Ethereum Price Forecast: Can ETH Price Defend $2,700 and Recover Toward the $3,800–$4,200

December 1, 2025

The Ethereum price today is stabilizing near key support following a volatile pullback, with market observers closely monitoring whether ETH can defend the $2,700 area and rebuild momentum toward $3,800 and higher. While near-term charts suggest hesitation, broader Ethereum price prediction models still indicate that a move toward the $4,200 region remains possible next year under favorable conditions.

Ethereum Price Movement Shows Recovery

According to price data from major market trackers and TradingView charts, the current ETH price has recovered into the $2,900–$3,000 range after an extended corrective phase. The price of Ethereum recently traded near $2,986, marking a rebound from earlier lows formed close to the $2,700 level.

Technical analysts now point to the $3,058 zone as an important resistance area. This level previously capped multiple upside attempts, making it a key threshold for short-term structure. A sustained breakout above this area could, if supported by volume, open the door for a broader move toward the $3,600–$3,800 range, which remains one of the most closely watched resistance clusters in recent Ethereum price news.

Crypto Tony advises waiting for Ethereum to dip to $2,785, as the current $2,850 mid-range offers low-conviction trade opportunities. Source: Crypto Tony via X

However, not all market participants are convinced a breakout is imminent. Crypto Tony, a trader known for short-term market structure analysis, recently advised caution, stating:

“I am waiting for a dip to $2,785 before I look for any longs for bounces. Right now we are mid range so no entry here.”

His view reflects a broader sentiment of patience among short-term traders as ETH continues to consolidate between well-defined support and resistance zones.

Impact of Upgrade on Price Projections

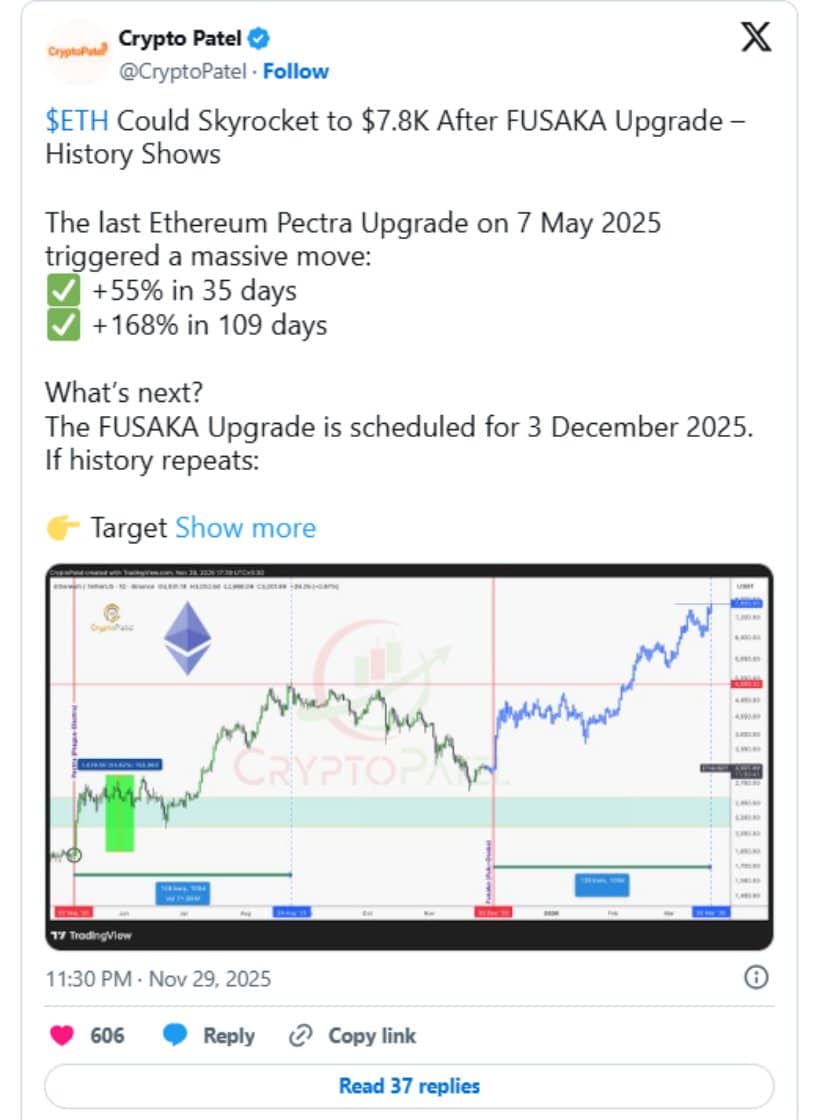

Network upgrades remain an important variable in the broader Ethereum forecast 2025 discussion. Historical data from Ethereum’s previous major upgrade cycle in May 2025 suggests that periods following upgrades have sometimes been accompanied by increased volatility and directional price movement. During that cycle, ETH saw rallies exceeding 50% within several weeks and extended gains of over 150% across multi-month windows, based on aggregated market data.

With another protocol upgrade scheduled for early December, some analysts are drawing cautious comparisons to those historical patterns. If similar market conditions develop, some projection models estimate that Ethereum price prediction 2025 scenarios could extend toward the $4,200 region. Projections stretching beyond that level, however, remain outside the current year’s forecasting horizon and depend on broader adoption and liquidity trends.

Ethereum (ETH) may be forming Wave 4, with a potential short-term bounce near $2,700; the chart also indicates take-profit (TP) and stop-loss (SL) levels for risk management. Source: HodlAhmad on TradingView

At the same time, derivatives traders are maintaining tight risk controls. Chart-based analysis circulating among professional traders references a potential Elliott Wave “Wave 4” formation. In Elliott Wave theory, Wave 4 usually represents a corrective phase that can precede further trend continuation if underlying support remains intact. Based on this framework, many short-term strategies now focus on defined ETH resistance levels, using take-profit (TP) and stop-loss (SL) levels to manage downside exposure rather than making directional assumptions.

Decline in Exchange Reserves Supports Ethereum’s Condition

On-chain analytics platforms tracking exchange balances indicate that ETH reserves held on centralized exchanges have declined by roughly 2% in recent weeks. This trend is often interpreted as reduced immediate sell-side supply, as fewer coins remain available for trading on exchanges.

If history repeats Pectra’s gains, Ethereum (ETH) could reach $4,500 by Jan 7, 2026, and $7,800 by Mar 22, 2026, after the FUSAKA Upgrade on Dec 3, 2025. Source: Crypto Patel via X

When the liquid supply contracts during stable demand, price reactions around resistance levels can become more sensitive. This dynamic is one reason traders are closely watching the $3,058 and $3,618 resistance zones. If sustained buying interest develops in these areas, some market participants believe the $3,800 ETH price target could emerge as the next key upside reference before any attempt at higher levels, such as $4,200.

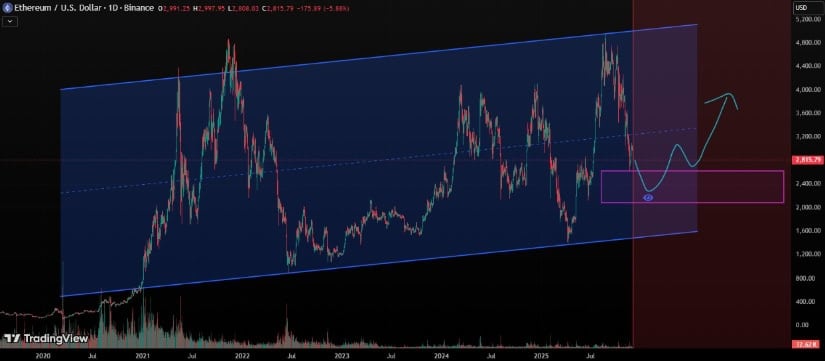

As of December 1, Ethereum sits near $2,800, with support at $2,000–$2,400 and risks of a deeper drop below $2,200 toward $1,500–$1,750. Source: oademirci on TradingView

At the same time, downside risk remains part of the technical picture. If the ETH price today fails to hold above the $2,700–$2,800 support band, technical models suggest the price may revisit lower support between $2,000 and $2,400. A breakdown below $2,200 would not guarantee further losses, but it may signal increased risk of testing deeper historical support zones toward the $1,500–$1,750 range.

Final Thoughts

The broader Ethereum price prediction landscape heading into 2025 reflects a careful balance between recovery signals and unresolved downside risks. On one side, improving market structure, falling exchange reserves, and upcoming network upgrades are often viewed as supportive elements for longer-term Ethereum price outlook scenarios toward the $3,800–$4,200 range. On the other hand, traders continue to emphasize the importance of maintaining support near $2,700 to avoid renewed bearish momentum.

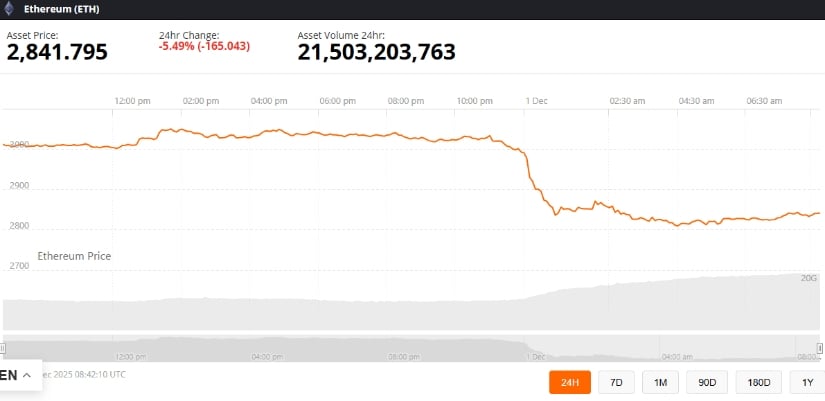

Ethereum was trading at around 2,841.79, down 5.49% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

As Ethereum news today continues to develop around network upgrades, macroeconomic conditions, and ETF-related speculation, ETH’s short-term direction is likely to be shaped by how the price behaves near the $3,000 threshold. If buyers are able to defend current levels and confirm a break above nearby resistance, the longer-term Ethereum price prediction 2025 narrative toward $4,200 remains technically plausible—though not guaranteed.

For now, most market participants remain focused on disciplined risk management rather than aggressive positioning, reinforcing the cautious tone that continues to characterize Ethereum’s end-of-year trading environment.

Search

RECENT PRESS RELEASES

Related Post