Ethereum Faces Critical Support Test as Institutional Interest Surges Despite Price Declin

June 9, 2025

Ethereum (ETH) trades below $2,500 as technical indicators signal consolidation phase while major investors continue accumulation strategy

Quick overview

- Ethereum is currently trading at $2,492, reflecting a 1.1% decline in the last 24 hours amidst cautious consolidation.

- Despite short-term selling pressure, institutional interest in Ethereum remains strong, with significant inflows into Ethereum ETFs and major investments from firms like SharpLink Gaming.

- Technically, Ethereum is at a critical juncture, with support at $2,392 and mixed indicators suggesting potential volatility ahead.

- Price predictions indicate bulls are targeting $2,700, while bears may push for a retest of the $2,300-$2,250 zone if support levels fail.

ETH’s Exchange Activity Signals Heightened Volatility Expectations

The way the market works shows a complicated picture of how investors feel. According to Coinglass data, trading volume has gone up by more than 25% to $11.42 billion in the last day, and derivatives volume has gone up by 21.9% to $37.36 billion. But the 1% drop in open interest shows that traders are selectively preparing themselves for possible short-term turbulence.

The latest market turmoil came after a rise in political instability. Exchanges saw net inflows of 117,000 ETH, which is the second-highest amount since April. This selling pressure led to more than $600 million in gains over two days, mostly from coins that were kept for 90 days to two years.

Institutional Conviction Remains Strong Despite Market Headwinds

Institutional interest in Ethereum keeps growing, even if retail selling pressure is high. Spot According to SoSoValue data, Ethereum ETFs have seen inflows for four weeks in a row, with $281 million coming in last week alone. This brings the total net assets to almost $9.6 billion.

The institutional movement goes beyond only passive investment vehicles. SharpLink Gaming, which is listed on the Nasdaq, recently received $425 million to buy ETH for its treasury. ConsenSys, a big Ethereum infrastructure company, led the investment round. In May, U.K.-based Abraxas Capital also increased its ETH holdings to more than $800 million, which shows that smart investors still have faith in the company.

A major change in the rules has happened: U.S. institutions can now stake Ethereum, which could lead to billions of dollars in new capital flows. This change is already happening on-chain, as ETH staking deposits on Lido rose 5% last week to 9.5 million ETH. Total network staking has now gone over 32.8 million ETH, which means that more than $100 billion in value is now locked up and the supply of liquid assets is getting tighter.

ETH/USD Technical Analysis Points to Critical Juncture

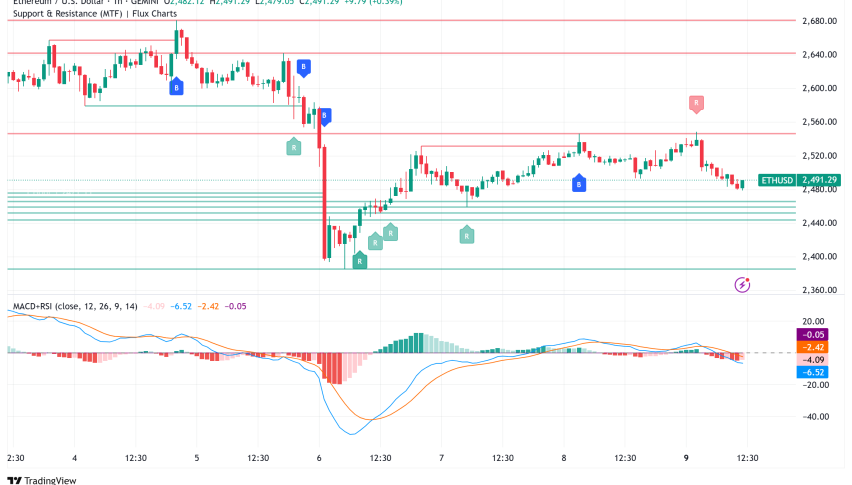

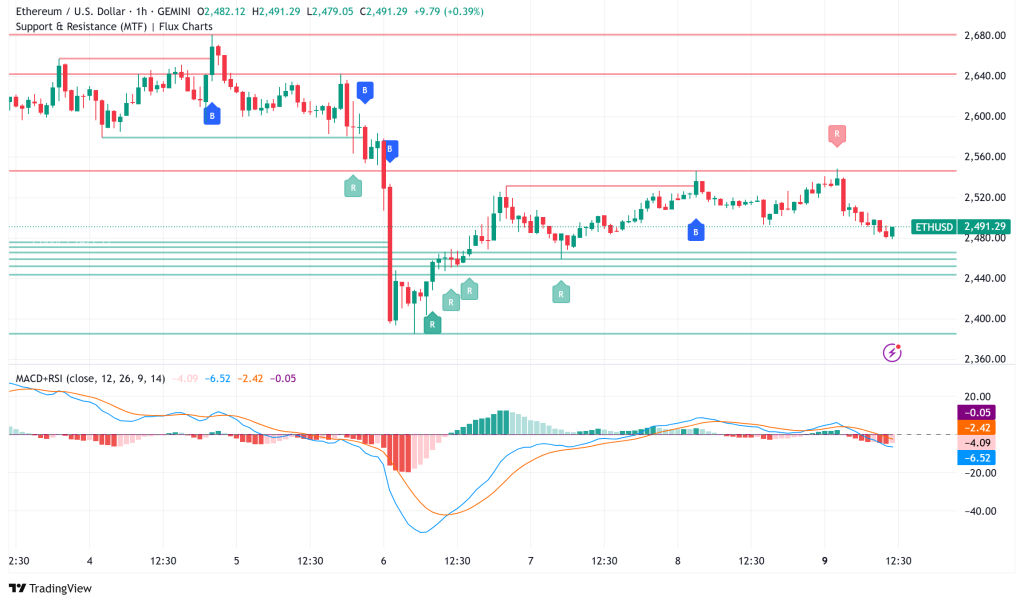

ETH/USD

From a technical point of view, Ethereum is at a very important turning point. The cryptocurrency is trading close to the lower end of its recent range, which was between $2,419 and $2,666. The $2,392 level is a strong on-chain support level, which is the realized price of Binance user deposit addresses.

The current technical indications show a mixed picture. The Relative Strength Index is at 51, which means the market is neutral. The Moving Average Convergence Divergence, on the other hand, indicates weak negative signs. The Stochastic RSI is getting close to being oversold, which could mean a change in direction.

Moving averages for the short term have turned bearish, which is putting pressure on prices to go down. But the 50-, 100-, and 200-day moving averages are all strongly bullish over the long run, which means that the overall uptrend is still going strong even though prices are currently consolidating.

Ethereum Price Prediction: Bulls Target $2,700, Bears Eye $2,300

The immediate price activity is focused on the $2,500 psychological threshold, which is the average price that people have paid for it on major exchanges. Most investors stay in the profit zone as long as the price stays above this level, which lowers the pressure to sell.

Bulls are getting ready for a move above $2,560, which might lead to a test of $2,700 resistance. If the price breaks above $2,700, it could go up to $2,850, which is the top of the recent trading range.

If the $2,430 support level is not held, bears might take over again, which could lead to a retest of the $2,300-$2,250 zone. Binance is the most popular place to trade ETH, and its users have made $2,392 in profits. This level is still very important for keeping the market structure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Search

RECENT PRESS RELEASES

Related Post