Ethereum Nears Breakout Point, Eyes $3,300 After Bullish Surge

June 5, 2025

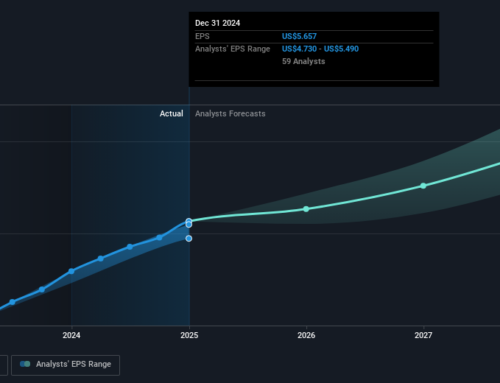

- Ethereum trades at $2,610.23, showing a strong 45.45% monthly gain despite a weekly decline.

- A descending triangle pattern forms, signaling a potential breakout as the price compresses between resistance and support zones.

- A breakout above the $2,700 resistance could drive Ethereum’s price toward the $3,300 mark with momentum.

- Volume spikes are crucial; rising trading activity would confirm the strength behind a potential bullish breakout.

Ethereum, the second-largest cryptocurrency by market capitalization, is in a phase of technical consolidation as it trades at $2,610.23. With a market cap of $315.1 billion and a 24-hour trading volume exceeding $17 billion, ETH is drawing heightened attention from market watchers.

Although the token has declined 4.30% over the past week, its 45.45% surge in the last month reflects robust market interest and investor optimism.

The current price movement reveals ETH approaching a pivotal point. Analysis based on a daily chart from mid-May to early July outlines a descending triangle, a technical pattern characterized by a horizontal support level near $2,588 and a declining resistance trendline from $2,735.

This formation commonly precedes a breakout, either upward or downward, as the price narrows toward the triangle’s apex.

Technical indicators are now signaling Ethereum to retest the region of the $2,695–$2,700 level of resistance. It lies on the upper edge of the descending triangle, where failed attempts to break higher had been made before.

A clean break past this level with increasing trade volumes can be considered bullish confirmation. Under such circumstances, ETH could pick up momentum towards the level of $3,300, which represents the resumption of the recent month’s rising trend.

Volume dynamics are critical to sustaining any movement. Increased volume on breaks has been the hallmark of strength within the trend and conviction among the investors, something closely monitored by the analysts as Ethereum approaches this level of resistance.

While the outlook is cautiously optimistic, a failure to push above $2,700 could keep downside pressure in place. A pullback would have Ethereum retest the $2,588 support zone.

If that level fails as support, then a drop toward $2,450 could be seen, which would be a pretty significant short-term correction. Currently, traders are waiting for some decisive move that would set the tone for Ethereum over the next few weeks while altcoins also remain closely tuned for directional cues.

Related Reading | Wall Street Giant JPMorgan to Accept Bitcoin ETF Shares as Collateral for Loans

Search

RECENT PRESS RELEASES

Related Post