Ethereum Price Forecast: ETH taps $4,100 after Kerrisdale Capital shorts BitMine

October 10, 2025

- Kerrisdale Capital stated that it has shorted Ethereum treasury firm BitMine, citing declining premiums on its ETH-per-share.

- The firm blasted the crypto treasury model, claiming the strategy “no longer works.”

- ETH risks a decline to $3,500 if it loses the 100-day SMA support.

Ethereum (ETH) declines 6% on Friday after Kerrisdale Capital disclosed a short position on BitMine Immersion (BMNR) earlier in the week, dismissing the crypto treasury model as “a playbook that no longer works.”

Investment management firm Kerrisdale Capital revealed a bearish stance on Ethereum treasury company BitMine, stating that it has taken a short position in its stock, according to a statement on Wednesday.

The company noted that BitMine adopted its Ethereum treasury plan as a replica of Strategy’s Bitcoin (BTC) model, a playbook copied by several digital asset firms.

It added that BitMine’s consistent stock issuance has turned initial investor excitement into fatigue, as markets now expect each rally to trigger another wave of supply.

Although BitMine continues to highlight growth in its total Ethereum holdings, Kerrisdale noted that the rate of ETH-per-share gains has declined amid a waning net asset value (NAV) premium.

“The pace of ETH-per-share accretion has slowed as the NAV premium narrows and the share count balloons – a trend made harder to follow after BMNR quietly dropped up-to-date share counts from its weekly press releases,” Kerrisdale Capital wrote.

The report criticized BitMine’s recent $365 million direct offering, describing it as a deal disguised as “materially accretive.” It argued that the move prioritized short-term cash over long-term credibility, further weakening investor confidence in the company’s premium narrative.

The firm drew a sharp contrast between BitMine’s Ethereum treasury and MicroStrategy’s Bitcoin reserve. It noted that although BitMine’s Executive Chairman Thomas Lee is a popular strategist and media commentator, he lacks the cult-like appeal that made Michael Saylor a “meme-stock icon.” It highlights that, unlike Saylor, Lee has yet to trigger the kind of investor enthusiasm needed to sustain large equity raises without backlash.

“A strategy built on reflexivity needs scarcity, charisma, and presumably something more innovative beyond massive ATM issuance to keep the flywheel spinning,” the report added.

Kerrisdale also criticized the recent surge in corporate crypto treasuries, highlighting that investors have shifted from having limited options to facing an oversupply of similar digital asset vehicles.

The firm added that the surge, soon to be intensified by a wave of ETFs, has erased market scarcity, making the public treasury model a strategy that “no longer works.” As a result, NAV premiums across the sector have fallen, with many vehicles now trading at or below parity as their self-reinforcing models lose momentum.

The decline is notable in Strategy’s capital acquisition model for its Bitcoin treasury. The report stated that the business intelligence firm once thrived on market scarcity and speculative enthusiasm, but those conditions have faded.

Strategy’s premium has now dropped from around 2–2.5x net asset value to below 1.5x after recent policy shifts and financing moves, the report stated.

BitMine’s share price is down over 7% on Friday following a general pullback across the crypto market.

Ethereum experienced futures liquidations of over $171.3 million within an hour during the midday US trading session, bringing its 24-hour liquidations to $237.9 million, per Coinglass data.

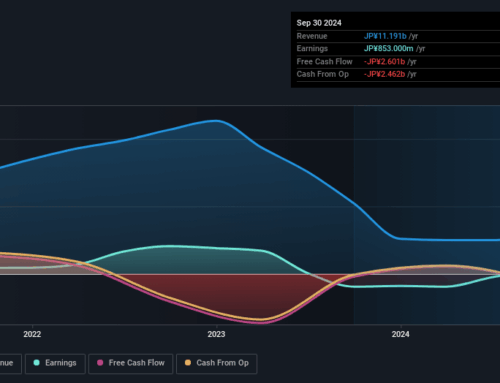

The sharp rise in liquidations follows ETH’s decline to test the $4,100-$4,000 support range near the 100-day Simple Moving Average (SMA), which bulls defended during key price declines on June 22 and September 25.

ETH/USDT daily chart

A failure to hold above the 100-day SMA could send ETH toward the $3,500 level. On the upside, the top altcoin faces resistance near a descending trendline, which is just above the 50-day SMA.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, with the latter about to cross into the oversold region.

Search

RECENT PRESS RELEASES

Related Post