Ethereum LTH Selling In October Hits 3-Month High — What’s Next for Price?

October 29, 2025

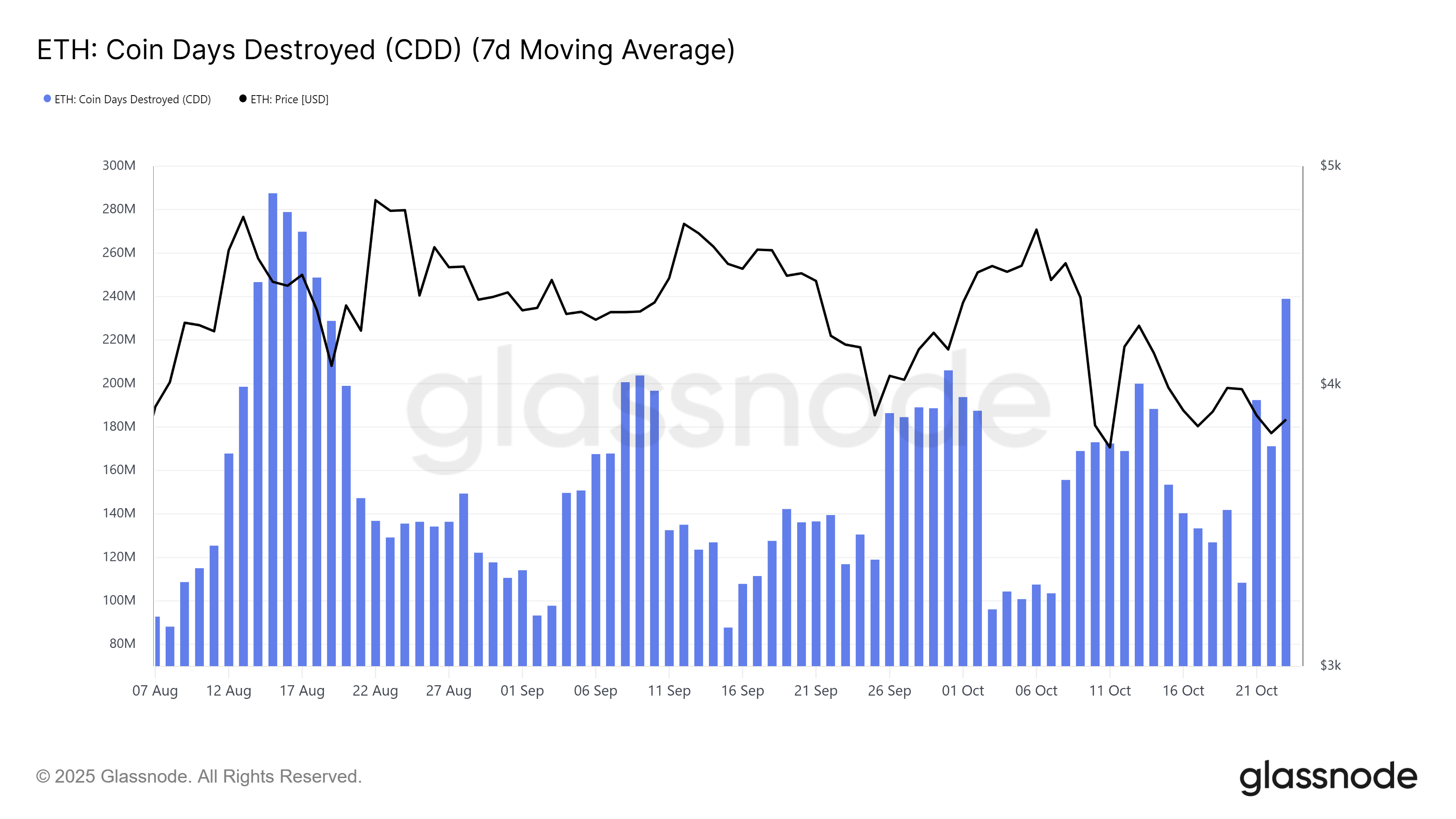

Ethereum closed October with limited price growth as long-term holders (LTHs) significantly reduced their positions, triggering bearish pressure across the market.

As November begins, the market awaits signs of renewed confidence among ETH holders.

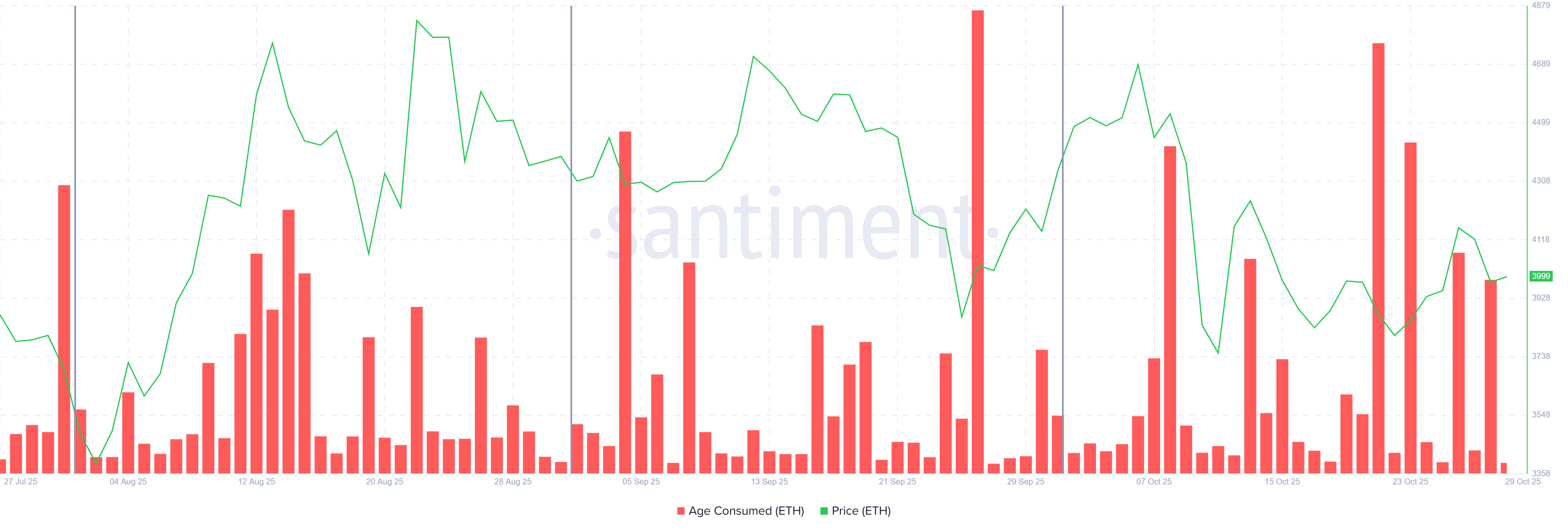

The Age Consumed metric reveals that October witnessed Ethereum’s largest wave of long-term holder activity since July. Spikes in the metric indicate that older coins were moved or sold, often signaling increased selling pressure from experienced investors. The cumulative activity in October far exceeded that of the prior two months, highlighting a notable lack of conviction among LTHs.

SponsoredSponsored

This sharp rise in selling reflects growing uncertainty over Ethereum’s near-term performance. Many holders appear to have taken profits amid stagnant price action, likely contributing to the lack of upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain data shows that Ethereum’s network activity followed a similar pattern. The number of new addresses grew steadily through most of October but dipped sharply during the final week.

This decline suggests that investor interest weakened as prices failed to move decisively higher, highlighting short-term market fatigue. However, this slowdown may prove temporary. If new addresses and network participation rebound in November, Ethereum could see renewed inflows of liquidity.

At press time, Ethereum price is at $4,002, maintaining a narrow range around the psychological $4,000 level for nearly three weeks. The inability to reclaim higher levels highlights the impact of ongoing selling and weak investor confidence.

In the near term, ETH could attempt to test the $4,221 resistance level. Yet, without stronger market conditions, it may remain confined between that resistance and the $3,742 support.

Should the broader environment improve, Ethereum could break above $4,221 and target $4,500. A sustained rally toward $4,956—its previous all-time high—would invalidate the bearish outlook and restore market optimism.

Search

RECENT PRESS RELEASES

Related Post