Ethereum Price Forecast: ETH could outperform Bitcoin as the top crypto faces diminishing

May 28, 2025

- Ethereum could be the primary beneficiary of institutional rotation, considering its staking yields may appeal to large investors.

- Bitcoin’s dominance over Ethereum faces a ceiling due to potential diminishing returns as its market cap crosses the $2 trillion mark.

- Ethereum bulls have to hold a rising trendline and 50-period EMA support to maintain dominance.

Ethereum (ETH) trades above $2,600 on Wednesday, following predictions that it would eventually outperform Bitcoin (BTC), considering the top crypto potentially faces slower gains due to the impact of diminishing returns on its rising market cap.

Ethereum regained mainstream attention in the cryptocurrency market in May after rising more than 40% in the month amid the successful Pectra upgrade. The ETH/BTC pair, which has been on a downtrend since November 2022, flipped toward the upside, gaining more than 30%.

While the recent outperformance of Ethereum over Bitcoin sparked conversations about ETH spearheading a new altseason, heavy institutional inflows into the top cryptocurrency sent it to a new all-time high last week. Several firms, including Trump Media and Strive, are looking to launch a Bitcoin treasury strategy, replicating Strategy’s BTC accumulation playbook.

The strong performance of Bitcoin has cooled talks of an altseason, but ETH still shows relative strength, as indicated in the chart below.

ETH/BTC weekly chart

“The fact that this strength is happening alongside, not after, BTC price acceleration makes it especially bullish: capital isn’t exiting Bitcoin, it’s compounding across L1s,” said Jag Kooner, Head of Derivatives at Bitfinex. “This is the beginning of what might become Phase 3 of the crypto bull cycle, where BTC strength stabilizes, ETH accelerates, and capital spreads out across selective altcoins,” he added.

However, Marcin Kazmierczak, co-founder and COO of Redstone, questioned the sustainability of Bitcoin’s dominance over Ethereum as its market value climbs into the $2 trillion range. “Bitcoin dominance faces natural ceiling effects as market cap grows. Simple math suggests diminishing returns on institutional inflows at current allocation levels,” said Kazmierczak.

He expects Ethereum to be the next institutional play as BTC approaches the $150K-$200K range.

“Ethereum benefits from having clearer institutional investment thesis (programmable money, DeFi infrastructure) compared to most alts, positioning it as the primary beneficiary when institutions eventually diversify beyond pure Bitcoin exposure,” added Kazmierczak.

The prediction aligns with the recent announcement of a $425 million private placement from SharpLink Gaming (SBET) to initiate an Ethereum treasury strategy. Market participants are predicting that ETH could reach $3,000 in June as SharpLink begins its accumulation of ETH, according to options exchange Deribit data from Amberdata.

The institutional rotation to ETH could gain traction in 2026 as Ethereum’s technological advancements and staking yields could prove compelling to institutions, Kazmierczak said.

Ethereum experienced $52.12 million in futures liquidations over the past 24 hours, according to Coinglass data. The total amount of long and short liquidations is $34.6 million and $17.48 million, respectively.

After bouncing off the $2,500 level on Monday and rising nearly 8%, ETH saw another rejection just above $2,700 on Tuesday, further strengthening the key resistance at $2,750. Following the rejection, the top altcoin continued its consolidation near $2,600 on Wednesday.

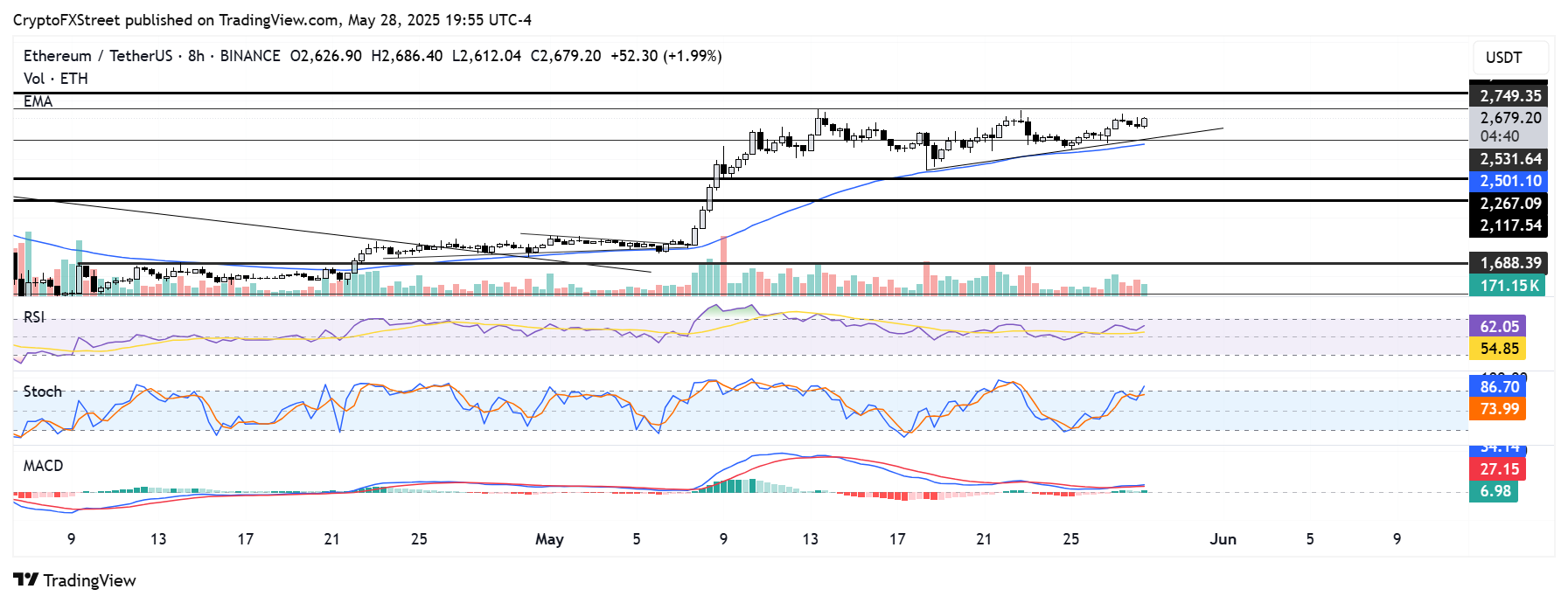

ETH/USDT 8-hour chart

Before ETH can begin a new uptrend, bulls must initiate significant buying to outweigh the selling pressure near the $2,750 to $2,850 key range and flip it into a support level.

On the downside, a rising trendline — strengthened by the 50-period Exponential Moving Average (EMA) dynamic support — could help provide short-term support. A decline below these levels could send ETH toward the support range around $2,260 to $2,100.

The Relative Strength Index (RSI), Stochastic Oscillator (Stoch), and Moving Average Convergence Divergence (MACD) are all above their neutral levels, indicating a modest short-term bullish dominance.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post