Ethereum Foundation Moves 1,000 ETH—Is A Price Crash Coming Next?

April 22, 2025

- The Ethereum Foundation transferred 1,000 ETH to the Kraken exchange on April 22, signaling a possible sell-off.

- Ethereum is downtrend, showing weak momentum and facing resistance despite a minor daily gain.

- In 2024, the Foundation sold 4,466 ETH, which previously led to short-term price drops in the market.

The Ethereum Foundation transferred 1,000 ETH to Kraken on April 22, signaling a possible intent to sell. The strategic foundation movement has sparked market-wide concerns about another price downfall because Ethereum continues its steep downward trajectory. This transaction occurs as Ethereum maintains weak momentum because short-term price gains meet growing opposition to higher values.

Previous sell signs from the Ethereum Foundation occurred this year during the first few months. The foundation conducted an ETH sale of 4,466 tokens during 2024, which resulted in $12.61 million in earnings for short-term price movements. Analysis shows that these price changes result in rapid price shifts even though market-wide factors determine long-term price movements.

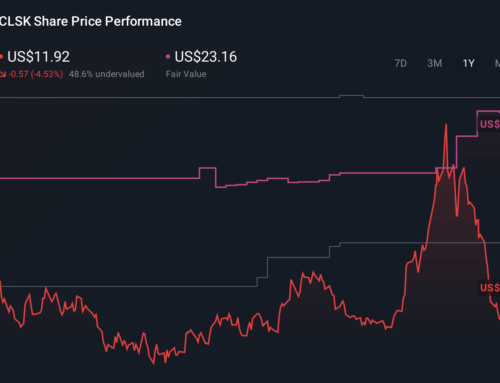

The cryptocurrency Ethereum maintains a market value of $1,582, rising by 0.25% from its initial drop of 2.76% from the daily opening price. The price experiences tension because macro-level market conditions and Bitcoin’s wild price swings create a negative sentiment. A 1,000 ETH transfer could become a negative market trigger, weakening short-term confidence throughout the market.

The Ethereum market has maintained static price levels for ten straight days, thus indicating a reduction in volatility. This area of price stability tends to lead to upcoming rapid price movements in both positive and negative directions based on outside market influences. A recent foundation movement shows potential as a factor that could shatter present support levels.

Rising pressure exists at $1,504 because the price has repeatedly stabilized near this area. A price below the current support would establish conditions for a significant market decline. A price drop through this support level would result in a strong downward move approaching $1,200, thus strengthening bearish momentum.

The crypto market shows bearish trends, which do not affect Ethereum’s current position above support yet indicate potential future price drops. During the daily time frame, prices continue to form lower highs, showing an upward trend. A powerful uptrend will not occur unless bullish support forms independently. The price will move downward moderately without this more decisive breakout.

The current bullish trend in Bitcoin, which derives from leverage, indicates sustainability concerns. Both Bitcoin and Ethereum tend to follow the same market trend because their asset correlations remain high. If Bitcoin starts losing momentum, Ethereum would immediately follow Bitcoin. Ethereum faces possible deterioration due to an intense Bitcoin market decline.

Ethereum’s price increase needs Bitcoin to maintain its current upward momentum, which reaches $88,000. Assistance from Bitcoin is needed to prevent possible short-term price declines for both digital currencies. Ethereum may test its bottom support areas if Bitcoin fails to maintain essential price points.

Effects on longer market conditions originate from overall market conditions, yet sudden events primarily affect short-term price movements. Previous market trends indicate that the Ethereum Foundation’s transfer led to price corrections in the past. Current market conditions decide whether the past price patterns will reappear.

Search

RECENT PRESS RELEASES

Related Post