for a potential rally above $10,000. Source: @TedPillows via X

Trader Ted (@TedPillows) argued that the pullback was not unexpected, given Ethereum’s nearly 250% rebound from its market bottom. “I’m not long-term bearish on ETH,” Ted noted, adding that he expects the correction to end in the coming weeks, with the next major move driving Ethereum above $10,000.

Key Resistance and Support Levels for Ethereum

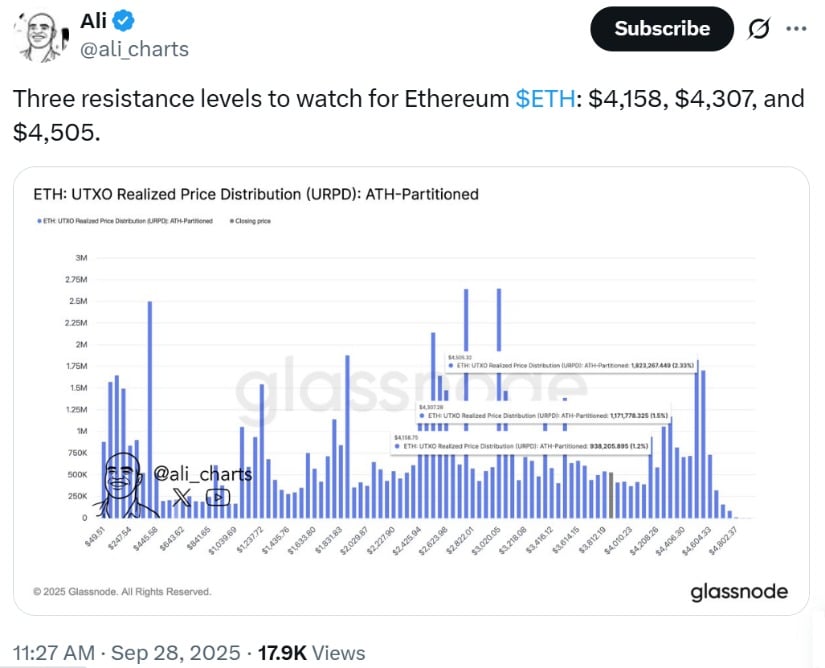

Ethereum is currently testing crucial technical zones that could determine its next major move. On the upside, resistance levels cluster between $4,158 and $4,505, based on Glassnode’s UTXO Realized Price Distribution (URPD) data shared by analyst Ali Martinez. These price points mark areas of heavy historical buying and may trigger selling pressure as investors look to exit near breakeven. A decisive breakout above these zones could open the door for Ethereum to retest its all-time high price of $4,950 and potentially build momentum toward $10,000.

Ethereum faces key resistance at $4,158, $4,307, and $4,505, with a breakout potentially paving the way toward $10,000. Source: @ali_charts via X

On the downside, Martinez identified support areas at $3,515, $3,020, and $2,772, where significant past transactions suggest buyer interest may re-emerge. Ethereum briefly dipped to $3,820 before recovering to around $4,000, though the rebound lacked strong momentum. Traders are watching closely to see whether ETH consolidates above support or risks another leg lower before a breakout attempt.

Technical Signals Point to Momentum Shift

Merlijn The Trader (@MerlijnTrader) pointed to Ethereum’s monthly chart, noting a breakout from a descending trendline alongside a MACD bullish cross. Historically, this technical setup has preceded 20–30% gains in prior cycles, including the 2021 rally. “The structure is broken, momentum is compounding, and ETFs add liquidity. Five-digit Ethereum is coming,” Merlijn said.

ETH is gearing up for its biggest run yet, with MACD momentum and ETF inflows pointing toward a potential five-digit surge in 2025. Source: @MerlijnTrader via X

Institutional flows support this outlook. Spot Ethereum ETFs launched in 2024 have attracted over $7 billion in inflows this year, despite temporary outflows of around $800 million amid broader market turbulence. Analysts argue that long-term institutional participation will remain a key driver of Ethereum’s price performance.

Looking Ahead: Can Ethereum Reach $10,000?

Optimism around Ethereum’s potential remains strong. Coinbase analysts have tied future growth to the upcoming Pectra upgrade in Q1 2025, which aims to improve scalability and lower gas fees. Historical patterns also suggest altcoins like Ethereum often trail Bitcoin early in a bull market but tend to outperform in later phases.

Ethereum (ETH) was trading at around $4,121, up 2.95% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Tom Lee, co-founder of Fundstrat, reinforced the bullish case, forecasting that Ethereum could trade between $10,000 and $12,000 by year-end. “Ethereum is entering real price discovery,” Lee stated, citing its neutrality, scalability, and growing acceptance on Wall Street as major catalysts.

Supporting this view, BitMine has become the largest Ethereum treasury holder globally, with 2.41 million ETH worth over $10 billion. The firm recently adjusted its strategy to increase exposure to Ethereum, signaling strong institutional conviction despite short-term volatility.

Search

RECENT PRESS RELEASES

Related Post