Ethereum Has Crashed, but the Option Strategy I Showed You 3 Months Ago Is Hanging Tough.

December 31, 2025

Ethereum coin by Amhnasim via Pixabay

Poor Ethereum (ETHUSD). It is always playing backup singer to Bitcoin (BTCUSD).

And by association, when I wrote about the iShares Ethereum Trust ETF (ETHA) back in September, and included a collar example (one of many flexible varieties you can screen for here), I suspect to some, the reaction was “Ethereum, that other crypto?”Let’s see what’s happened since, and what we can learn from it.

What Band-Aid brand is to adhesive bandages is what Bitcoin is to cryptocurrency. Ethereum takes a backseat to that. But what ETHA does offer, and what prompted me to use it as a collar example back then, was its higher volatility much of the time, compared to Bitcoin.

As it turned out, that created some pretty good option pricing a few months ago. I say that because with ETHA crashing recently, that collar would have allowed traders to take on the risk inherent in crypto, while creating an escape hatch in the form of a protective put option. Because it is part of the collar, along with the more familiar covered call segment of that trade.

So I guess we could say that protective puts and Ethereum have that in common. They are the afterthought. And, as ETHA has declined so sharply this quarter, I suppose we can also consider another reason to refer to it as “poor Ethereum.” Because for big-position, unhedged traders, it has made them poorer.

I do not at all mean to be flippant about this, only to highlight that risk management was a good thing to learn in 2025. But in 2026, it might just be the whole ballgame. Return is always possible, but risk has eras in which it is greatly elevated. I think 2026, especially early in the year, is one of those times.

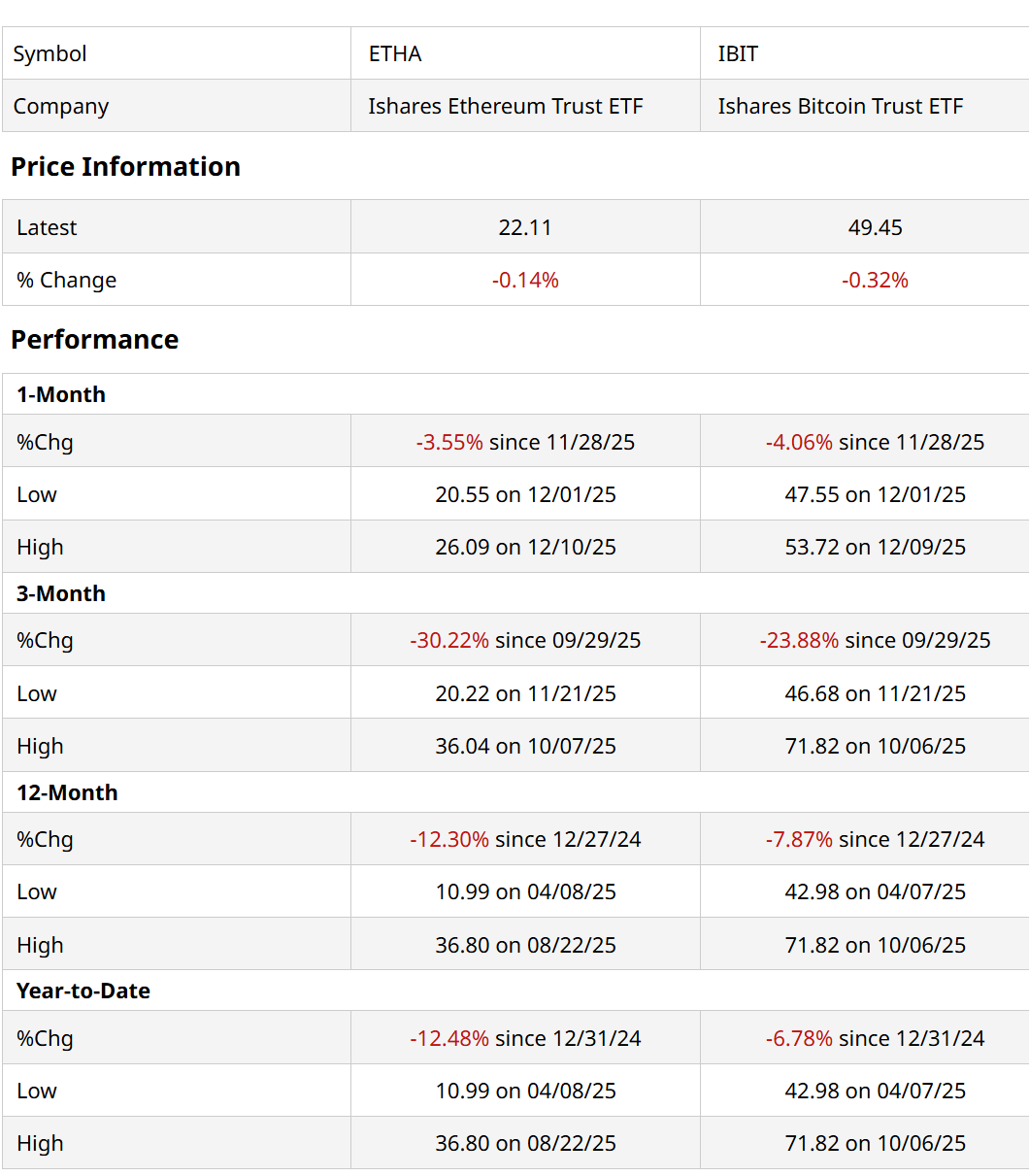

Here we see that Ethereum tracks behind Bitcoin over multiple time frames, except for the past month, where it outperformed slightly. But this is a shallow victory, if the only time something outperforms is also when it is down. This is a short time frame of course, but there’s not too much long-term history, as ETHA, the first spot Ethereum ETF, came to market in July 2024. Not enough to fill a 2-year daily chart.

When we look at the chart now, we see that damage has been done. A lot of it, in fact. $35 to $22, with that prior article preceding the recent top by just a couple of weeks. This chart below appears flat and indecisive to me, and that brings us back to the original collar sample from September, to bring it current.

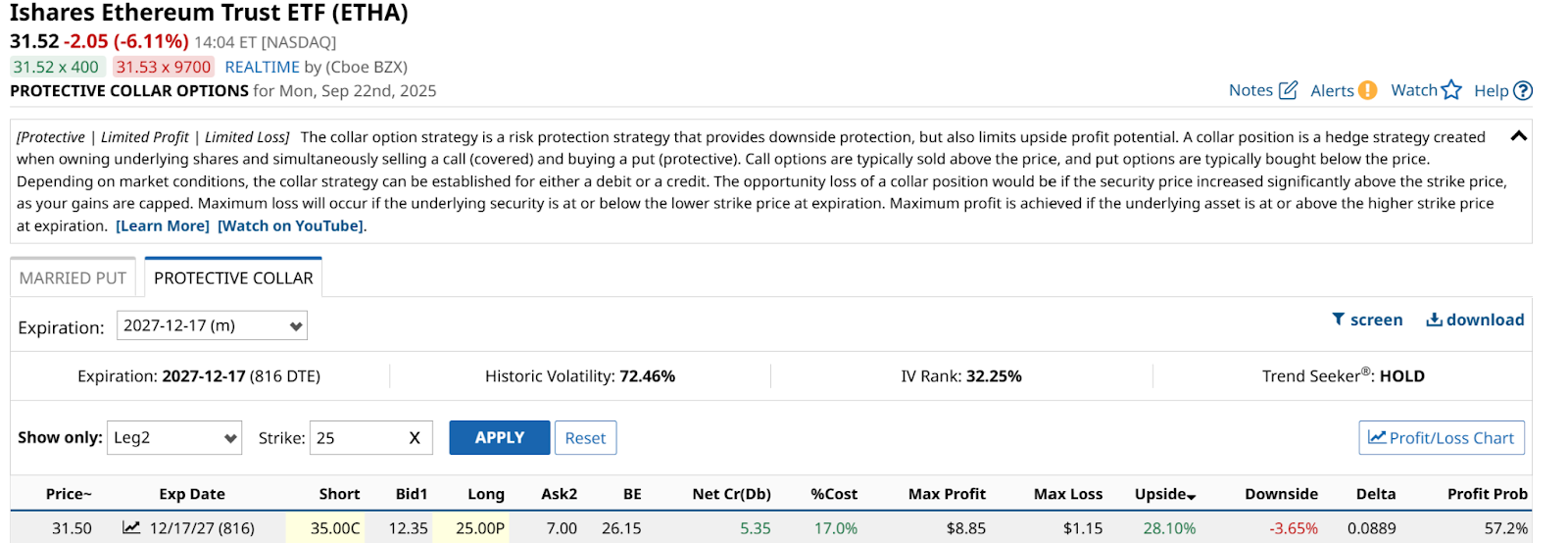

Here’s what I presented back then, not coincidentally on a day when ETHA was off more than 6% intraday. I summed it up then as follows:

I have that 28% to under 4% up/down potential over 27 months, but I receive as much up front as I’d make in a bond yielding around 7.5% for 2 years and 3 months. There’s some downside risk if ETHA falls. But it could fall all the way back to $12 and I could still sell it for $25 a share, any time during the next couple of years, through that expiration date in late 2027.

With the ETF down to $22, one way to play it is to buy back the covered calls and sell the puts to close as well. And essentially start over, but with the profits offsetting most of the underlying loss on ETHA. The calls that brought in about $12 a share are now around $6, so that’s a gain of $6 since that was money I received that could now be bought back for half as much. Similar to making 50% on shorting a stock.

The puts are less liquid now, and did not appear in my filter for that reason, but they closed at $9.49 Monday. So that’s more than $8 a share gain on the options, versus $9 loss on the underlying ETF. In other words, I was able to ride out the mess in ETHA for a while, without sweating it, because my losses were minimal.

The other approach, since this collar goes out another 2 years (almost to the day, in fact), is to do nothing. If ETHA ends up under $10, no harm done, and increased volatility might even produce a net profit on the position. If ETHA’s decline is “merely a flesh wound,” I have 2 more years to see it recover.

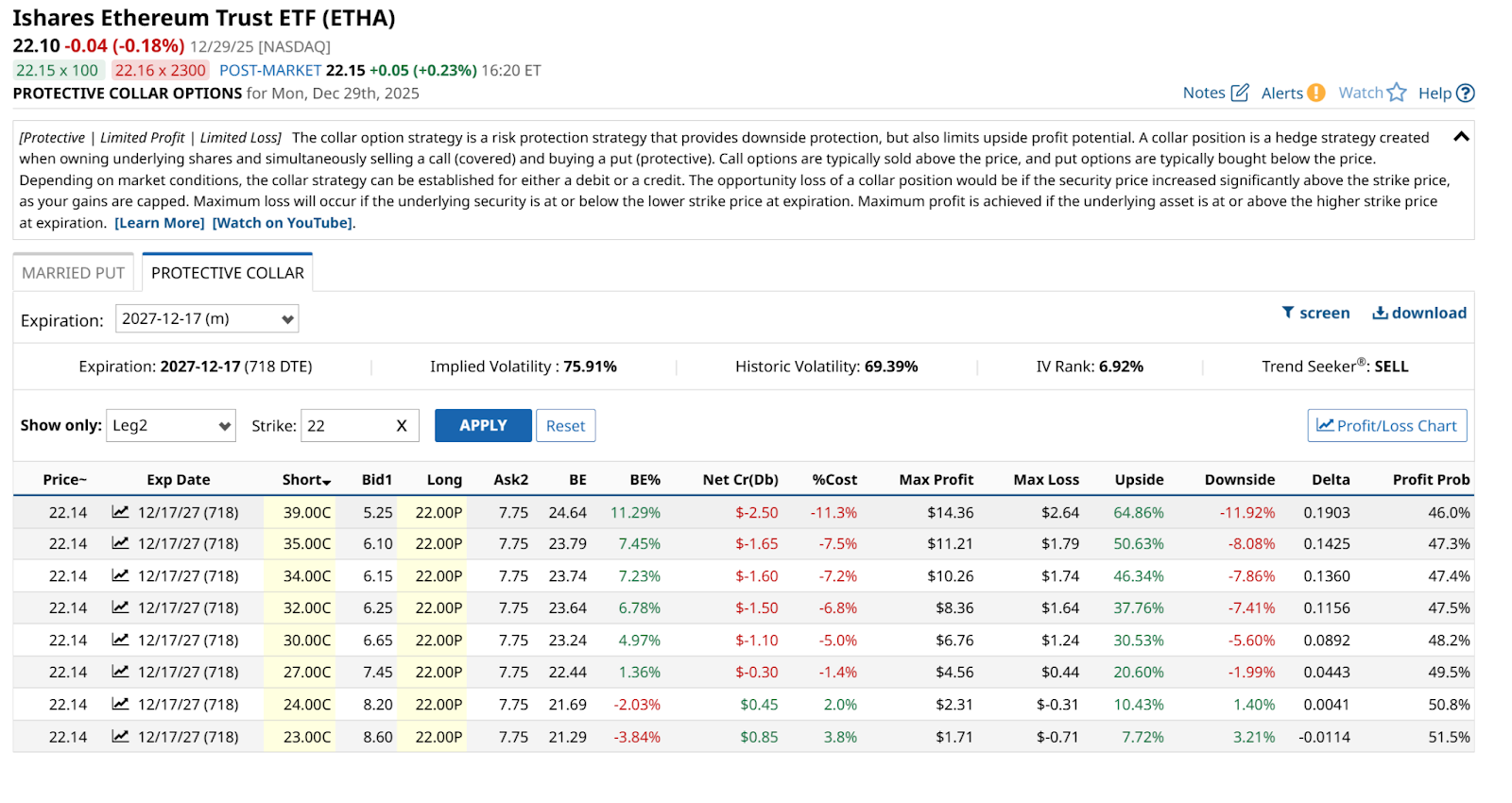

ETHA may just be resting here, and I’m going to assume that the December 2027 expiration is still my preference, for this updated look at where a new collar might be set up.

I see ETHA can be collared a number of ways, either as the bond-like approach toward the bottom of those choices, or as a 6:1 up/down ratio at the top of that list of call/put combinations. The tradeoffs between strike prices, expiration date and out-of-pocket cost (if any), are where each trader must decide for themselves. What is less debatable, and thus worth repeating here, is what I said in a subheader in that first article: Collaring ETHA isn’t popular, but maybe it should be.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Search

RECENT PRESS RELEASES

Related Post