Ethereum Eyes $3.5K Breakout as Whales Drop $800M on ETH

June 9, 2025

- Ethereum bounces from $2,392 on-chain support amid whale buying.

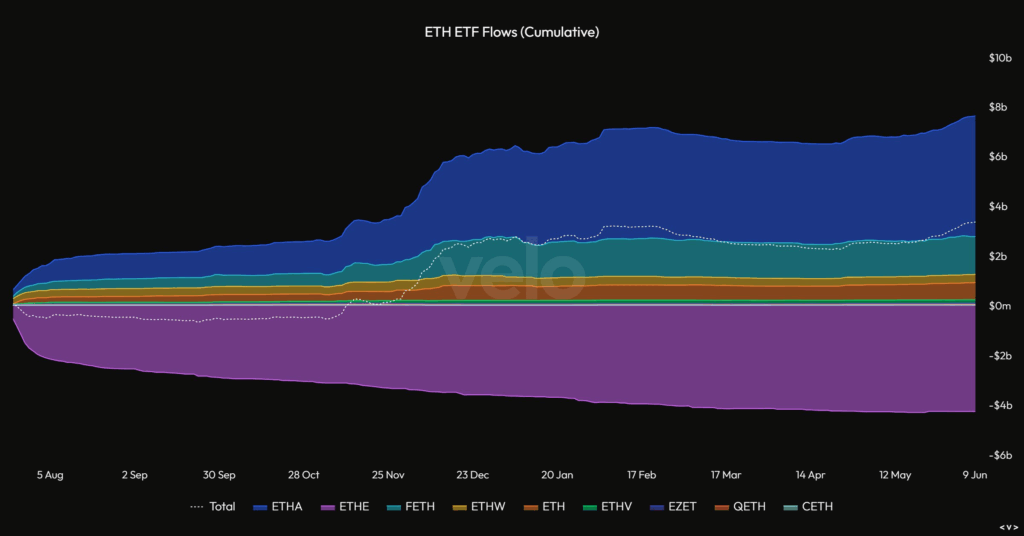

- ETF inflows hit new all-time high, quietly signaling demand.

- Chart structure points to $3,530 if $2,800 gets cleared.

Ethereum is holding steady near $2,516 after recovering from a key support zone around $2,392 — the average cost basis for Binance deposit addresses.

That rebound didn’t happen in isolation. According to @ByCoinvo, a single wallet scooped up $800 million worth of ETH, raising eyebrows across the market. At the same time, @StackerSatoshi noted that ETH ETFs just logged their highest-ever cumulative inflows, though the development hasn’t received much mainstream attention.

Supporting the trend, @crypto_goos flagged a 16% rise in active users over the last week — a solid signal that Ethereum’s network activity is accelerating again. Taken together, these data points hint at renewed strength beneath the surface.

ETH’s bounce came at a level that matters beyond charts. On-chain metrics show most major user cohorts still sit in profit — for now.

Data compiled by Crazzyblockk shows Binance users bought ETH at an average of $2,392. On OKX, the realized price is closer to $2,706. Wallets that frequently receive ETH from centralized exchanges are sitting at around $2,532, and highly active addresses average $2,513.

As long as ETH stays above $2,500, most of these groups are in the green. That means fewer holders have a reason to sell. But a drop below that line could quickly flip sentiment, driving many portfolios into the red and sparking fresh sell pressure.

This makes the $2,500 to $2,530 zone critical — not just technically, but from a behavioral perspective. It’s where fear could creep in fast.

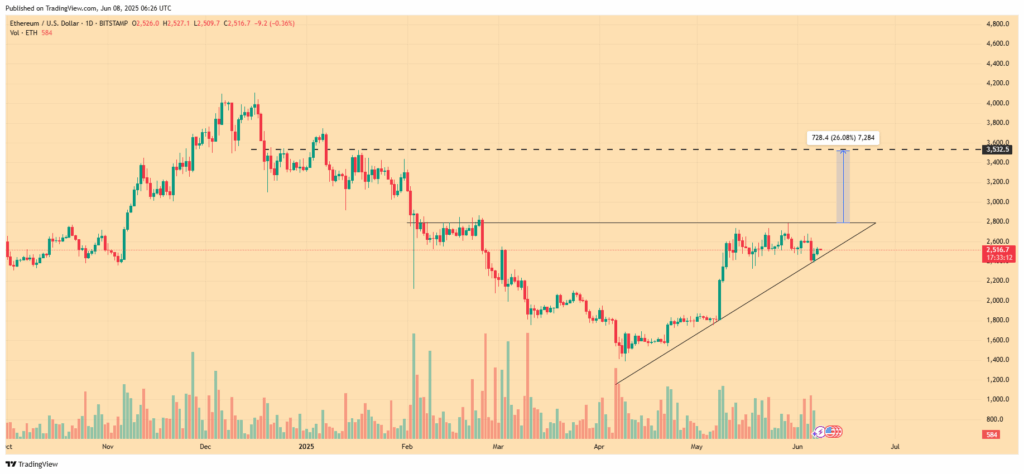

ETH’s daily chart is forming an ascending triangle — a pattern known for bullish breakouts.

Since May, buyers have made several attempts to crack resistance around $2,800, but each try has stalled. At the same time, higher lows have kept forming since April, tightening the range and setting up a decision point.

If ETH closes above $2,800 with strong volume, the triangle pattern points to a breakout target near $3,530. That would mark a 26% move higher — and retest price levels last seen in early 2024.

Volume remains moderate at 584K ETH, based on TradingView data. For now, the breakout hasn’t materialized. But pressure is building.

While much of the attention remains on on-chain flows, traditional finance is quietly increasing its ETH exposure.

Ethereum ETFs just reached their all-time high in lifetime inflows, according to @StackerSatoshi. The move hasn’t sparked headlines, but it does echo the early stages of Bitcoin’s ETF-driven surge.

That quiet accumulation could be institutions positioning ahead of a potential price rally. It’s not confirmation of anything — but it does suggest growing conviction from professional investors.

Ethereum is consolidating just below $2,800 a resistance level it has failed to break for weeks.

Strong hands appear to be stepping in, judging by the $800 million buy and ETF inflows. On-chain activity is rising, and most large cohorts still sit on unrealized gains.

But without a break above $2,800, the bullish setup remains incomplete. A decisive move higher could confirm the ascending triangle and send ETH toward $3,500 in the weeks ahead.

Until then, Ethereum remains in limbo — caught between cautious optimism and technical resistance.

In this article, the views and opinions stated by the author or any people named are for informational purposes only. And they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Moses K is a crypto journalist covering markets, regulation, and blockchain trends. He has written for The Coin Republic, Coinchapter, Cryptopolitan, Cryptotale, Coinspeaker, and MPost. Known for his concise, data-driven reporting, Moses focuses on price analysis, on-chain metrics, and policy developments shaping the global digital asset landscape.

Search

RECENT PRESS RELEASES

Related Post