Ethereum (ETH) Price Prediction: Ethereum Whales Fuel Bullish Momentum With $15K Target in

August 17, 2025

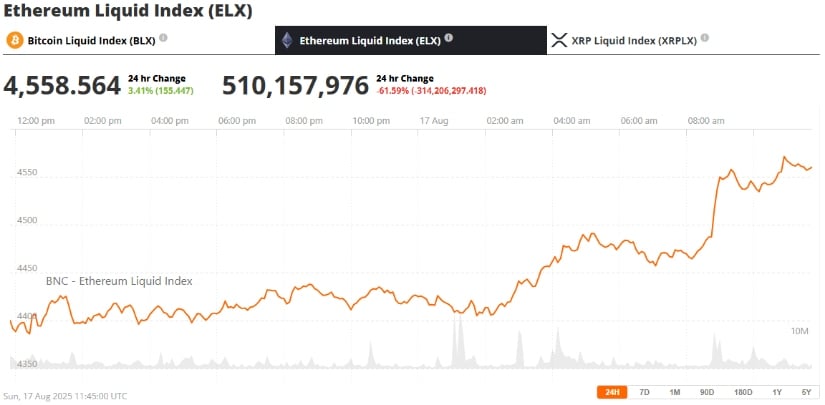

Ethereum price today is around $4,550, drawing attention as whales and institutional investors steadily accumulate large amounts of ETH, fueling optimism for a potential surge toward $15K.

This bullish sentiment comes at a time when institutional demand, ETF inflows, and Layer 2 adoption are reshaping Ethereum’s market outlook. Analysts now believe Ethereum’s combination of deflationary supply and whale accumulation could set the stage for one of its strongest rallies yet.

Ethereum Price Today and Market Sentiment

Ethereum price today remains under close watch as whales and institutions quietly accumulate massive amounts of ETH. Analysts suggest this buying pressure could be the catalyst for a significant rally, with projections ranging from $10,000 to $15,000 in the coming months.

Ethereum is poised for a potential $15,000 by December, according to Tom Lee, underscoring its rising importance among both institutional and retail investors. Source: @rovercrc via X

Tom Lee, Managing Partner at Fundstrat Global Advisors, made waves by forecasting Ethereum could “reach $15,000 by December,” highlighting the coin’s strengthening role in institutional portfolios. His call comes as both retail and corporate investors look for the next big move in crypto markets.

Whale Accumulation and Institutional Demand

Whale activity has intensified in recent weeks. According to blockchain tracker Lookonchain, one address believed to be linked to DeFiance Capital purchased 30,366 ETH worth $114 million in just 28 hours. This comes on top of significant institutional allocations such as BitMine Immersion Technology’s purchase of over 106,000 ETH, valued at more than $470 million.

A large whale recently bought a significant amount of ETH, signaling renewed bullish momentum in the market. Source: @lookonchain via X

“The conviction of whales in current market conditions signals long-term confidence in Ethereum,” analysts at AMBCrypto noted. Despite volatility in spot trading, accumulation continues at scale, suggesting that smart money is positioning ahead of a breakout.

Ethereum ETFs and Layer 2 Growth

Fresh inflows into Ethereum spot ETFs have also boosted optimism. CoinGlass data shows weekly inflows of $2.85 billion, marking one of the largest on record. Analysts point to ETFs as a key bridge for traditional investors entering the ETH market.

Meanwhile, the Layer 2 ecosystem is expanding rapidly. Networks such as Arbitrum, Optimism, and zkSync continue to report rising transaction volumes and total value locked (TVL). This growth not only relieves pressure on Ethereum gas fees but also strengthens ETH’s long-term utility and adoption narrative.

Deflationary Design and Staking Impact

Ethereum’s proof-of-stake (PoS) transition has created a deflationary token model. More ETH is being locked in validator contracts, reducing circulating supply. At the same time, staking rewards have incentivized long-term holding.

Standard Chartered raised Ethereum’s year-end target to $7.5K, highlighting stronger engagement and growing holdings—fueling FOMO among investors. Source: @nicrypto via X

As Standard Chartered noted in its recent report, “Ethereum’s deflationary mechanism combined with institutional demand provides a unique setup for sustained price growth.” The bank has set a medium-term target of $7,500 but sees potential for $12,000–$15,000 if adoption trends continue.

Technical Analysis: ETH RSI and Futures Market

From a technical perspective, Ethereum’s Relative Strength Index (RSI) indicates building momentum, though not yet at overbought levels. Futures markets tell a similar story: while the spot market has seen consistent selling, leveraged long positions are rising sharply.

Ethereum eyes new all-time highs, fueled by institutional demand and strong on-chain activity, with resistance near $4,793–$5,000. Source: @misterrcrypto via X

CryptoQuant’s futures volume data suggests whales are preparing for a potential squeeze. Futures leverage is climbing while spot selling continues, creating conditions for a sharp upward move once supply begins to thin.

Ethereum’s Role in Corporate Treasuries

The corporate sector is also leaning into Ethereum. Companies such as SharpLink and BitMine Immersion Technology have issued stock sales worth billions of dollars to build ETH treasuries.

This move reflects Ethereum’s growing status not just as a decentralized finance (DeFi) asset but also as a strategic treasury reserve.

Outlook: Will Ethereum Hit $15K?

The convergence of whale accumulation, ETF inflows, deflationary tokenomics, and Layer 2 expansion provides strong bullish momentum for Ethereum. While some forecasts point to $10,000–$12,000 in the short term, more aggressive predictions, like Tom Lee’s $15,000 year-end target, highlight the growing optimism surrounding ETH.

Ethereum (ETH) was trading at around $4,558, up 3.41% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Still, market risks remain. Spot traders continue to sell into strength, and regulatory uncertainty in the U.S. could weigh on sentiment. Yet, with smart money signaling confidence and corporate adoption accelerating, Ethereum’s path to a new all-time high appears increasingly within reach.

Search

RECENT PRESS RELEASES

Related Post