Ethereum Price Forecast: ETH sees rising buying pressure as it recovers the $2,500 mark

May 21, 2025

- Ethereum exchange supply plunged to its lowest since August 2024, indicating dominant bullish momentum.

- Whales continue their buying pressure, expanding their balance by over 670K ETH in the past nine days.

- ETH continues consolidating near the $2,500 key level amid a lack of directional bias.

Ethereum (ETH) saw a 2% gain in the early Asian session on Thursday, recovering the $2,500 key level after whales stepped on the gas with their buying pressure.

Ethereum’s supply on exchanges extended its decline to 18.73 million ETH on Wednesday, indicating sustained spot market buying pressure. Since the metric began a downtrend on April 24, more than 1 million ETH have left exchanges to private wallets for potential long-term holding. As a result, ETH’s supply on exchanges has reached its lowest level since August 2024.

The reduced exchange supply partly explains why ETH’s price has maintained an upward trajectory since the same date.

-1747882240100.png)

ETH Exchange Reserve. Source: CryptoQuant

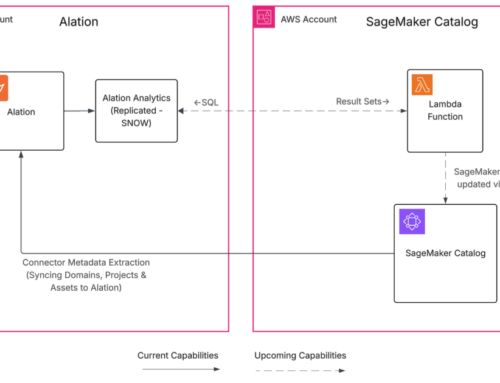

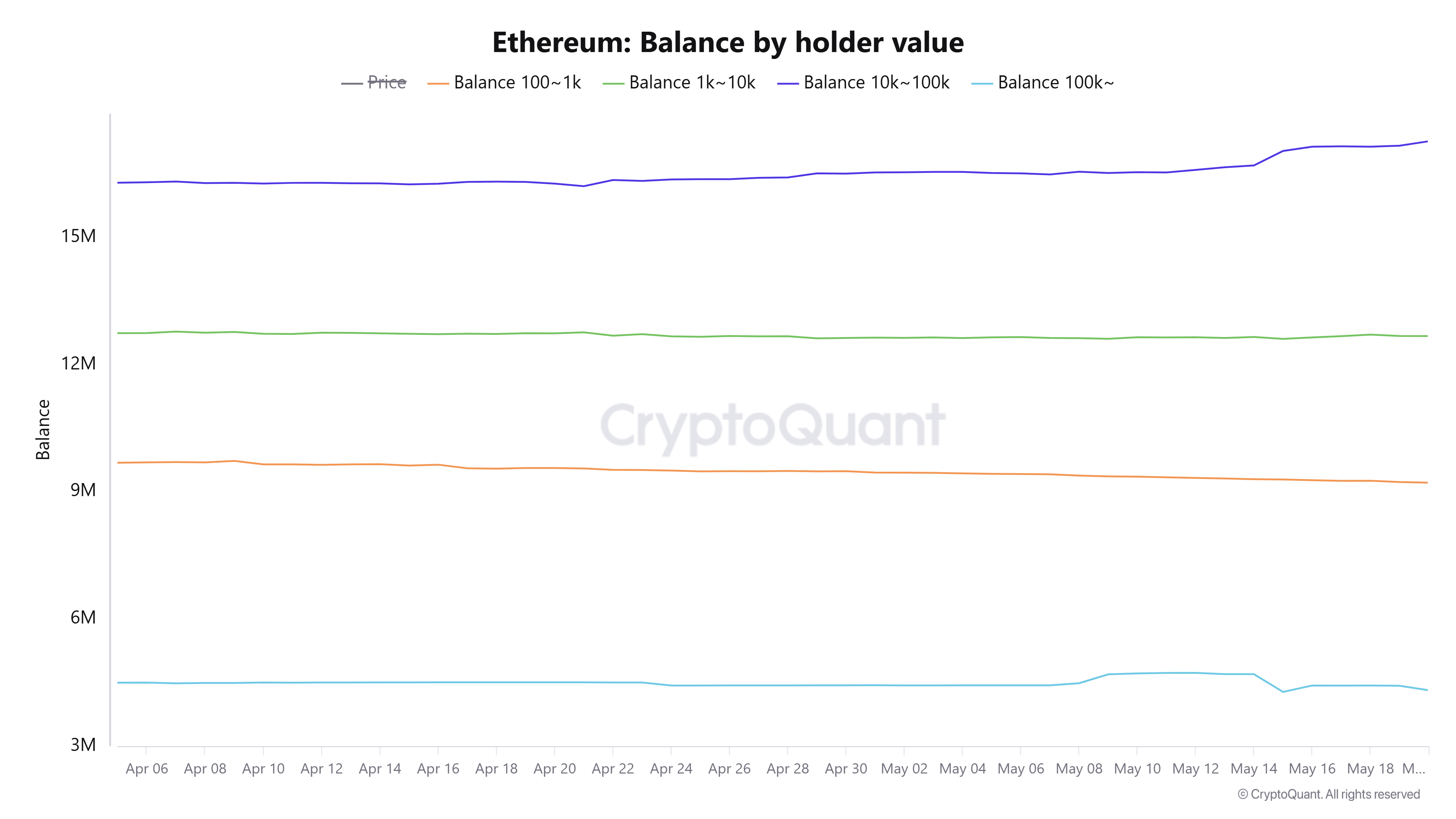

Similar to previous weeks, whales with a balance of 10K-100K continued leading the buying activity, growing their holdings by a net of 670K ETH in the past nine days. However, smaller holders have been distributing, with their total balance declining by 110K ETH during the same period.

ETH Balance by Holder Value. Source: CryptoQuant

Despite dominant spot buying pressure, ETH continues to move range-bound near the $2,500 mark. ETH Futures Bubble Maps show increased trading volume whenever prices move below or above $2,500, making it a critical level that could define the top altcoin’s next major trend.

-1747882311891.png)

ETH Futures Volume Bubble Map. Source: CryptoQuant

Meanwhile, search interest for Ethereum has picked up pace again near the 60-point mark, up from 45 on May 17 but down from the 100-point level seen during the May 8 – 9 rally. This indicates that intense retail excitement isn’t leading ETH’s price, leaving room for a more robust price growth.

ETH Search Interest. Source: Google Trends

Ethereum experienced $106.52 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions is $56.20 million and $50.32 million, respectively.

After closing near $2,500 on Tuesday, ETH briefly surged above $2,600 on Wednesday but saw a rejection just below the 200-day Simple Moving Average (SMA). The top altcoin is up 2% at the time of writing as bulls look to maintain a firm move above the $2,500 level.

ETH needs a high volume move above the $2,850 resistance or below the $2,260 – $2,100 range to establish its next direction. A move above $2,850 could see ETH rally toward the $3,250 resistance, while a breakdown below $2,100 could send its price to the $1,688 support.

ETH/USDT daily chart

The Relative Strength Index (RSI) continued its horizontal trend near the overbought region line, indicating slight weakness in the bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) is testing its moving average line as its histogram bars are about to flip negative. A successful cross below will signal rising downward pressure.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post