Ethereum Price Forecast: ETH sees increased buying pressure as Pectra upgrade draws closer

March 21, 2025

- Ethereum supply on exchanges dropped to a 10-year low, according to Santiment.

- Ethereum accumulation addresses added 2.11 million ETH in March.

- ETH could find support at $1,800 if it fails to hold a key descending trendline.

Ethereum (ETH) trades above $1,900 on Friday following investors stepping up their buying pressure in March. The top altcoin could be set for a recovery if the Pectra upgrade proves to be a strong price catalyst.

Ethereum supply on exchanges declined further on Friday, reaching a 10-year low of 8.71 million ETH, per Santiment data.

“There is 16.4% less ETH on exchanges compared to just 7 weeks ago,” noted Santiment in a Thursday’s X post.

A reduction in a coin’s exchange supply indicates that investors are potentially moving tokens to private wallets for long-term holding. It’s important to note that this metric may differ across other on-chain analytical tools.

ETH supply on exchanges. Source: Santiment

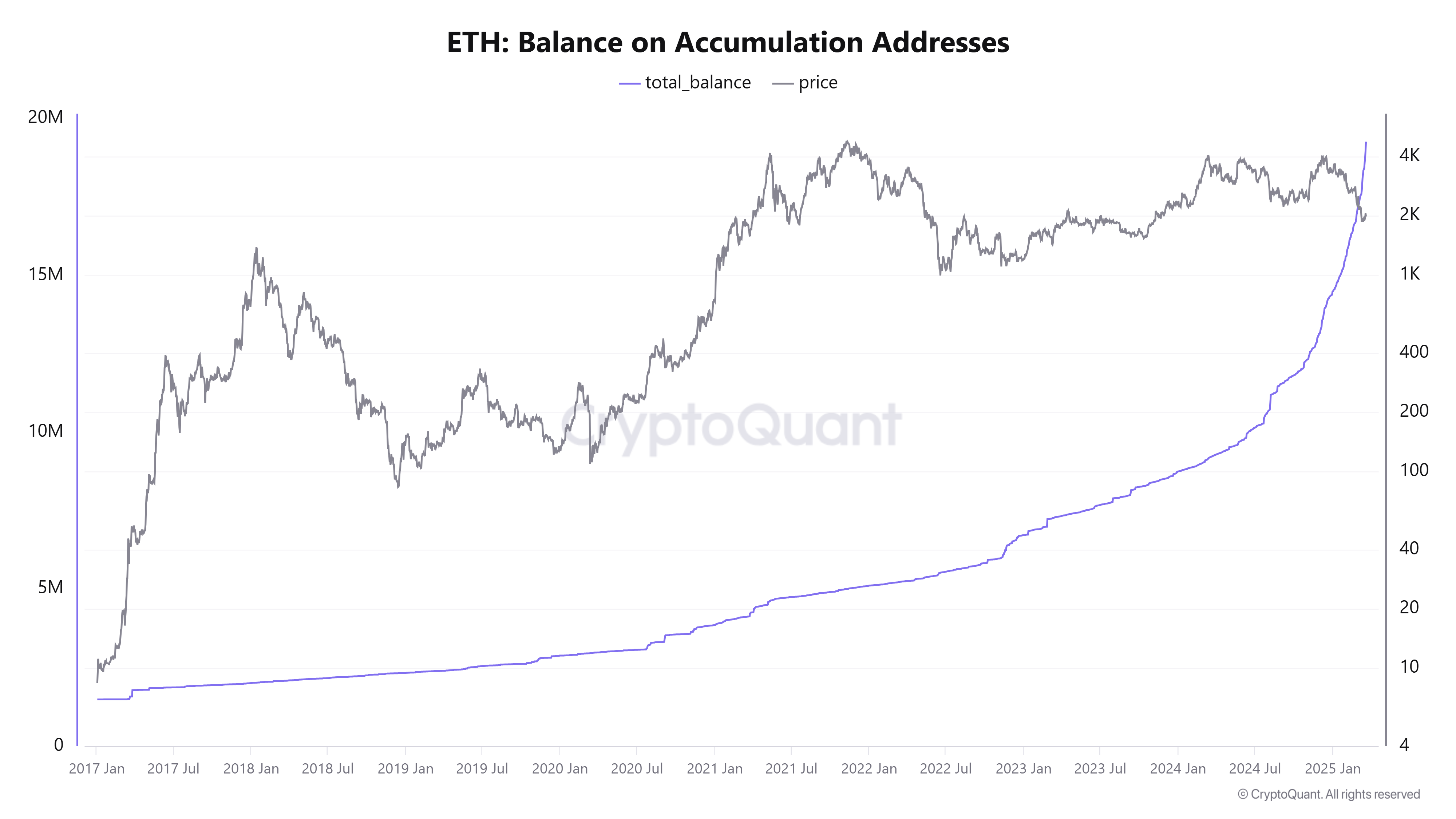

A similar buying pressure is also visible across the balance on ETH accumulation addresses, which has grown by 4.77 million ETH since the beginning of the year — an impressive 32% growth rate. Notably, about 45% of that growth (2.11M ETH) occurred in March following ETH’s decline below the $2,000 psychological level.

Accumulation addresses are wallets that haven’t recorded any outflows.

ETH balance on accumulation addresses. Source: CryptoQuant

Meanwhile, ETH’s open interest in the futures market increased from 9.40M ETH to 10.10M ETH in the past three days, reflecting a slight growing confidence among derivative traders in the top altcoin.

The intense buying pressure around current price levels could establish it as a critical support and spark a rally if ETH sees a strong market catalyst.

The upcoming Ethereum Pectra upgrade could provide the needed spark to cause a turnaround. Pectra will introduce several features to Ethereum, including transaction batching, payment of gas fees in other ERC-20 tokens, sponsored transactions, increased staking limit and blobspace expansion.

While Pectra triggered issues among validators during its deployment on test networks Holesky and Sepolia, developers have navigated the challenges impressively.

Pectra is scheduled to go live on a new testnet, Hoodi, on Wednesday. If successful, developers will deploy Pectra on the mainnet after 30 days.

Ethereum saw $25.06 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $17.13 million and $7.93 million, respectively.

ETH is testing the support near a descending trendline on Friday. If ETH bounces off the trendline, it could retest the resistance at $2,070. However, a firm decline above the trendline could see ETH finding support near the $1,800 level. A further decline below $1,800 could send ETH to $1,500.

ETH/USDT daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels and testing their moving average lines. A decline below their moving average lines will accelerate the bearish pressure.

A daily candlestick close below $1,500 will invalidate the thesis and potentially send ETH toward the $1,000 psychological level.

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum’s roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post

%20%5B00.47.05,%2022%20Mar,%202025%5D-638781979366851799.png)