Ethereum Price at Risk of 17-Month Low As Huge Volatility Surge Is Inbound

March 19, 2025

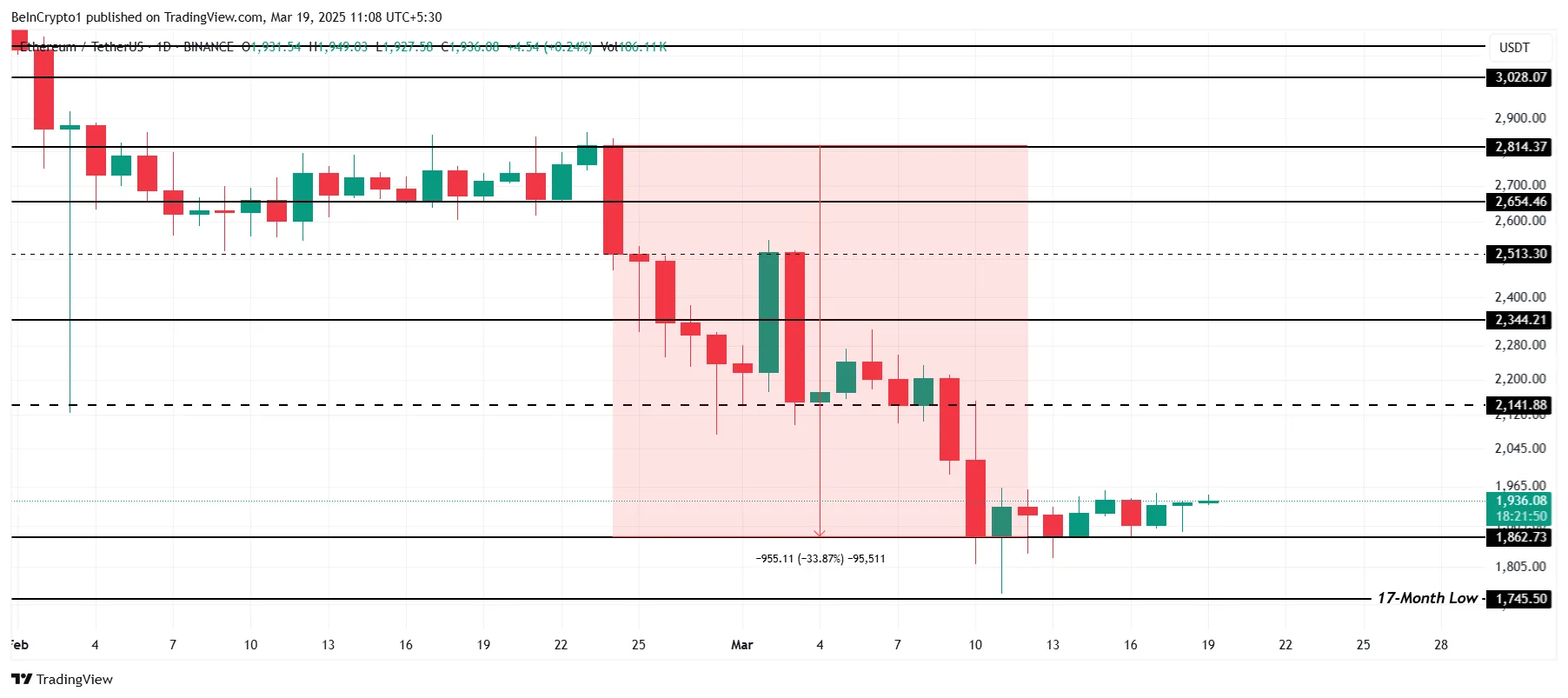

Ethereum (ETH) has been struggling to maintain upward momentum despite repeated attempts to recover. Recent price movements show Ethereum trading at $1,936, hovering just above the critical $1,862 support.

However, the lack of volatility and declining market interest could push the price down further, potentially reaching a 17-month low.

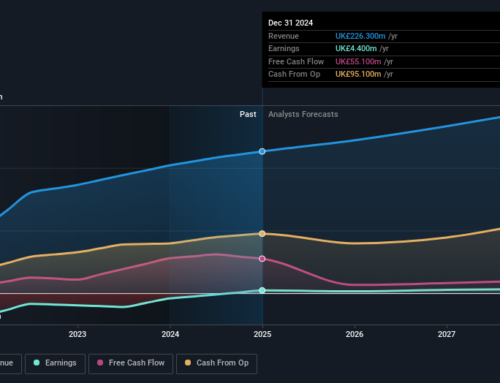

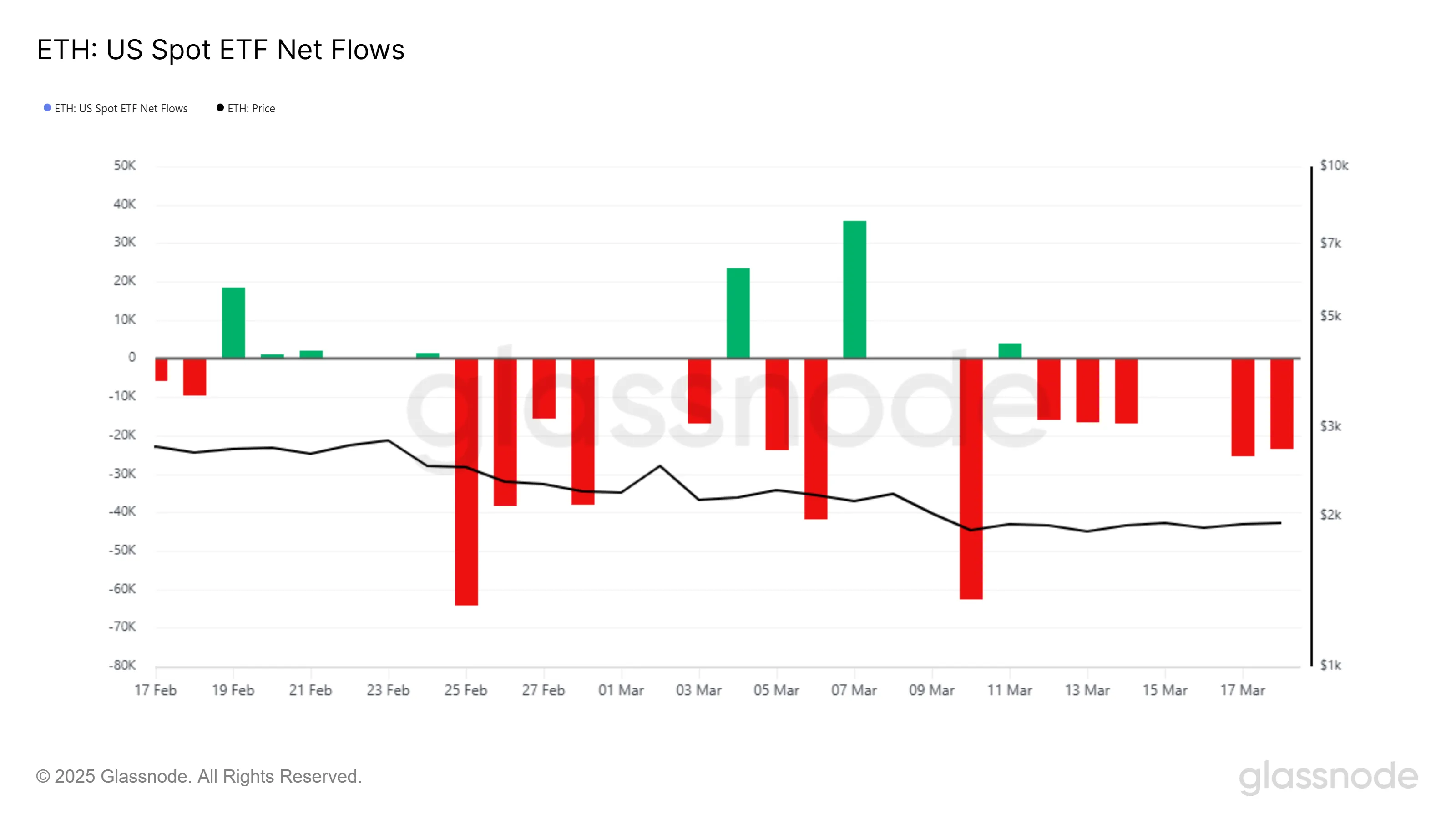

Ethereum’s spot ETF has experienced significant outflows over the past month, highlighting declining interest in the cryptocurrency. In the last 48 hours alone, nearly 49,000 ETH were withdrawn from the ETF, signaling that investors may be losing confidence in Ethereum’s short-term prospects.

The sustained outflows reflect a broader market sentiment that has been bearish toward Ethereum. While there were some instances of inflows, they were far outweighed by the outflows. As a result, the market’s faith in Ethereum’s immediate recovery remains low.

Technical indicators suggest that Ethereum’s price may be in for further challenges. The Bollinger Bands are nearing a squeeze, a signal that volatility is imminent. Historically, when the candlesticks appear above the baseline of the Bollinger Bands during such squeezes, the price tends to dip rather than surge. This raises concerns that Ethereum may experience a significant price drop if the pattern continues.

Furthermore, Ethereum’s inability to break free from the downward trend reflects a lack of momentum. Despite previous attempts to recover, the technical indicators point to continued pressure on the cryptocurrency. If this pattern holds, Ethereum’s price could struggle to maintain its current levels and face further declines.

Ethereum has seen a 33% decline over the past month, with its price dropping sharply toward the end of February and early March. Currently trading at $1,936, Ethereum is holding above the $1,862 support level.

However, if the bearish trend continues, Ethereum could break through this support and fall to $1,745. Such a move would mark a 17-month low, further testing market confidence.

If Ethereum continues to face selling pressure, further declines could occur, possibly taking the price down to $1,500. The combination of weak ETF inflows and bearish technical signals suggests that downward momentum is more likely than a quick recovery.

However, there is still a potential for recovery if Ethereum capitalizes on the upcoming Pectra upgrade. Should the upgrade spark renewed interest from institutional investors and increase ETF inflows, Ethereum’s price could rise back up to $2,141, helping to recover some of the losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post