Ethereum Network Booms as USDC Activity Hits Record High

May 27, 2025

- USDC supply and transfer activity are surging on Ethereum.

- Capital is flowing back into Ethereum-based ecosystems.

- ETH may be undervalued as usage outpaces price.

Ethereum usage is rising rapidly as on-chain activity surrounding USD Coin (USDC) reaches new records. Data from early 2025 indicates that USDC transfer volume, supply, and transaction count on the ETH network have all surged to all-time highs.

Data shows Ethereum-based USDC activity is reaching record levels across several key metrics. The outstanding supply of USDC on ETH is now approximately $40 billion, the highest recorded level. This growth suggests an increasing level of trust in Ethereum as the primary network for stablecoin transactions.

The monthly transfer volume of USDC has spiked to around $635 billion, surpassing earlier highs from both 2022 and 2023. This rise reflects greater utilization of the ETH network for transferring stable assets. Meanwhile, the monthly transfer count has climbed past 7.2 million, marking another record. The large number of transfers indicates rising adoption among retail users and institutions alike.

Market observers note that such growth in USDC activity often correlates with increased network engagement. As Ethereum continues to host the majority of USDC supply and transfers, the blockchain’s role as a financial settlement layer appears to be expanding.

Despite the surge in stablecoin usage, ETH price has shown mixed short-term behavior. Analyst TheMoonCarl recently noted that Ethereum is trading at a critical technical level on the 4-hour chart. A potential double top has formed near the $2,700 resistance zone, while the price is currently testing an ascending trendline support.

Should this support level break, Ethereum could fall toward $2,200, representing a 10% decline from current levels. However, if support holds, Ethereum may remain within a bullish ascending triangle structure, which could allow for renewed attempts to break resistance.

The current technical setup reflects a neutral to slightly bearish outlook in the short term. However, longer-term data shows stronger fundamentals. Rising Ethereum network activity, steady capital inflows, and increasing stablecoin usage may help support a potential shift toward renewed bullish momentum.

There are more funds entering Ethereum than any other blockchain network these days. Ethereum tops all other chains in positive fund transfers and Arbitrum, Polygon and Base come next. Every one of these belongs to the Ethereum world, either forming the foundation or serving in a second layer solution.

Solana, OP Mainnet and Berachain, together with several other networking tokens, have seen more coins go out than come in. According to this trend, individuals and companies are starting to focus more in Ethereum and the things related to it.

When new tokens are flowing into an ecosystem, it usually reflects increasing user activity and hope. With stablecoins becoming more widely used, the new reserve flow helps make a case for Ethereum surging again as a leading blockchain for decentralized finance and applications.

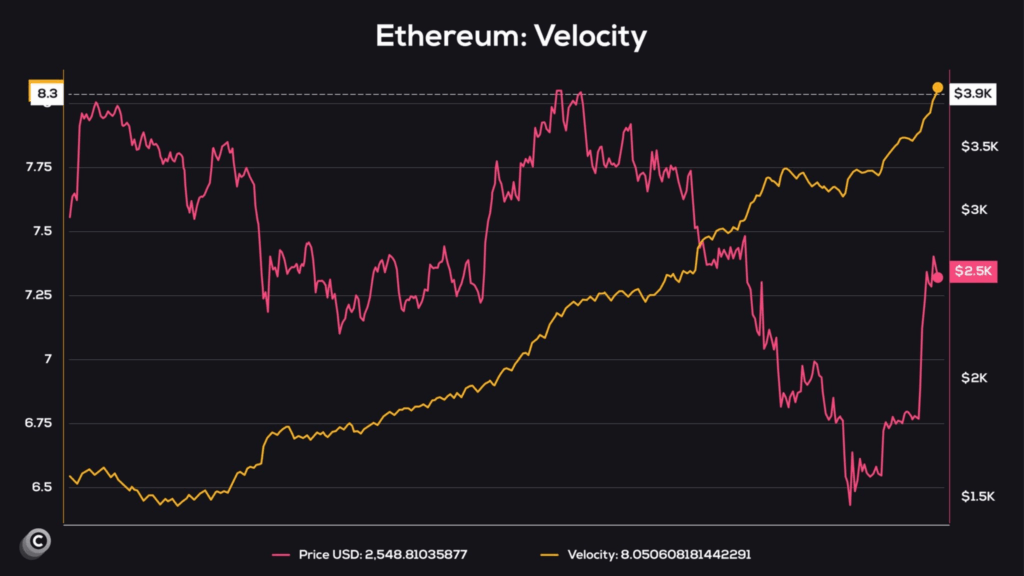

Additional data shows that Ethereum’s transactional velocity is also rising. The rate or velocity of ETH activities on the network is now 8.0 and has reached its highest point in years. If the metric goes up, it often shows that more people are interested in using Ethereum for on-chain activities.

While the price of ETH had gone in different directions from velocity earlier in the year, that gap is being closed now. Since falling below $1,500, ETH is now back above $2,500 in value. Analysts note that this change in market trends suggests that prices may once again be driven by demand.

An increase in transaction speed and a rebound in price suggest the market is recovering. If current conditions continue, some expect Ethereum’s price to reach the $3,500 to $3,900 range soon.

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Search

RECENT PRESS RELEASES

Related Post