Ethereum Foundation Launches New Resource for Wall Street Firms: Details

October 30, 2025

The Ethereum Foundation is stepping up its outreach to traditional finance. It has launched a new website designed to help institutions understand and use the Ethereum blockchain.

The site, called institutions.ethereum.org, provides clear steps for banks, asset managers and corporations interested in Ethereum-based applications. The foundation says the goal is to make Ethereum the natural home for financial institutions entering the blockchain space.

The new website serves as a bridge between traditional finance and decentralised technology. It features a clean layout and focuses on real-world use cases. Visitors can look at examples of tokenised real-world assets (RWAs), stablecoins, defi products and privacy-focused tools built on Ethereum.

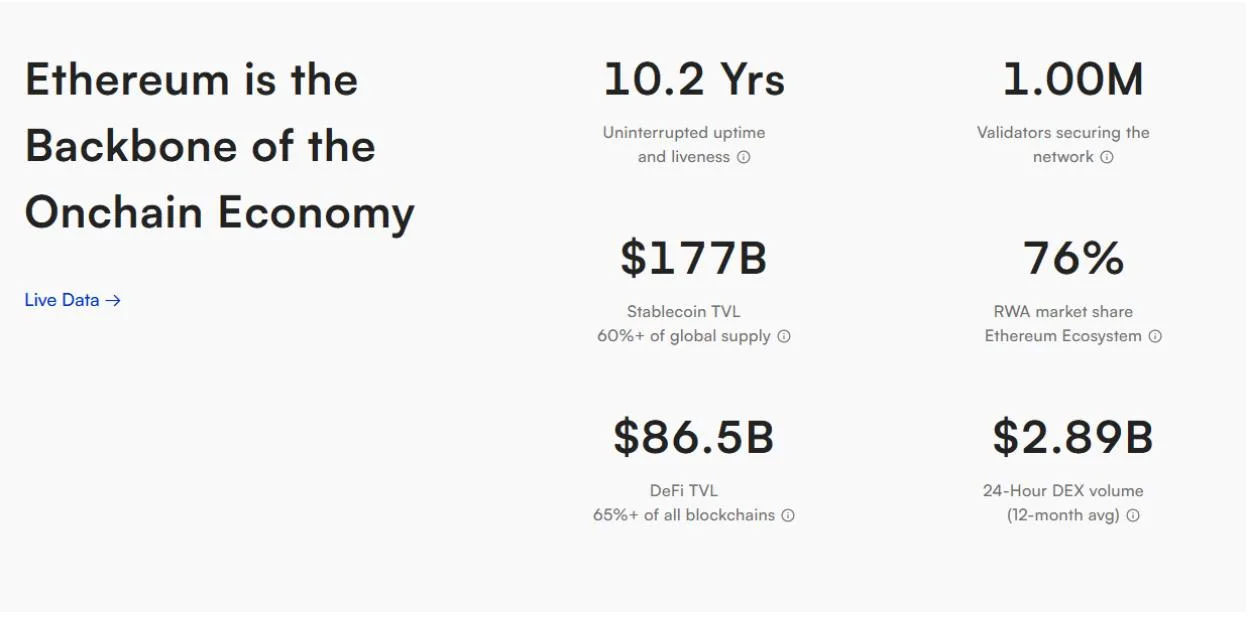

A section called “Digital Assets” gives an overview of blockchain sectors, while another tab labeled “Live Data” tracks Ethereum’s role in the global digital economy. There is also a “Library” that hosts reports, insights and articles explaining how institutions are using the network.

The foundation’s post on X described Ethereum as a “neutral, secure base layer where the world’s financial value is coming on-chain.” It added that the site is built for “builders, leaders and institutions advancing this global movement.”

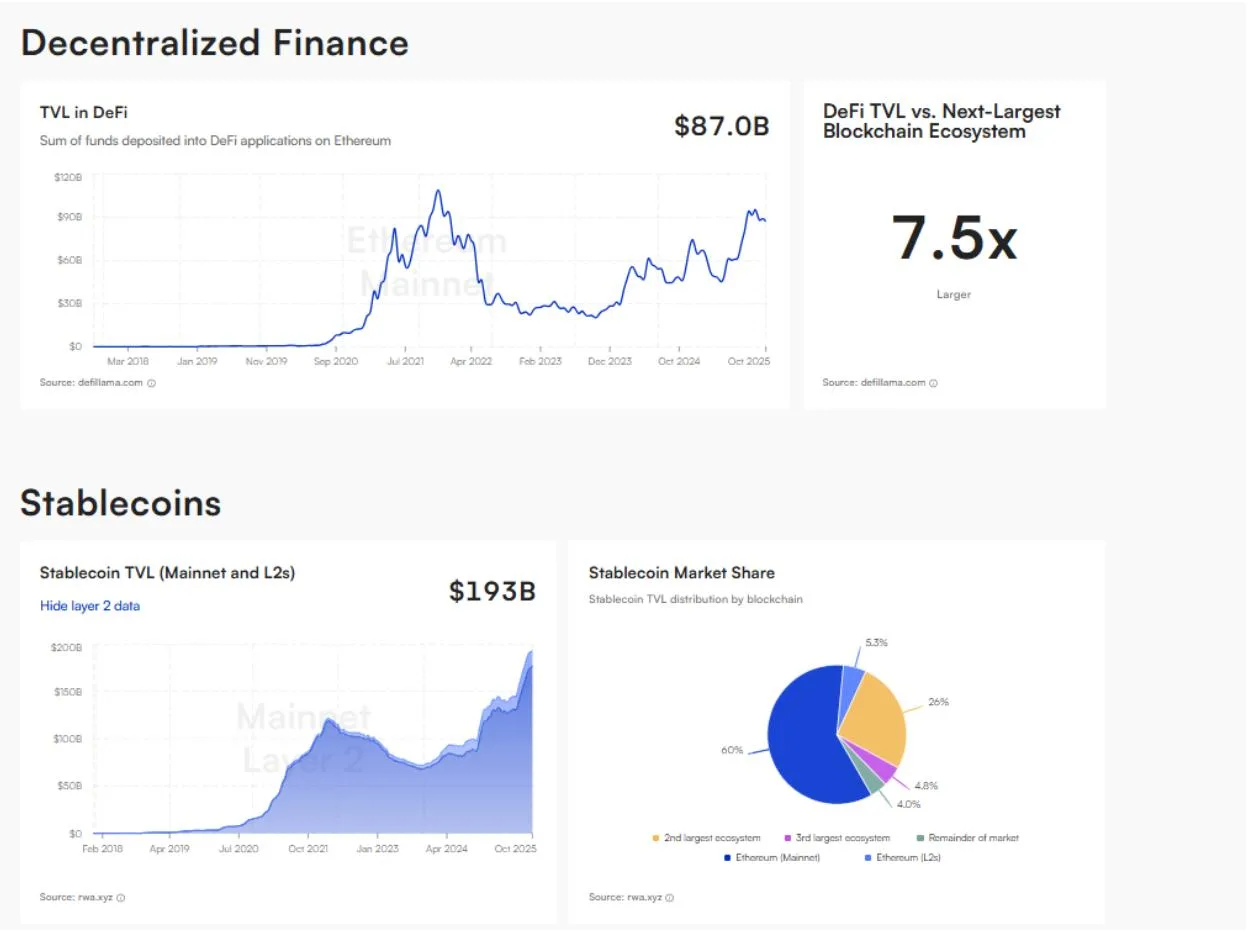

According to data featured on the site, Ethereum holds a dominant position in several blockchain categories. It supports 75% of all tokenised real-world asset activity, 65% of total DeFi value locked and 60% of stablecoin liquidity across the market.

Ethereum shows live stats on its website | source: institutions.ethereum.org

These numbers show why Ethereum continues to be the go-to platform for financial applications. It has a strong record of security, extensive developer support and a wide range of live projects already trusted by international brands.

Some of the most prominent examples include Visa, which processes around $1 billion in stablecoin transactions annually on Ethereum.

BlackRock also manages $1.15 billion in tokenised assets and Coinbase has Base, its layer 2 network securing $15.5 billion in total value locked.

The Ethereum Foundation’s Enterprise Acceleration team developed the website to make it easier for companies to transition from trad-fi systems to blockchain models.

This stands as part of an effort to attract more institutions, while showcasing Ethereum’s enterprise-grade capabilities.

Earlier this year, the foundation supported Etherealize, which is a startup dedicated to educating financial institutions about Ethereum’s infrastructure.

Etherealize is aimed at connecting Wall Street firms with on-chain tools and data, while helping them test blockchain products in real environments.

Wall Street’s interest in blockchain has increased after the passage of several new laws in the United States, related to digital assets. Financial giants like Citi, Zelle and Western Union have all announced new blockchain integrations in recent weeks.

Ethereum markets itself as a leader in Stablecoins and defi | source: institutions.ethereum.org

Citi recently partnered with Coinbase to build a stablecoin settlement layer. The partnership will allow faster payments and 24/7 fund transfers using tokenised dollars.

Zelle and Western Union are also developing stablecoin-based transfer systems to make international payments cheaper and faster.

These moves show how financial firms are taking advantage of blockchain solutions to improve settlement speed and transparency. The Ethereum Foundation’s website also comes at a time when many institutions are actively searching for guidance on how to use the technology safely.

Search

RECENT PRESS RELEASES

Related Post