Ethereum Price Breakout: Bull Flag Points to 100% Rally Toward $3,600

April 26, 2025

- Ethereum targets $3,600 after breakout from long-term downtrend.

- BlackRock’s $40M ETH buy boosts institutional bullishness.

- Core on-chain data remains strong despite price volatility.

Ethereum (ETH) broke above $1,790 on Apr. 26, signaling a strong bullish shift as traders eyed higher targets.

Ethereum (ETH) broke out of a five-month descending channel this week, according to the ETH/USD daily chart on TradingView. The move marked the first major bullish reversal since December 2024, putting a potential target of $3,638 into play — a rally of nearly 100% from April’s lows.

The breakout saw Ethereum reclaim the $1,785 support zone while positioning itself above the channel resistance. The Relative Strength Index (RSI) climbed to 55.48, suggesting that buying momentum could continue without the asset entering overbought territory.

Mister Crypto fueled the bullish narrative, posting that a “massive bull flag” formation could eventually catapult Ethereum past $10,000. “Nobody is bullish enough. Bears will cry,” he commented on X.

Short-term, the $1,800–$1,850 zone remains the level to beat. Ted Pillows highlighted this resistance range, suggesting ETH could rally to $2,200–$2,300 if it breaks cleanly above.

Ethereum briefly tested $1,816 on Apr. 26 before pulling back slightly. Momentum above $1,850 could open the door for a stronger surge into May.

However, some traders urged caution. $0uL warned of a possible slip below $1,500 if the bullish momentum fails. “If it happens, MAX LONG EVERYTHING,” he wrote, hinting that a sharp dip could attract buyers aggressively.

Ethereum’s bullish breakout received a major boost from institutional interest this week.

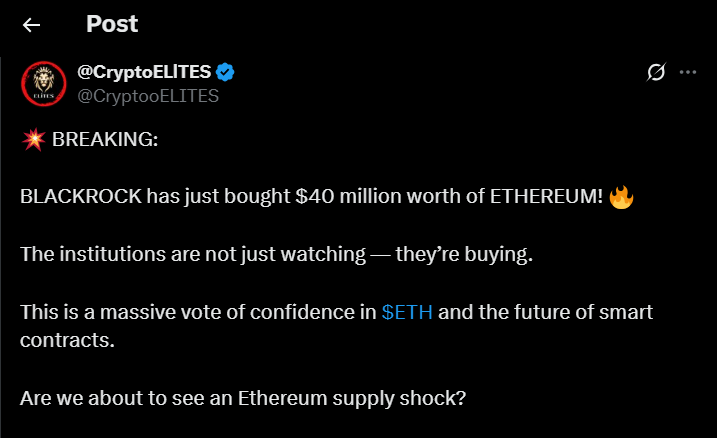

According to CryptoELlTES, BlackRock purchased $40 million worth of ETH, fueling speculation about a looming supply squeeze. “Institutional investors aren’t just watching — they’re buying,” the account posted, highlighting a shift in sentiment among major players.

Market Prophit data also showed a sharp uptick in bullish sentiment for Ethereum. Both retail traders and proprietary indicators turned positive, reinforcing the technical momentum seen after ETH reclaimed the $1,785 level.

As institutional appetite grows, many traders are now positioning for a potential breakout continuation heading into May.

Analyst DD pointed to a critical support zone between $1,750 and $1,800. A failure to hold this range, he warned, could send Ethereum tumbling toward $1,200.

“Conversely, a weekly close above the blue box would prompt me to develop a more bullish outlook,” he said, adding that he would wait for a confirmed weekly candle close before adjusting his long-term view.

Heading into May, Ethereum’s fate depends largely on its ability to secure a strong close above $1,850.

If bulls succeed, $2,200 and higher levels could come into play. If not, renewed selling could drag ethereum price back to $1,500 — or even lower.

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Search

RECENT PRESS RELEASES

Related Post