Ethereum Price Analysis: ETH Short Traders Deploy $650M Leverage Ahead of Trump – China Ta

October 26, 2025

Key Notes

- Ethereum price surged above $4,000 as optimism grew over Trump’s upcoming trade meeting with China’s Xi Jinping.

- Treasury firms holding ETH have overtaken Bitcoin in supply dominance, driven by yield-seeking institutional demand.

- Short traders deployed $650 million in leverage near $4,150, signaling resistance amid heightened market speculation.

Ethereum price reclaimed the $4,000 level on Sunday, October 26, boosted by optimism around Trump’s visit to Asia, climaxing in trade talks scheduled with Xi Jinping in Korea on Friday, Oct 30. Ethereum treasury firms maintained an aggressive accumulation outlook during the mid-October market dip, overtaking Bitcoin counterparts in terms of circulating supply dominance. Amid the market weekend recovery, ETH remains subject to intense speculation, with bear traders concentrating leverage positions around the $4,100 mark on Sunday.

Ethereum moves above $4,000 as Trump Asia Meet Ignites Optimism

Ethereum price rebounded to $4,099 on Sunday, October 26, up 10% from its seven-day low of $3,811 recorded last Wednesday. ETH’s rebound mirrored broader market gains, where all top 10 cryptocurrencies, including BTC, SOL, and XRP, posted consecutive green days over the weekend.

Ethereum (ETH) price crosses $4,000 on October 26 | CoinMarketCap

Ethereum’s rebound was linked mainly to Trump’s Asia visit, which began on a positive note as he oversaw a peace treaty signing between Cambodia and Thailand, in Malaysia on Saturday. The development eased geopolitical tensions ahead of the much-anticipated trade talks with China’s Xi Jinping, slated for Friday, October 30.

Yield-Seeking Ethereum Treasury Firms Overtake Bitcoin in Supply Dominance

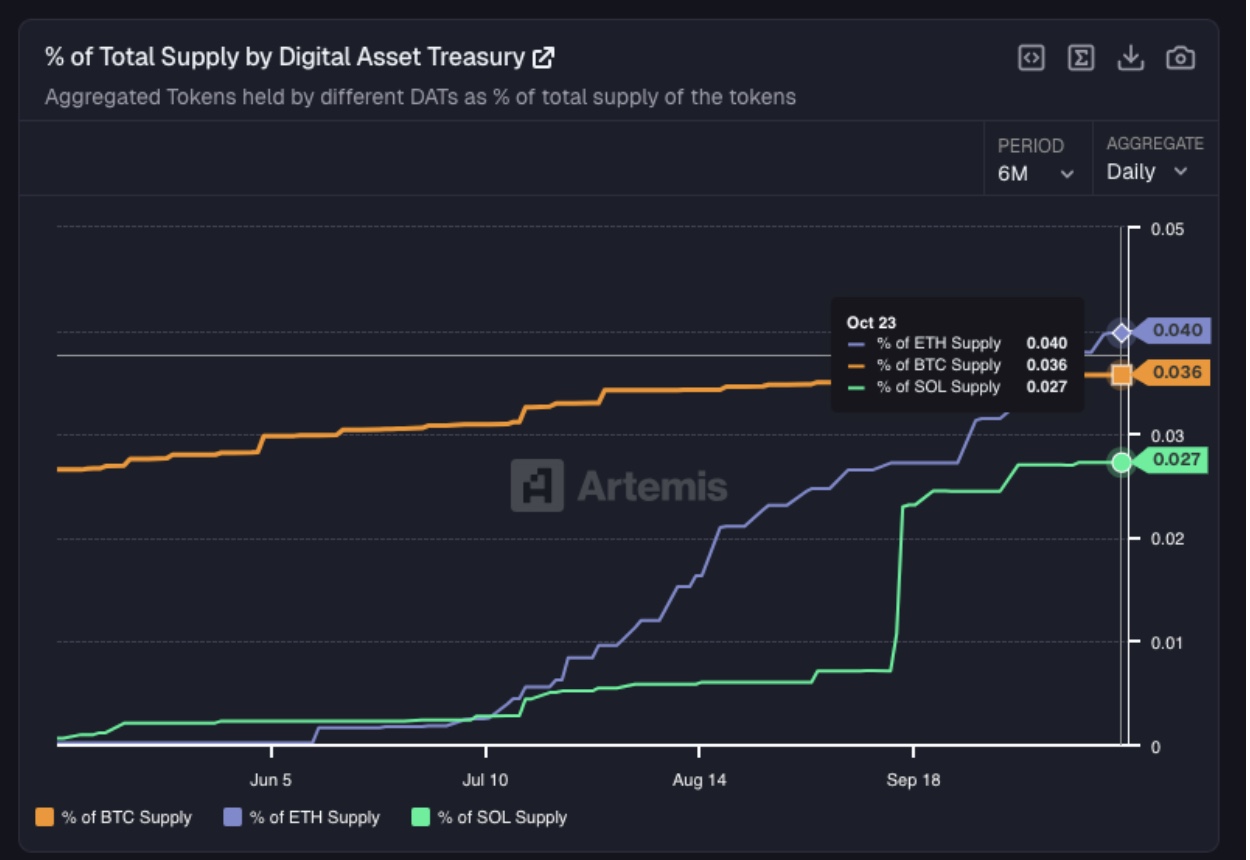

Despite volatility in ETH’s price in October, Ethereum treasury firms, led by Tom Lee’s Bitmine (BMNR), maintained an aggressive accumulation pace. Notably, Artemis data shows that publicly-listed firms holding ETH have now leapfrogged their Bitcoin counterparts in terms of supply dominance.

On October 23, Total ETH supply held by Digital Asset Treasury firms hit 3.2 million ETH, 0.40% outpacing Bitcoin’s corporate investors, which jointly hold 640,040 BTC, accounting 0.36% of the total 19 million BTC in circulation.

Digital Treasury Holdings as percentage of circulation supply, Oct 2026 | Source: Artemis

This reflects that demand for Ethereum Treasury continues to outpace Bitcoin in 2025, boosted by the crypto regulatory framework and ETH ETF staking approval in 2025.

Ethereum claimed plaudits after its Proof-of-Stake (PoS) transition dramatically reduced its energy consumption (by 99%) while simultaneously introducing a yield-bearing feature, making it more attractive to global conglomerates and portfolio managers with sustainable and clean energy mandates.

Art Malkov, strategic advisor at Electroneum, an eco-friendly blockchain, provided insights affirming that yield is the more attractive factor for corporate treasuries and institutional investors.

“We’ve observed that institutions discuss yield in every conversation, but mention energy efficiency only when compliance teams are in the room.

Corporate treasuries are fiduciaries first. ETH staking yields (currently 3-4% APY) provide a revenue-generating alternative to cash reserves, which is their core mandate. The green credentials primarily serve to satisfy ESG checkboxes that allow institutional entry—they remove a barrier rather than create demand. – Art Malkov, Electroneum CEO.

Ethereum Price Forecast: ETH Faces Major Resistance at $4,150 as Bears Deploy $650M Leverage

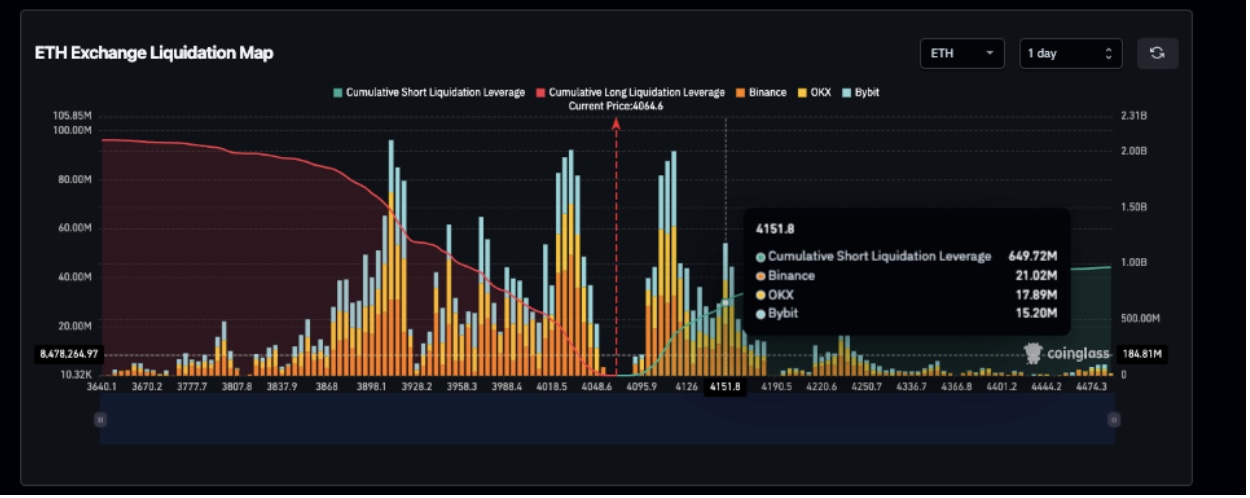

Ethereum price posted a 3% gain, stabilizing near $4,077 at press time on Sunday, October 26, after rejecting the $4,099 intraday peak. However, derivatives market data culled from Coinglass indicates that most new ETH contracts opened on Sunday leaned bearish.

ETH’s 24-hour trading volume rose 54%, while open interest increased by 5.88%. The long-to-short ratio fell to 0.82, signaling that more short contracts were opened than long ones. Short contracts exceeding longs during a rally often suggest investors are bracing for a potential price reversal.

With Trump’s meeting with China and the upcoming U.S. Federal Reserve rate decision looming large, traders appear to be hedging against potential downside risks, as any of these events could trigger large-scale crypto liquidations, as seen in prior weeks.

Ethereum Liquidation Map, October 25, 2025 | Source: Coinglass

In terms of ETH price projections for the week ahead, bears have concentrated roughly $650 million in short contracts around the $4,150 level, accounting for 76% of the $840 million in total short leverage deployed within the past 24 hours.

If Ethereum breaches this resistance, it faces relatively lighter opposition until the $4,240 zone, where another significant supply cluster lies. Conversely, failure to break above $4,100 could trigger liquidations, dragging ETH prices back toward short-term support near $3,911, where bulls have deployed approximately $1.5 billion in long ETH contracts.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Cryptocurrency News,Ethereum News,News

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Search

RECENT PRESS RELEASES

Related Post