Ethereum Price Forecast: $7K to $12,000 Still Possible as ETF Flows Shift

October 1, 2025

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Ethereum is back in focus with forecasts suggesting it could climb between $7,000 and $12,000 in the coming months. Analysts remain split after recent ETF outflows, but projects like MAGACOIN FINANCE are also attracting attention from those seeking undervalued altcoins during market dips.

Tom Lee’s Bold Ethereum Forecast

At Korea Blockchain Week 2025, Tom Lee, co-founder of Fundstrat and chairman of BitMine, predicted that Ethereum could hit $7,000 to $12,000 by year-end. He also sees a possible extension to $15,000. He framed this as part of what he called a new multi-year “super cycle” for ETH, lasting more than a decade.

Lee connected Ethereum’s rise to two major themes: artificial intelligence and finance. He argued that a future machine-driven economy would likely use Ethereum as its base layer due to its neutrality and scalability.

He also pointed to Wall Street and policymakers leaning on Ethereum as a trusted network, with stablecoins and real-world assets reinforcing its use case.

Supporting his view, BitMine has turned itself into an Ethereum-focused treasury firm, now holding 2.41 million ETH valued at over $10 billion. According to Lee, this positions Ethereum not only as a cryptocurrency but also as a core financial asset that could eventually be included in equity indices.

ETF Outflows Challenge Short-Term Sentiment

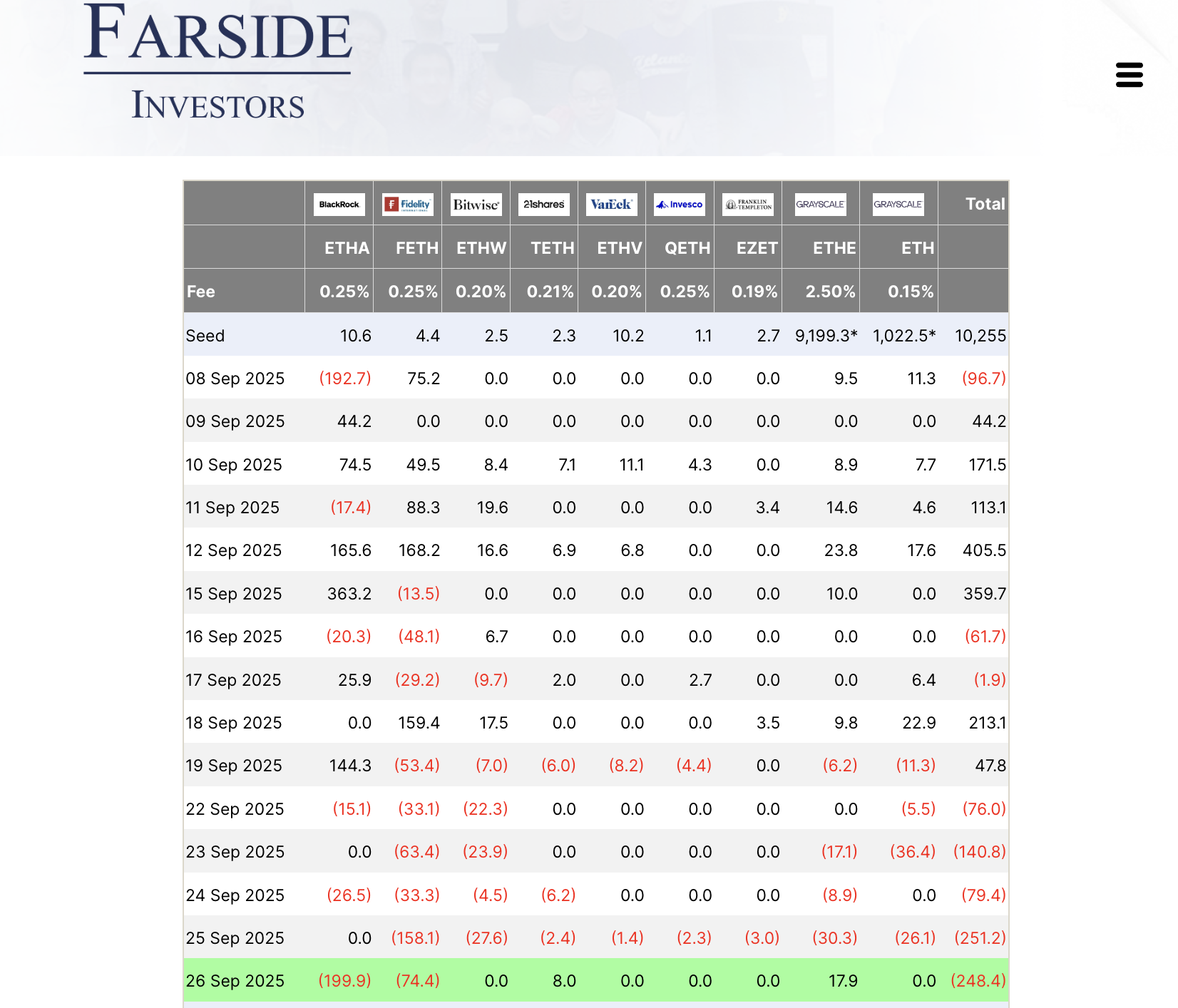

Despite Lee’s bullish outlook, Ethereum’s spot ETFs recorded $795.8 million in outflows over five days, raising doubts in the short term. Data showed that BlackRock’s Ethereum fund sold ETH thrice within a week, adding to the concerns.

On September 24 and 25 alone, more than $315 million exited Ethereum ETFs. Fidelity, Grayscale, and Bitwise also saw large withdrawals, which dragged the ETH price under $4,000 before a mild recovery.

Still, on-chain data tells another story. Around 420,000 ETH were withdrawn from exchanges, pushing balances to nine-year lows. This suggests some large holders may be buying quietly despite the ETF exits. Analysts note that such withdrawals often hint at long-term holding strategies, even as traders react nervously in the short term.

MAGACOIN FINANCE: Another Coin to Watch

Alongside Ethereum’s moves, many analysts are putting MAGACOIN FINANCE on their watchlist as an undervalued altcoin. Over 18,000 investors are already on board, and whales have been spotted taking early positions.

Some analysts describe it as one of the best altcoins to buy in 2025, useful both as a hedge and as a way to diversify during uncertain Ethereum price swings. This growing interest has sparked curiosity among those seeking fresh opportunities beyond the larger names.

How Traders Can Position

Ethereum remains in the spotlight with forecasts as high as $12,000, but ETF outflows remind traders that the path may not be smooth. A balanced approach could involve holding ETH while also exploring undervalued altcoins like MAGACOIN FINANCE. Those curious can visit the official site to learn more and act early:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Search

RECENT PRESS RELEASES

Related Post