Ethereum: Heavy Usage, Weak Price? | Analyst Weekly Jan 12, 2026

January 11, 2026

Analyst Weekly January 12, 2026

Ethereum is doing a lot, even if the token price doesn’t show it yet. Activity on the network is hitting records, stablecoins are at all-time highs, and real use cases like tokenisation are starting to scale. More of this activity is happening on cheaper “Layer 2” networks that still rely on Ethereum underneath.

So why isn’t ETH moving? Because the network is choosing scale over short-term profits.

Recent upgrades made it much cheaper for Layer 2s to use Ethereum. That’s great for users and developers, but it also means fewer fees flowing to Ethereum itself. In simple terms: Ethereum lowered its prices to make sure everyone keeps building on it, even if that hurts revenue today.

This creates a mismatch. Usage is strong, but value capture is weak. Ethereum doesn’t have a demand problem, rather, it has plenty of spare capacity. When supply is high and demand hasn’t caught up yet, prices stay under pressure.

Why do this at all? Because Ethereum is becoming core infrastructure. Around half of all stablecoins, about $165bn, sit on Ethereum. It’s trusted, liquid, and seen as relatively neutral and regulator-friendly. In a world where digital dollars are becoming financial plumbing, that positioning matters.

Think of it like Amazon in its early years: not focused on profits, but on becoming unavoidable. Once demand finally fills the available capacity, fees and pricing power don’t need to be forced. They come naturally.

Investment takeaway: Ethereum today looks less like a broken network and more like one in a transition phase. The bet for investors is simple but not risk-free: if demand keeps growing, today’s weak value capture could turn into strong pricing power later. The risk is that this never happens and Ethereum stays important, but not very profitable for ETH holders.

For now, the network is playing the long game. The market just hasn’t priced that in yet.

The Quiet Shift Powering Banks and Homebuilders

If you are still watching markets through the lens of “how many rate cuts are coming,” you might be missing the real story. This year’s biggest market driver may not be the price of money, rather, how money is moving through the system.

Behind the scenes, policy is shifting in a way that quietly supports banks, mortgages, and housing-related stocks. It’s less flashy than a rate cut, but historically, it can be just as powerful.

QT Has Ended; Reserves Are Rising

Quantitative tightening, the steady shrinking of the Fed’s balance sheet, has effectively come to an end. Instead of draining liquidity, the Fed is now managing its balance sheet in a way that allows bank reserves to rise, particularly during periods when the system normally tightens, like tax season.

Why does this matter? Because reserves are the raw material of the financial system. When reserves are rising, financial conditions tend to ease, even if policy rates stay higher for longer. This is why focusing only on rate cuts misses the point. Liquidity is already improving, just quietly.

Deregulation: Why Liquidity Suddenly Matters Again

Liquidity only helps if banks can actually use it. Over the past few years, tighter regulations limited how much banks could expand their balance sheets, even when reserves were available.

That’s starting to change. Financial deregulation, especially around leverage and capital requirements, allows banks to do something very basic again: intermediate. They can hold more government bonds, invest in mortgage-backed securities, and support lending without constantly running into regulatory limits.

This doesn’t mean banks suddenly take on excessive risk. It simply means the plumbing works again. And when the plumbing works, liquidity starts to matter.

Banks Move From Problem To Plumbing

For banks, this shift is meaningful. Rising reserves combined with regulatory relief turn banks from a constraint into a conduit. Instead of struggling with balance-sheet limits, banks can grow through volume, more lending, more securities, more activity, rather than relying on wider spreads or riskier behavior.

From an investor’s perspective, this reduces the downside risks that have weighed on bank stocks. Banks don’t need a credit boom to benefit; they just need a system that stops fighting them.

The Quiet Force Behind Lower Mortgage Rates

This is where everyday investors feel the impact most clearly: mortgages.

Mortgage rates aren’t set directly by the Fed. They depend heavily on mortgage spreads, or the difference between mortgage yields and government bond yields. Those spreads are influenced by who’s buying mortgages.

Right now, the Fed is stepping back from buying mortgage-backed securities. Normally, that would push mortgage rates higher. But something else is happening at the same time. Fannie Mae and Freddie Mac are increasing their purchases of mortgage-backed securities by roughly $200 billion: almost exactly the amount the Fed is letting roll off its balance sheet.

At the same time, banks, freed up by deregulation, are able to hold more of these securities as well. The result is simple: more buyers for mortgages. More buyers mean tighter spreads, and tighter spreads mean lower mortgage rates, even if broader interest rates don’t fall much.

Why Homebuilders Are Paying Attention

For homebuilders, this setup is quietly powerful. Housing doesn’t need mortgage rates to collapse: it just needs them to stop being prohibitive. Even modest declines in mortgage rates can improve affordability enough to unlock pent-up demand from buyers who’ve been waiting on the sidelines.

Supply remains tight, household formation continues, and builders have already adapted to a higher-rate environment. That makes homebuilders especially sensitive to incremental improvements in financing conditions: the kind driven by mortgage mechanics, not headline-grabbing policy announcements.

When mortgage markets stabilize, housing activity usually follows with a lag.

The Takeaway For Investors

The big lesson is that markets don’t always move on the loudest signals. Sometimes they move on the quiet ones. Rising reserves, looser regulation, and shifting demand in the mortgage market don’t make headlines, but they change behavior: first in banks, then in housing, and eventually in the broader economy.

For investors, this argues for looking beyond rate-cut countdowns and paying closer attention to where liquidity is flowing. If these trends continue, banks and homebuilders may benefit well before the broader market narrative catches up.

So:

- Don’t fixate on rate cutsBalance sheet expansion and deregulation are doing more of the work at this point.

- Banks benefit from being allowed to functionRising reserves + regulatory relief reduce risk and improve intermediation.

- Mortgage mechanics matter more than housing headlinesSpreads, not subsidies, are driving rates.

- Homebuilders remain quietly well positionedSmall improvements in mortgage rates can have outsized effects.

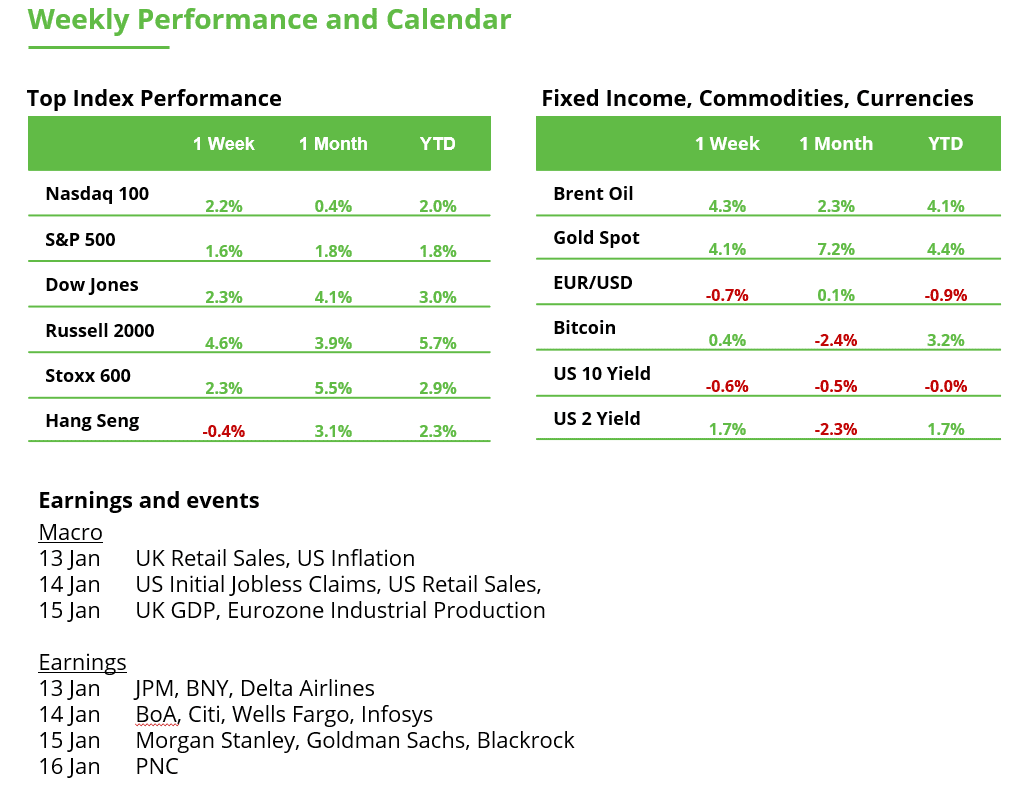

US Banks Kick Off Earnings Season: Tailwind For The Etf?

The SPDR S&P Bank ETF got off to a strong start to the new year. In the first full trading week, the index gained 3.6% to $63.25. On Friday, it even reached a new record high at $63.99. In the final trading hours, however, some light profit-taking set in.

This likely reflects not only the usual caution ahead of the weekend, but also growing attention on the upcoming US earnings season. As always, the major US banks will be the first to report, providing early signals for the entire sector. If the overall set of results is positive, the ETF could quickly set its sights on another record high.

If profit-taking continues, two support zones (fair value gaps) come into focus. The first zone, which has already played a role in recent weeks, lies between $60.65 and $62.03. Two weeks ago, the ETF briefly slipped as low as $59.92. Below that, a second support zone is located between $58.04 and $58.49.

Only a break below both zones would indicate a potential trend reversal. The 20-week moving average also runs between these two support areas, adding further technical significance.

SPDR S&P Bank ETF, weekly chart. Source: eToro

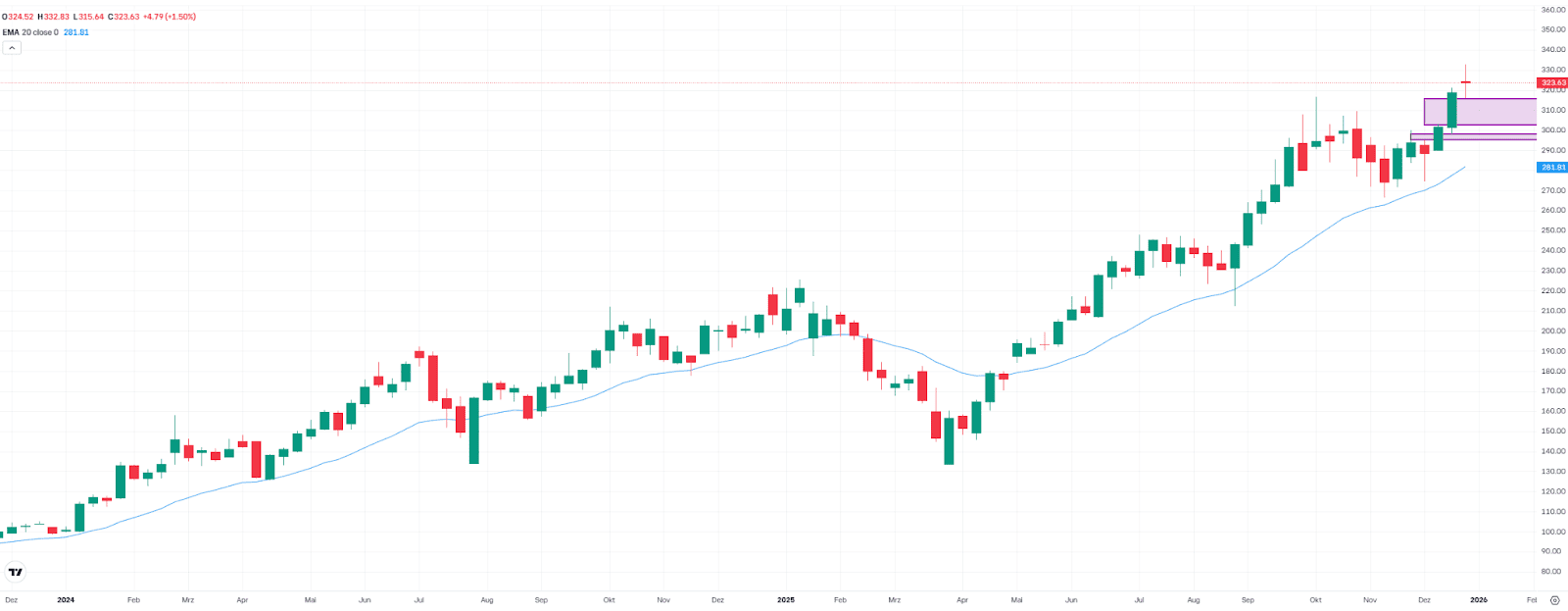

TSMC Earnings: Tailwind For New Highs Or Time For A Pause?

TSMC will report new figures on Thursday. They will show whether the world’s largest contract chipmaker can continue to confirm its role as a key beneficiary of the AI boom. The market’s focus is less on the past quarter and more on the outlook for capital expenditure in 2026.

Strong results would support the view that massive AI investments are increasingly reaching the real economy, rather than remaining purely a stock-market theme. At the same time, skepticism is growing. With investment momentum remaining strong, the risk increases that the typical cyclicality of the semiconductor industry could return in the medium term, especially if AI applications are monetized more slowly than currently expected.

Since the April low, the stock has risen by around 140%, reaching a new record high of $332.83 just last week. If the numbers impress, another push to fresh highs could follow quickly.

In the event of a pullback, two technical support zones (fair value gaps) come into play at $302.90–315.64 and $295.25–298.20. The stock could therefore withstand a more pronounced pullback without jeopardizing the uptrend. Especially as the 20-week moving average is currently much lower at around $282 and would provide additional support.

TSMC, weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Search

RECENT PRESS RELEASES

Related Post