Ethereum Overtakes Bitcoin in Spot Trading Volume for the First Time in 7 Years

November 24, 2025

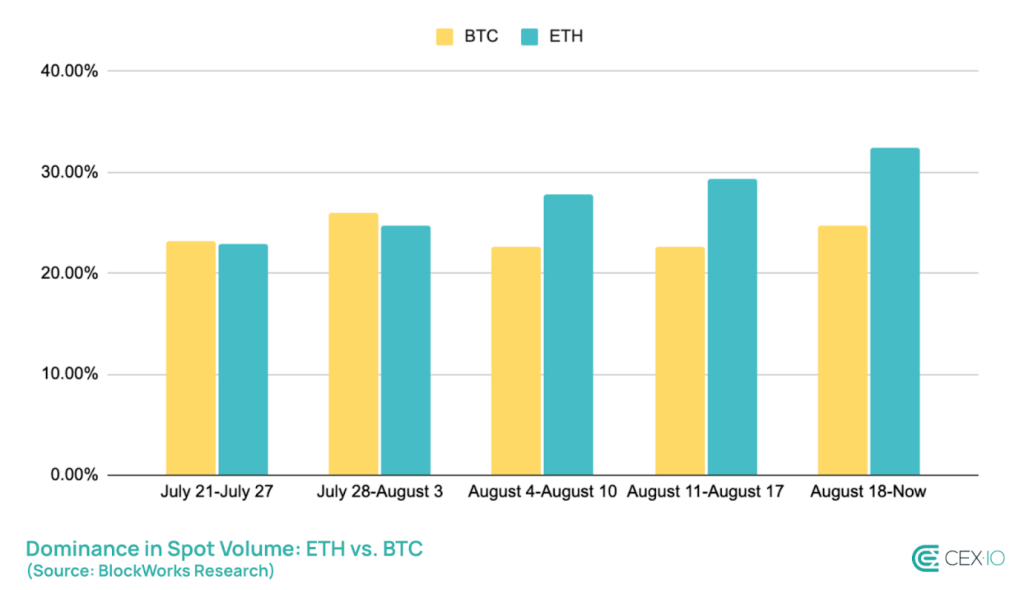

Ethereum just outtraded Bitcoin in spot volume for the first time since 2017. That’s a huge moment that shows how investor sentiment and institutional interest are really changing things up.

Ethereum hit $480 billion in spot trading on central exchanges in August 2025, while Bitcoin lagged at $401 billion. These aren’t just numbers. They signal a major shift in how people view these two crypto giants.

If you’re a Bitcoin investor (especially in places like South Asia or Australia) this change means it’s time to pay attention to new market dynamics and capital flows. Get ready to rethink your strategies as the landscape evolves!

Bitcoin has dominated trading volume since its creation. The last time Ethereum came close was back in 2017 during the ICO and DeFi boom. Since then, Bitcoin has solidified its position as “digital gold”.

But the market isn’t static. It’s always evolving. Bitcoin’s network trading volume is now at its lowest since mid-2019, while Ethereum has been on the rise. So, what was the big turning point? Ethereum’s move from proof-of-work to proof-of-stake in 2022. This step was able to boost confidence in its long-term potential.

Now you might be wondering what’s behind Ethereum’s recent trading volume explosion? Here are the key drivers of the ETH climb. This includes the Ethereum price AUD bump.

- Big Money Moves

Institutional players are shifting gears. Companies like SharpLink Gaming and BitMine Immersion have made huge Ether purchases this year. This signals a move away from Bitcoin-heavy portfolios. For example, SharpLink launched a $1.5 billion Ether buying program, and BitMine picked up a staggering 373,110 ETH in mid-August alone.

- ETFs Changing the Game

U.S. spot Ethereum ETFs are making it easier for institutions to invest in ETH. Ethereum ETFs saw $3.87 billion in inflows while Bitcoin ETFs experienced outflows of $751 million in August 2025. This shows that institutions are increasingly betting on Ethereum’s future.

- Staking Advantage

About 27.5% of Ethereum supply is currently staked and creates supply constraints that help stabilize prices and drive trading interest. This staking process offers yields that Bitcoin simply can’t match and makes it an attractive option for investors looking for income.

The technical indicators are backing the momentum of Ethereum and its growing appeal to both institutional and retail investors is hard to ignore.

| Metric | Ethereum | Bitcoin |

| August 2025 Spot Volume. | $480B | $401B |

| YTD Price Growth. | 30% | 20% |

| All Time High. | $4 950 | $124 171 |

| Current Price (Oct 2025). | $3 933 | $90 000 |

The ETH/BTC ratio has been on a steady climb and moving up from historical lows to hit 0.05854 by May 2025. Some analysts think it could even reach 0.1 in the coming months, which shows Ethereum’s potential to outperform.

Ethereum’s futures trading volume has also taken off, jumping from 42% of Bitcoin’s in October 2024 to a massive 98% now. This shift suggests more sophisticated traders are diving into Ethereum and bringing in institutional-level liquidity and better price discovery.

This shift in volume has some key takeaways for both current and future Bitcoin investors:

- Look in towards Diversifying your Portfolio

The trading data hints that institutional investors are starting to lean toward Ethereum. While Bitcoin is still the go-to for macro hedging and long-term value, Ethereum offers a different type of demand driven by its utility.

- Spot the Trend

The high Ethereum trading volumes usually signal the start of an altcoin season. Bitcoin holders should keep an eye on these shifts as they might point to broader market movements.

- Less Regulatory Worry

Ethereum’s ETF launches are a big deal that shows regulatory acceptance of proof-of-stake cryptos. This lowers some of the risks and encourages more institutional investors to jump in. This could benefit the entire crypto market.

What this all means that Ethereum’s growing momentum is worth watching- no matter if you’re a Bitcoin diehard or an all-around crypto enthusiast.

Let’s talk about where crypto prices might be headed with all the buzz around institutions getting involved. Here are a few scenarios for both Bitcoin and Ethereum:

Ethereum Price AUD targets

- End of 2025: We could see it around $4,200-$4,600.

- 2026: Might be a bit of a cool-down, possibly $1,800-$3,160.

- 2027-2030: We could be looking at $9,000-$32,000 if institutions keep jumping in!

Things to Keep an Eye On:

- How much money is flowing into crypto ETFs from big players?

- How many people are staking Ethereum and what kind of returns they’re getting.

- How Bitcoin’s network is growing. Especially the Lightning Network.

- Any new rules that change how cryptocurrencies are classified.

The Australian dollar price of Ethereum is really tied to how the global market feels and if more big companies adopt it. If you’re an Aussie investor, you might want to think about currency hedging.

Here’s something to think about if you’re a Bitcoin investor. Diversify! Splitting investments between Bitcoin and Ethereum can reduce risk since they’re not as tied as before.

Also, Ethereum’s been on a roll as 50% of last month’s trading days were “green.” A dollar-cost averaging strategy might be smart, especially with institutions buying in.

And remember to think long-term. Bitcoin is solid as digital gold, but Ethereum’s usability and staking make it a growing star worth considering.

Ethereum topping trading volume isn’t just luck. It signals a big shift in the crypto world. Institutions are jumping in, staking is booming, and clearer rules are making it a solid bet.

But don’t forget Bitcoin! Its scarcity and proven security still make it a rock-solid choice when things get bumpy. The real question is: Can Ethereum keep this lead through all market conditions?

Experts like Michael Novogratz even predict the possibility of an Ethereum supply shock. If more companies buy crypto and staking demand grows, expect sustained buying pressure. This means the Ethereum volume will tend to remain high.

This milestone means investors should change things up a bit beyond just Bitcoin as the market evolves. Watch closely. This could be a permanent change that you can capitalize on as one of the early adopters!

Search

RECENT PRESS RELEASES

Related Post