Ethereum Price Forecast: ETH ETFs record seven weeks of inflows; here’s why

June 9, 2025

- Ethereum investment products recorded a seventh consecutive week of net inflows, raking in $296.4 million.

- Growing stablecoin adoption is reshaping institutional narratives around public blockchains, increasing interest in Ethereum ETFs

- Invesco filed with the SEC to permit staking within its Ethereum ETF, as anticipation of SEC approval could boost inflows.

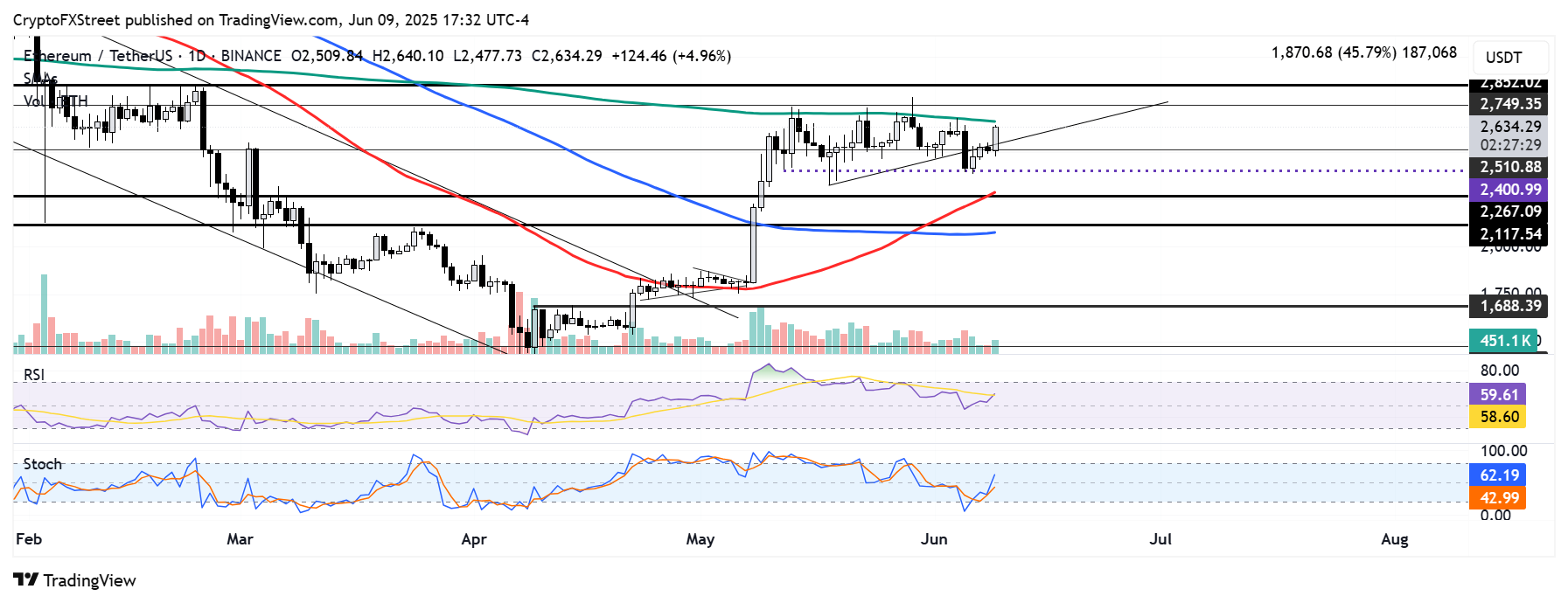

- ETH is retesting a rising trendline resistance after three consecutive unsuccessful attempts to rise above it.

Ethereum (ETH) investment products maintained their inflow streak last week, likely driven by the shifting narrative around public blockchains and high anticipation of a Securities and Exchange Commission (SEC) approval for staking within ETH ETFs.

Ethereum-based products globally continued their positive streak last week, with net inflows of $296.4 million, according to CoinShares. The products have now recorded a seventh straight week of inflows, totaling $1.5 billion.

“This represents the strongest run of inflows since the US election last November and marks a significant recovery in sentiment amongst investors,” wrote CoinShares Head of Research James Butterfill in a report on Monday.

US spot Ethereum ETFs — supercharged by BlackRock’s iShares Ethereum Trust (ETHA) — accounted for the majority of the flows, bringing in $281.3 million and registering 15 consecutive days of inflows.

The inflows into ETH ETFs can be attributed to rising interest in stablecoins and tokenization both, from the US Congress and major Fintech institutions like Visa, Mastercard and Stripe, according to Bernstein analysts led by Gautam Chhugani.

In a note to investors on Monday, the analysts highlighted that the potential widespread use of stablecoin payments is altering how investors view public blockchain networks, such as Ethereum, and their native cryptocurrencies.

“Investors have always told us — crypto is useless, but blockchain is valuable. But these are not different things,” the analysts wrote.

“If you believe in stablecoin-based payments innovation, why is the Ethereum network that mints the stablecoins and processes stablecoin transactions not valuable? Any company that uses stablecoin tech pays transaction fees to the Ethereum network. There is now both utility and value accrual. We believe that the narrative around value accrual of public blockchain networks is at a critical inflection point, starting to reflect in investor interest in Ethereum ETF inflows,” they added.

The prediction comes at a time when the US Senate is wrapping up plans to move forward to vote on the final passage of the GENIUS Act, which regulates stablecoins, in the coming weeks.

The inflows in ETH ETFs could also stem from high anticipation of a potential SEC approval for staking in US spot ETH ETFs, especially after the Division of Corporation Finance’s statement on May 29, which indicated that certain staking activities do not fall within the boundaries of securities laws.

On Monday, the Cboe BZX filed with the SEC to allow staking within the Invesco Galaxy Ethereum ETF, joining the likes of Fidelity, Grayscale, Bitwise, and 21Shares in waiting for the agency’s decision.

“Based on discussions with the Sponsor, the Exchange proposes to amend several portions of the Eth ETP Amendment No. 1, as amended, in order to allow the staking of ether held by the Trust,” the filing states.

Meanwhile, the Ethereum Foundation (EF) has also been undergoing a restructuring, establishing new treasury policies and protocol research teams.

Ethereum futures recorded $21.40 million in liquidations, with liquidated long and short positions reaching $0.3 million and $21.07 million, respectively, in the past 24 hours, according to Coinglass data.

The top altcoin crossed above an ascending trendline resistance after seeing a rejection near it in the past three days. If ETH maintains a firm move above this trendline, it could tackle the $2,750 – $2,850 resistance range. The 200-day Simple Moving Average (SMA) also stands as a dynamic resistance, consistently pushing prices down since May 13. ETH has to clear this level to begin its next uptrend.

ETH/USDT daily chart

On the downside, ETH could find short-term support near $2,400. Further below, the $2,250 – $2,100 range — supported by the 50-day SMA — could provide strong support if ETH declines below $2,400.

The Relative Strength Index (RSI) is above the neutral level and on the verge of testing its moving average line. Meanwhile, the Stochastic Oscillator (Stoch) is rising towards its neutral level. Crosses above their moving average and neutral level, respectively, could strengthen the bullish momentum for ETH.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post