Ethereum Price Forecast: ETH short traders move $270M as BlackRock buys $1B BTC in 24 Hour

April 29, 2025

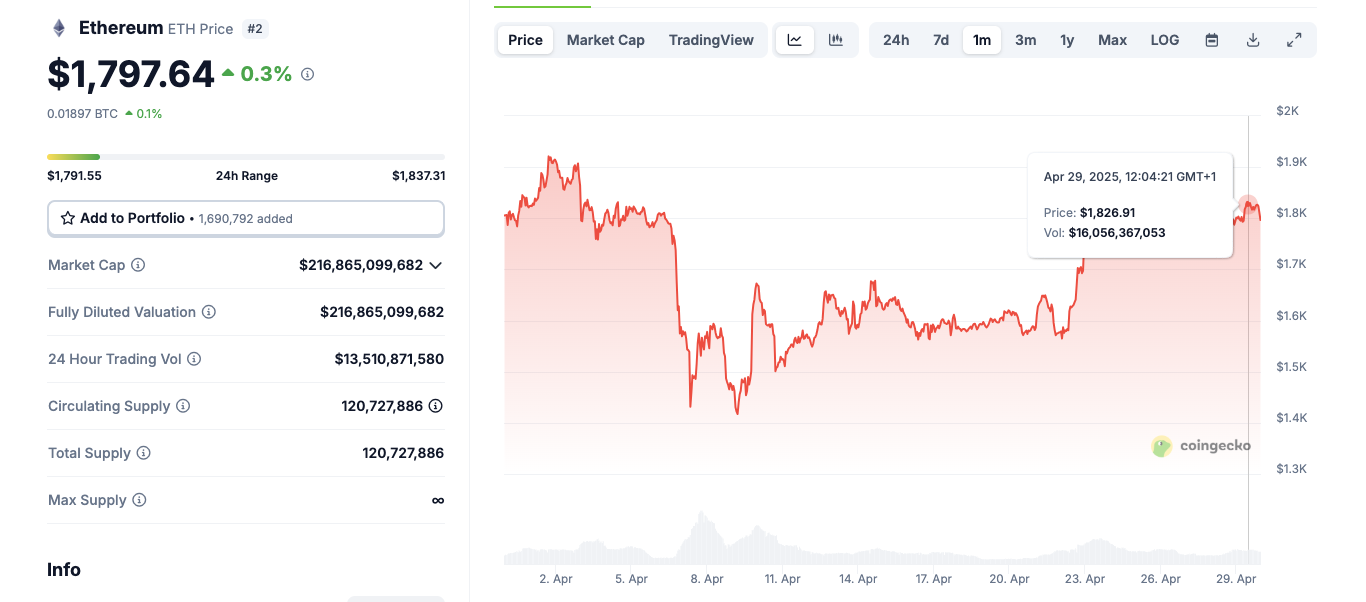

- ETH price gained 2% on Tuesday, crossing $1,835, first time in April as the Ethereum foundation announced another leadership shuffle.

- While ETH price rose 2% in the last 24 hours, a $273 million drop in open interest signaled mass short liquidation.

- Ethereum ETF inflows crossed $231 million for the week, its highest since February.

- ETH ETF demand mirrors BlackRock’s IBIT Bitcoin ETF which set an all time record of $970.1 single-day inflow on Monday.

Ethereum price outperforms Bitcoin on Tuesday, with a 2% rally to the new monthly timeframe peak of $1,837.

Derivatives markets data shows the ETH upswing coincides with traders closing large volumes of short positions. Could BlackRock’s record-breaking Bitcoin haul support ETH’s next price breakout towards $2,000.

Ethereum price gained 2% on Tuesday, crossing $1,835 for the first time in April, as the Ethereum Foundation announced another leadership shuffle.

Ethereum price tapped $1,837 on Tuesday, a new peak for April 2025 | Source: Coingecko

Ethereum (ETH) climbed to a new monthly high of $1,837 on Tuesday, posting a 2% daily gain. The surge coincided with organizational changes within the Ethereum Foundation, signalling continued evolution in Ethereum’s core governance.

On Tuesday, Ethereum Foundation confirmed Hsiao-Wei Wang and Tomasz Stańczak as two new co-executive directors.

This move aims to enhance the execution of Ethereum’s vision and ensure more efficient governance with the following changes.

Key Changes:

- New Co-Executive Directors: Hsiao-Wei Wang and Tomasz K. Stańczak have been appointed as co-executive directors, effective from April 28.

- Board and Management Split: The board will now act as a “security council” to protect the foundation’s core values and set Ethereum’s strategic vision.

- Board Composition: The board consists of Ethereum co-founder Vitalik Buterin, the Ethereum Foundation’s President Aya Miyaguchi, Swiss counsel Patrick Storchenegger, and Wang, who will bridge between the board and management team.

- Focus Areas: The foundation’s main focus areas over the next 12 months will be to scale the Ethereum layer 1, scale blobs at the layer 2 level, and improve user experience.

The leadership change at the Ethereum Foundation was confirmed in a governance note, although full details remain undisclosed.

Market sentiment appeared to interpret the change positively, especially with institutional interest in Ethereum-linked products accelerating.

Ethereum products on Monday hit $64 million on Monday, totaling $231 million in the last three consecutive days of trading.

Ethereum ETF flows | Source: SosoValue

A closer look at the SosoValue chart above shows this is the longest buying run for Ethereum ETFs since February 2025.

The rapid inflows also saw Ethereum outperform Bitcoin intraday, despite the world’s largest cryptocurrency receiving $970.1 billion in new investment from BlackRock’s IBIT ETF within 24 hours.

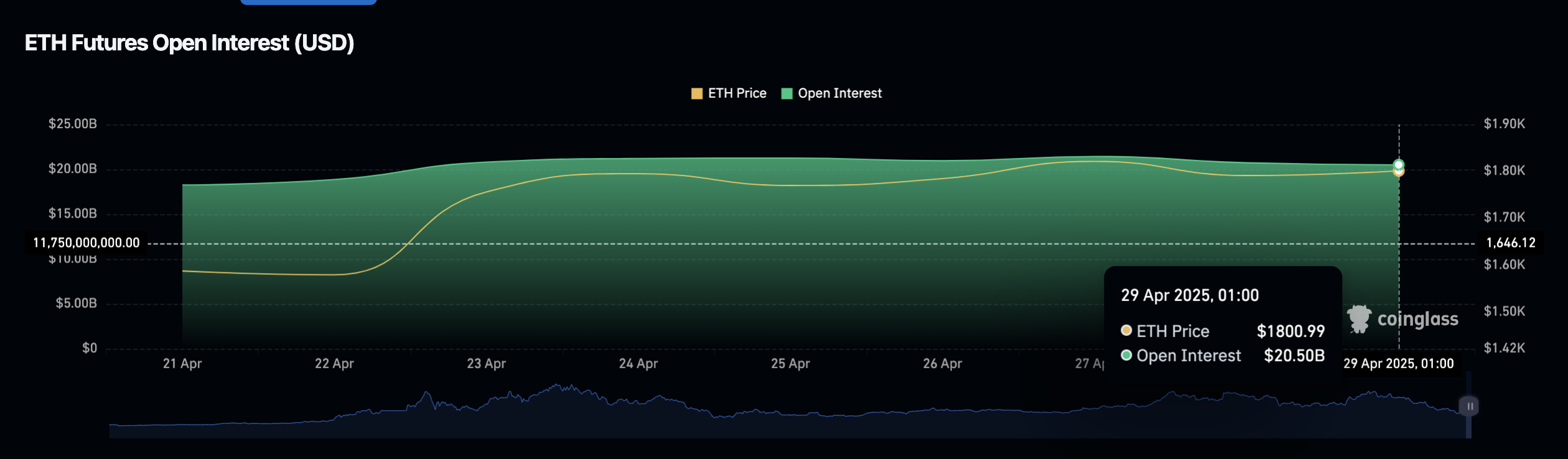

While ETH price rose 2% in the last 24 hours, data from Coinglass shows that open interest (OI) in Ethereum futures dropped by $273 million.

This coinciding trend between Ethereum price and open interest indicates that short traders likely closed large positions en masse, potentially fueling the upward momentum seen in spot markets.

Ethereum Open Interest | Coinglass

Typically, when an asset’s open interest declines amid a rally, it suggests that rather than make covering moves, the majority of short-traders are opting to close out their positions.

At press time, ETH open interest stands at approximately $20.5 billion, down from $20.73 billion on Monday.

If the ETH breaks above the $1,850 support a short-squeeze could trigger cascading liquidations, potentially accelerating the rally closer towards $2,000 in the days ahead.

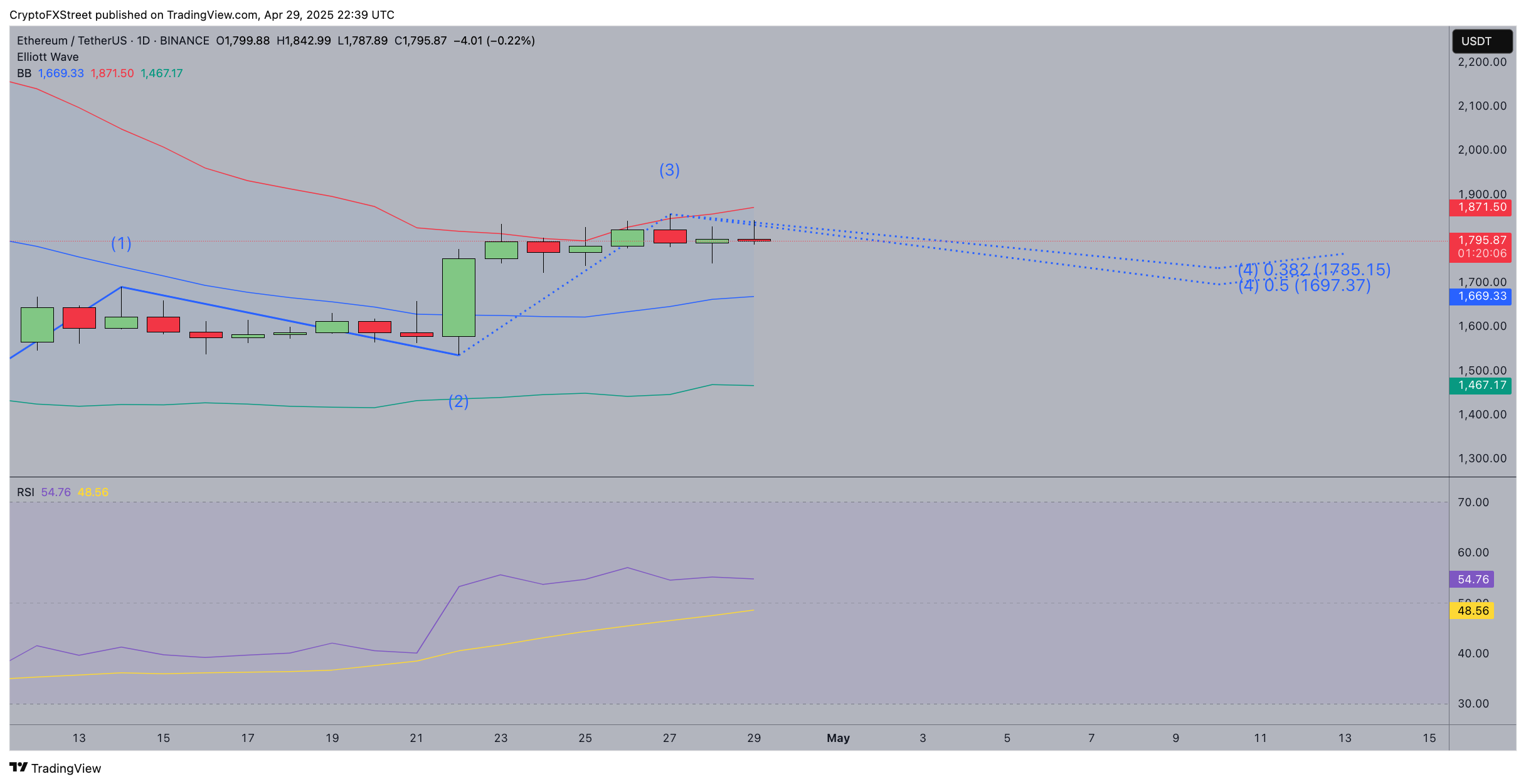

Ethereum price forecast signals show signs of bullish consolidation above the $1,735 level, as indicated by the Elliott Wave (3) peak.

As seen below the 38.2% Fibonacci retracement level at $1,735.15 appears to be acting as short-term support. This suggests that Ethereum price stagnation above $1,800 could be a brief corrective phase rather than a full trend reversal.

More so, the RSI reading at 54.70, mildly bullish, but yet enter overbought territories. Notably, Bollinger Bands are beginning to flatten, suggesting a consolidation phase that could precede a major breakout.

Ethereum price forecast | ETHUSDT

In contrast, the projected lower boundary of Wave (4) aligns with the 50% retracement level at $1,697.37. A daily close below this mark would invalidate the bullish continuation scenario and signal the onset of a deeper retracement.

However, with the ETH price with institutional ETF demand on the rise, and short-traders closing out $273 positions in the last 24 hours, market sentiment remains firmly bullish. If ETH reclaims $1,837 with volume, the next leg is toward $1,900, and possibly $2,000 could be on the cards.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post