Ethereum (ETH) Price Prediction: Ethereum’s MVRV Signals $5,140 Target if $3,300 Support H

July 31, 2025

Ethereum is closing in on a major breakout, with analysts eyeing the $5,000 mark as institutional demand surges and technical indicators hint at a bullish continuation.

Following a record-setting ETF inflow streak and renewed whale accumulation, Ethereum’s bullish setup is backed by growing institutional interest and a solid technical base. If momentum holds, a push toward the $5,000 zone looks increasingly likely.

Ethereum Rallies on ETF Momentum, Strong On-Chain Metrics

Ethereum rallied past $3,800 today, buoyed by growing interest in spot ETH ETFs, record institutional inflows, and technical signals suggesting a major move is underway. According to analyst Ali Martinez (@ali_charts), Ethereum could reach $4,220—and potentially $5,140—if the $3,300 support level remains intact, based on the MVRV Pricing Bands.

Ethereum eyes $5,140 as long as the $3,300 support holds, with MVRV bands signaling a bullish breakout. Source: Ali via X

The MVRV (Market Value to Realized Value) indicator, often used to assess whether an asset is over- or undervalued, shows Ethereum in a bullish zone. Historically, similar patterns have preceded major rallies in ETH price.

Technical Overview: Ethereum Builds Toward Breakout

After consolidating in the $3,700–$3,900 range through late July, Ethereum is now preparing for a potential breakout above the $4,000–$4,200 resistance band. CoinCodex data forecasts Ethereum climbing gradually toward $4,191.79 by August 2—a move that would confirm the end of its consolidation phase.

Ethereum forms a bullish cup and handle pattern, eyeing a breakout above $4K with a target near $4,191. Source: CobraVanguard on TradingView

Ethereum’s RSI remains elevated, reflecting strong buying pressure, while funding rates across exchanges suggest low leverage—a healthy backdrop for a sustained rally.

If momentum continues, analysts expect Ethereum to enter a vertical price phase in early August. A close above $4,200 could trigger the next leg higher, opening the path toward $5,000 and beyond.

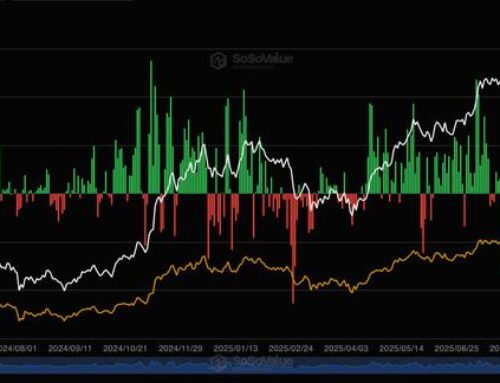

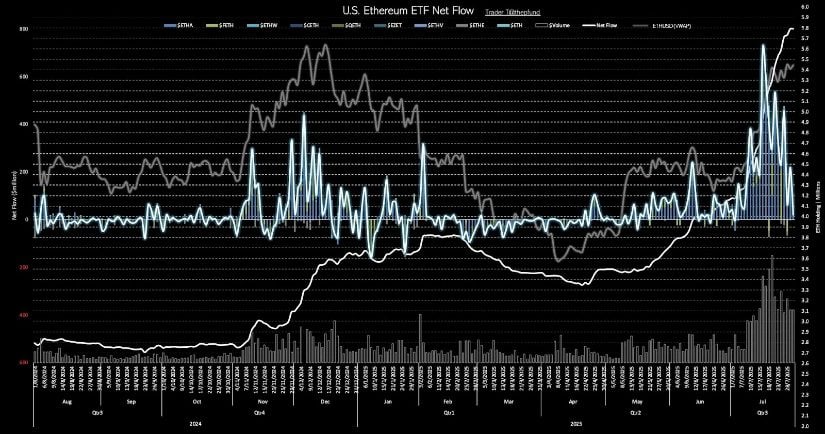

ETF Inflows Near 5% of Circulating Supply

Ethereum’s fundamentals are also strengthening, especially on the institutional side. Spot ETH ETFs have recorded a record-tying 19-day net inflow streak, adding $5.4 billion in that span. The combined holdings now represent 4.7% of Ethereum’s circulating supply, or approximately 5.7 million ETH, according to The Block and CoinGlass data.

ETH ETFs see strong inflows, led by BlackRock—signaling rising institutional confidence in Ethereum. Source: @thepfund via X

Notably, BlackRock’s ETHA product has led the charge, accounting for $4.19 billion of the inflows. This surge in demand reflects growing investor confidence in Ethereum’s long-term viability as a core crypto asset—particularly as regulatory clarity around ETH ETFs improves in the U.S.

Whale Accumulation Intensifies: Supply Squeeze Ahead?

Institutional demand is also coming from outside the ETF market. SharpLink, a gaming and investment firm, recently purchased 77,210 ETH, exceeding the total ETH minted during the past 30 days (72,797 ETH). This accumulation adds to its total holdings of 438,017 ETH, now worth nearly $1.7 billion.

Ethereum nears the critical $4K mark—reclaiming it could trigger an unstoppable rally. Source: @TedPillows via X

The move underscores a growing supply-demand imbalance. Ethereum’s net issuance remains low, while demand from both ETFs and direct buyers like SharpLink continues to rise. This dynamic is fueling speculation that ETH may be entering a supply squeeze—one that could accelerate price discovery.

Ethereum Price Outlook: $5,000 in Sight, $10,000 Not Off the Table

With Ethereum’s price up 170% from its April low of $1,471, and less than 23% away from its all-time high near $4,871, the path to $5,140 is becoming increasingly realistic.

Ethereum breaks out of a weekly triangle, eyeing a potential rally toward $10,000 if momentum holds. Source: @teluguweb3 via X

If current momentum holds—driven by institutional inflows, strong ETF demand, and bullish technical patterns—Ethereum could test $5,000 in the coming weeks. Analysts at Crypto Crew University even suggest a longer-term breakout to $7,800, or $10,000 by late 2025, if the macro trend continues.

Final Thoughts: Ethereum at a Crossroads

Ethereum’s short-term technical setup and long-term fundamentals are aligning in a way that hasn’t been seen since its 2021 peak. If it can firmly hold above the $3,300 support, technical models suggest a rapid climb to $5,140 is in play.

Ethereum (ETH) has been trading at around $3,858, up 1.74% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Combined with ETF-driven demand and whale accumulation, Ethereum may be preparing for one of its strongest quarters yet.

Search

RECENT PRESS RELEASES

Related Post