Ethereum MVRV Ratio Nears Risk Zone, Says CryptoQuant

August 17, 2025

18h05 ▪

4

min read ▪ by

Mikaia A.

Can Ethereum tame the bull? This is a question that haunts more than one investor. Because behind its recent surge lies a very real but equally fragile shift. The market’s second-largest crypto has delivered performances up to the point of nudging its all-time high. And yet… despite the enthusiasm, subtle but strong signs suggest a possible calm. Could the bull be tired?

In Brief

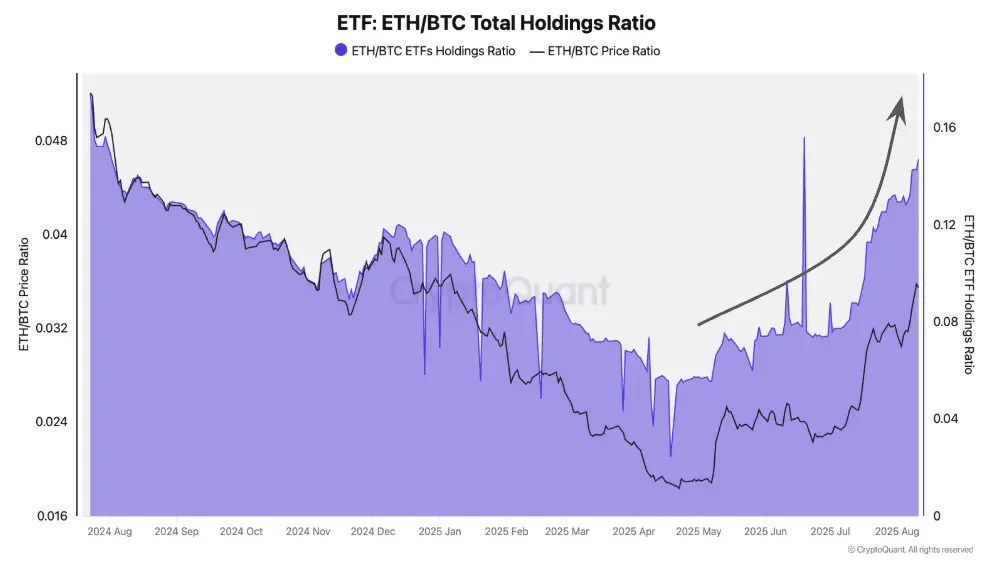

- The Ethereum/Bitcoin ETF ratio rose from 0.05 to 0.15 between May and August.

- Ethereum surpassed Bitcoin in weekly spot volume for four consecutive weeks.

- The ETH/BTC MVRV ratio reaches 0.8, close to a threshold signaling historical overvaluation.

- ETH inflows to platforms exceed those of bitcoin, signs of profit-taking.

This rise in power is not going unnoticed: the ETH/BTC ratio of crypto ETFs has tripled in three months, according to CryptoQuant. Translation: institutional investors, who still favored bitcoin, now seem to bet more strongly on Ethereum. In August, this ratio increased from 0.05 to 0.15, indicating a massive allocation shift within portfolios.

Another strong clue: Ethereum recently reached $4,743, its highest since 2021, nearing its all-time record. Meanwhile, the ETH/BTC price ratio crossed its 365-day moving average – an indicator which, historically, signals phases of outperformance for ether.

Trading volumes do not lie either: for four weeks, the weekly spot volume of ETH has exceeded that of BTC. Latest figures: $24 billion versus $14 billion, according to CryptoQuant.

This growth is explained by a combination of factors: increased demand via ETFs, long-term investors rebalancing their positions, and a market sentiment leaning towards Ethereum use cases – staking, DeFi, tokenization.

Behind the encouraging numbers, some signals call for caution. Still according to CryptoQuant, ETH inflows to exchanges recently exceeded those of bitcoin. This suggests some holders are considering taking profits especially after such a rapid rise.

Start your crypto adventure safely with Coinhouse

This link uses an affiliate program.

Another discreet alert: the ETH/BTC MVRV ratio rose from 0.4 to 0.8 between May and August, approaching the 0.9 threshold. For analysts, this level often indicates relative overvaluation of ether – a zone where reversals are common.

Add to this a surge in activity on ETH perpetual futures contracts, with open interest growing faster than bitcoin’s. Interest is there, yes, but the higher it climbs, the greater the risk of a domino effect if profits are taken.

In short, Ethereum leads the dance… but the music might slow down. ETFs support the rise, but strong hands remain cautious about a potential consolidation.

Crypto, ETFs, altcoins: data that says a lot

To better grasp this moving dynamic, here are some key landmarks:

- ETF ETH/BTC ratio: rose from 0.05 to 0.15 between May and August (source: CryptoQuant);

- Spot volume ETH/BTC ratio: 1.66 – highest level since June 2017;

- ETH/BTC MVRV: rose from 0.4 to 0.8 – close to an overvaluation zone;

- Weekly spot amount: ETH ($24B) surpasses BTC ($14B), 4 consecutive weeks;

- ETH Open Interest: accelerating increase compared to bitcoin’s.

Ethereum enters a new era. Although the market sometimes wavers, signals converge: it is indeed the ETF and 401(k)-style retirement savings combination that could sustainably transform this network. No longer a mere altcoin, but a central infrastructure of tomorrow’s crypto economy.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Search

RECENT PRESS RELEASES

Related Post