Ethereum (ETH) Price Prediction: Ethereum Wyckoff Pattern Signals $10,000 Breakout as Smar

October 23, 2025

Ethereum (ETH) is showing signs of renewed strength as analysts highlight a potential Wyckoff re-accumulation phase forming on the charts.

With ETH trading near the $3,850 level, growing institutional demand and on-chain accumulation are fueling speculation of a possible move toward the $8,000–$10,000 range in this market cycle.

Wyckoff Re-Accumulation Hints at Smart-Money Positioning

Crypto analyst Ash Crypto noted on X that “$ETH Wyckoff re-accumulation is happening right now. $8,000–$10,000 ETH is still possible this cycle.” His post included a schematic overlay showing ETH’s current price action entering the “Test” phase—a stage that often precedes a breakout in the Wyckoff model.

Ethereum enters the Wyckoff re-accumulation phase as smart money eyes a potential $8,000–$10,000 breakout this cycle. Source: @Ashcryptoreal via X

The Wyckoff theory, a century-old framework for analyzing market cycles, describes how large investors accumulate positions during low-volatility periods before driving prices higher. If this pattern holds true, Ethereum could be setting up for a strong markup phase, similar to its 2021 rally from $1,400 to $4,800.

ETH’s three-day chart currently mirrors the structural characteristics of that cycle, suggesting institutional participants are quietly building exposure while retail sentiment remains cautious.

Whale Accumulation Reinforces Bullish Outlook

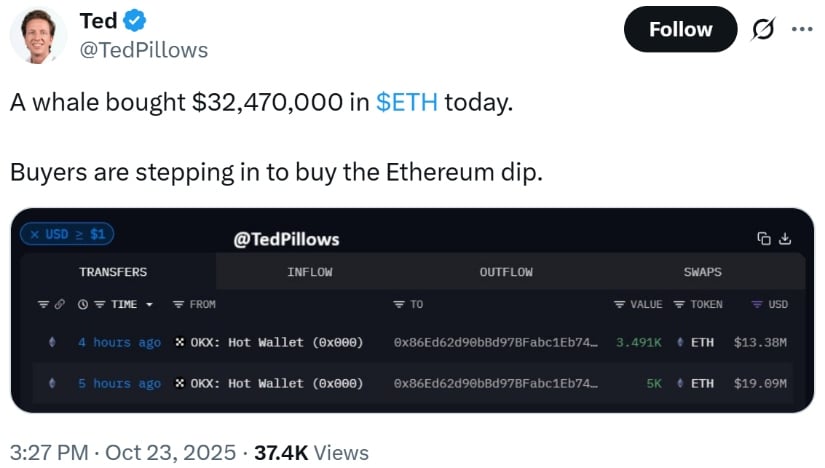

Market data support the idea of renewed smart-money inflows. On-chain analyst Ted (@TedPillows) reported that a whale wallet withdrew 8,491 ETH (≈ $32.47 million) from the OKX exchange in two separate transactions an hour apart. Such withdrawals typically signal accumulation, as large holders move funds into cold storage rather than exchanges.

A $32.4 million Ethereum whale purchase signals renewed buyer confidence as investors scoop up the dip. Source: @TedPillows via X

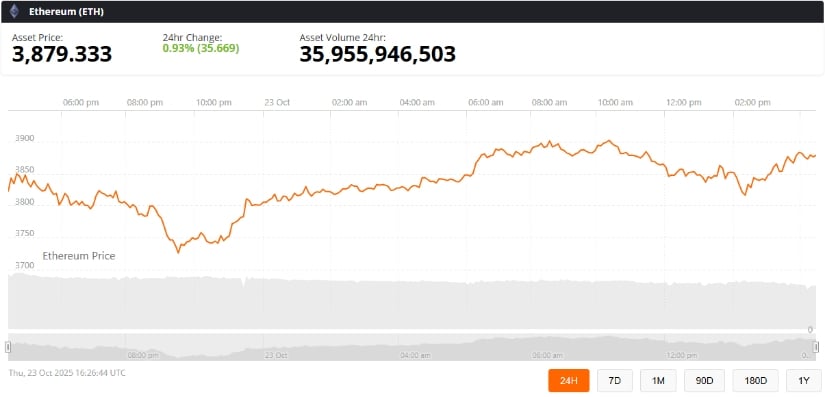

As of October 23, 2025, Ethereum trades near $3,879, up 0.93% in the last 24 hours, with a market cap of $463.8 billion and 24-hour trading volume exceeding $35.9 billion. This activity follows a brief dip to $3,700 earlier in the week—a zone now emerging as a strong support level amid whale and institutional buying.

However, whale behavior remains mixed. Some large holders have realized losses near $3,815, highlighting ongoing uncertainty. Historically, though, net inflows to private wallets have preceded sustained bullish trends once exchange selling pressure begins to fade.

Technical Structure Aligns with Triple-Bottom Pattern

Adding to the bullish technical context, market analyst Crypto Caesar (@CryptoCaesarTA) identified a potential triple-bottom formation between $3,700 and $3,800 on ETH’s 4-hour chart. The setup includes a “Break of Structure” (BOS) and “Change of Character” (CHoCH), both early signs of a trend reversal.

Ethereum forms a potential triple bottom pattern, hinting at a bullish reversal toward the next breakout zone. Source: @CryptoCaesarTA via X

A confirmed breakout above $4,000 would validate this structure, potentially signaling the start of a new medium-term rally.

Combined with the Wyckoff accumulation narrative, the confluence strengthens Ethereum’s technical base heading into November.

Institutional and ETF Flows Support Long-Term Momentum

Institutional participation continues to grow. Standard Chartered and Fundstrat’s Tom Lee both reaffirm their bullish long-term ETH outlooks, citing sustained ETH ETF inflows, growing staking participation, and the broader tokenization trend across real-world assets.

Tom Lee recently stated that “Ethereum remains one of the best-positioned digital assets for the next leg of the cycle, and $10,000 ETH is achievable before year-end if ETF demand continues.”

Meanwhile, post-merge supply dynamics remain tight—with issuance rates near zero and staking reducing available liquid supply. Combined with steady ETF inflows, these factors reinforce the argument that Ethereum’s market structure could be entering a new expansion phase.

Ethereum Price Forecast

If Ethereum maintains support above $3,700 and breaks through $4,200 with convincing volume, the next technical targets lie around $6,000 and $8,000, followed by an extended cycle move toward $10,000, as projected by multiple analysts.

Ethereum (ETH) was trading at around $3,879, up 0.93% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

The Wyckoff re-accumulation narrative, combined with whale inflows and ETF demand, paints a constructive medium-term picture. Still, Ethereum must sustain momentum and confirm the breakout before a full-scale rally can materialize.

Search

RECENT PRESS RELEASES

Related Post