Ethereum (ETH) Price Prediction: Ethereum Prepares for $4,800 Push as July Rally Sets New

July 29, 2025

Ethereum price today continues to attract investor attention as it hovers near the $3,800 mark, holding key technical support despite brief pullbacks.

As July draws to a close, Ethereum’s bullish momentum has fueled fresh optimism, with analysts now eyeing a breakout that could carry ETH toward the $4,800 level.

Ethereum Price Today: Consolidation or Springboard?

As of writing, Ethereum trades around $3,766, slightly below recent resistance at $3,917. The asset remains above its 100 and 200-day exponential moving averages (EMA), signaling ongoing bullish structure despite a short-term dip. According to TradingView data, ETH gained over 3% in the last 24 hours, with trading volume rising to $32.95 billion.

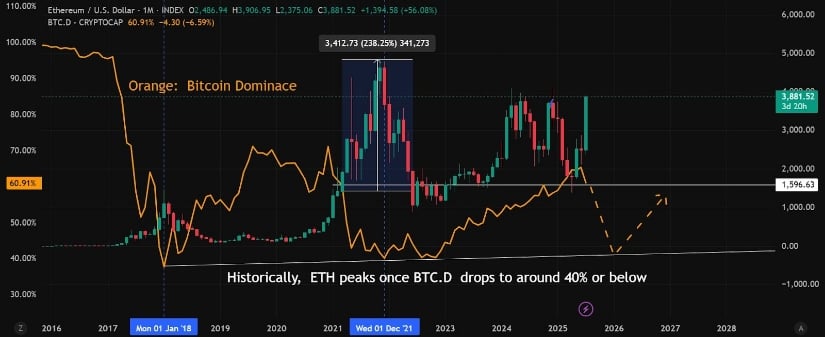

Ethereum nears a $4,000 breakout, fueled by an 80% July rally, declining Bitcoin dominance, and massive ETF inflows. Source: Lark Davis via X

“Ethereum’s stability above key EMAs suggests the bulls are still in control,” noted crypto analyst Lark Davis. “A clean break above $3,880 could trigger the next leg up.”

Institutional Accumulation Strengthens Ethereum Price Prediction

In a recent development, institutional players such as SharpLink Gaming appear to be deepening their involvement in Ethereum markets. While specific transaction volumes have not been publicly disclosed, blockchain analytics platforms have flagged notable ETH wallet activity linked to corporate entities over the past several weeks. Market analysts suggest this could be tied to long-term staking strategies and growing optimism surrounding spot Ethereum ETFs. The trend highlights increasing institutional confidence in Ethereum’s long-term value and its expanding role in the digital asset ecosystem.

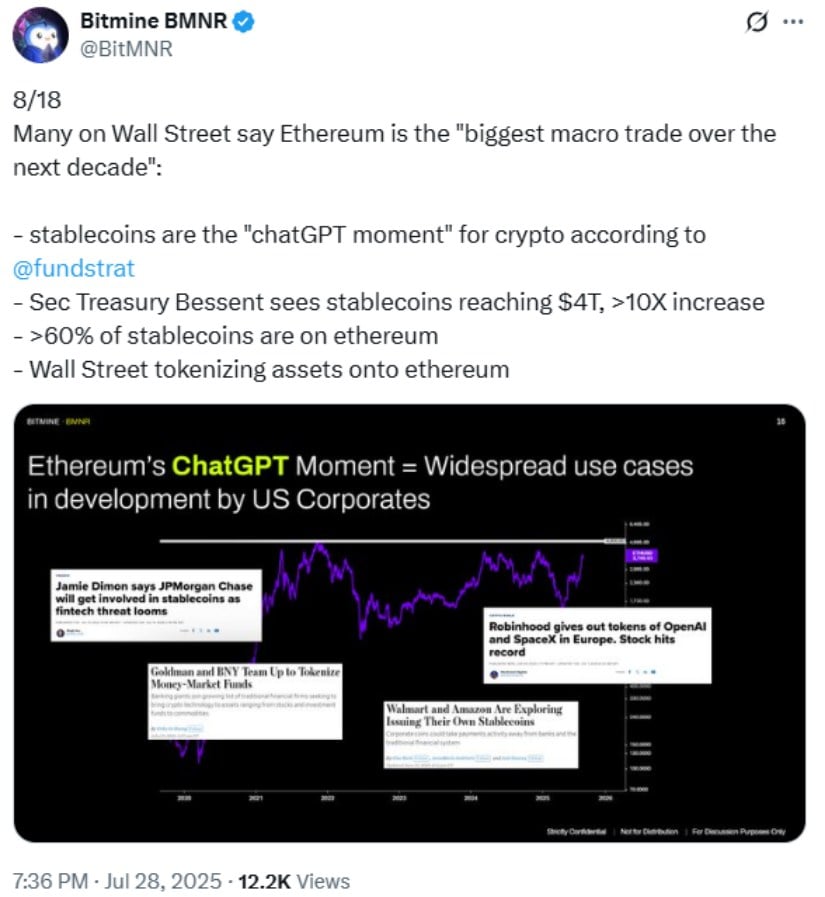

Wall Street hails Ethereum as the decade’s top macro trade, powered by a $4T stablecoin surge and growing asset tokenization. Source: @BitMNR via X

“Wall Street is treating Ethereum as the macro trade of the next decade,” said BitMine Chairman Tom Lee. According to internal estimates, Ethereum’s long-term implied value could reach $60,000, driven by stablecoin adoption and asset tokenization.

Technical Analysis: ETH RSI Today and Resistance Watch

From a technical analysis standpoint, Ethereum has broken down from its ascending channel and is now consolidating between the 20 and 50 EMAs. The immediate resistance sits near $3,880, while critical support is held at $3,703.

Ethereum (ETH/USD) tests support near $3,751 after dropping from its rising channel, with bullish targets at $3,867 and $3,993 in sight. Source: Export_Gold on TradingView

The Ethereum RSI today shows neutral momentum, suggesting the market is awaiting a decisive move. A surge in volume or a fundamental trigger—like a major ETF announcement—could tip the balance either way.

Layer 2 Activity and DeFi Fuel Broader Ecosystem Strength

Ethereum’s growing dominance in Layer 2 scaling and decentralized finance (DeFi) is playing a quiet but powerful role. Networks like Arbitrum, Optimism, and zkSync have all reported increased Layer 2 transaction volume, while protocols like AAVE continue to attract significant value.

AAVE recently bounced from the 0.618 Fibonacci level around $303, indicating potential upside toward $400 and possibly $560, especially with its integration into Kraken’s new Ink blockchain.

Fundamental Catalysts: Staking, Supply Outflows, and Wall Street Interest

Ethereum staking rewards and consistent on-chain outflows from exchanges indicate that long-term holders remain confident. Over $52 million in ETH left centralized platforms on July 29 alone, part of a multi-week trend pointing to accumulation.

Ethereum (ETH) has been trading at around $3,817, down 1.45% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Meanwhile, BitMine’s report “The Bull Case for ETH” frames Ethereum’s future as central to Wall Street’s tokenization ambitions. With over 60% of stablecoins running on Ethereum, demand for block space—and by extension ETH—continues to rise.

Ethereum Price Prediction: Can Ethereum Hit $4,800?

Analyst projections are growing more optimistic. “If ETH clears the $4,000 barrier, $4,500 and even $4,800 come into view quickly,” said Ronaldo Marquez from NewsBTC. Ethereum’s current performance marks one of its strongest Julys on record, up nearly 80% month-to-date.

Ethereum closes its strongest monthly candle since 2021, signaling bullish momentum aiming for $4,800 resistance. Source: BitcoinGalaxy on TradingView

Still, caution remains. A failure to reclaim the $3,880–$3,917 zone could push ETH back to test supports at $3,660 and $3,600.

Final Thoughts: Ethereum vs. Bitcoin 2025 and the Road Ahead

As Bitcoin dominance trends downward, some believe Ethereum could outperform Bitcoin in 2025, especially if ETF approvals and Layer 2 growth continue. Speculation is also rising around Ethereum’s upcoming Dencun upgrade and its role in powering institutional DeFi.

In short, Ethereum’s recent rally may just be the beginning. While $4,000 remains a key psychological level, eyes are now turning to $4,800 as the next major milestone in Ethereum’s journey.

Search

RECENT PRESS RELEASES

Related Post