Ethereum Price Forecast: Short sellers dominate ETH futures, but spot investors remain bul

May 6, 2025

- Ethereum open interest rose by 4% alongside a sharp decline in the Taker Buy Sell Ratio, indicating dominant bearish sentiment.

- However, spot investors maintained a bullish bias ahead of the Pectra upgrade, sparking 63,690 ETH in exchange net outflows.

- ETH could decline to $1,688 if it fails to recover a key symmetrical triangle and the 14-day EMA and 50-day SMA.

Ethereum (ETH) saw a 2% decline on Tuesday following an increase in short positions ahead of the Pectra upgrade set to go live within the next 24 hours. While spot investors maintained a bullish bias, futures traders are leaning toward the downside potentially in anticipation of a sell-the-news event.

Ethereum’s open interest increased nearly 3% in the past 24 hours despite its price dropping by 2%, per Coinglass data.

Open interest (OI) is the total number of unsettled contracts in a derivatives market. An increase in OI, accompanied by a price decline, signifies that the new money entering the market has flowed into short positions.

This is evident in ETH’s Taker Buy Sell Ratio, which plunged to 0.866 — its lowest level since February 2. The metric measures takers’ buy volume divided by sell volume in the perpetual market. A value under 1 indicates a dominant bearish sentiment, and vice versa for values above 1.

-1746567208608.png)

ETH Taker Buy Sell Ratio. Source: CryptoQuant

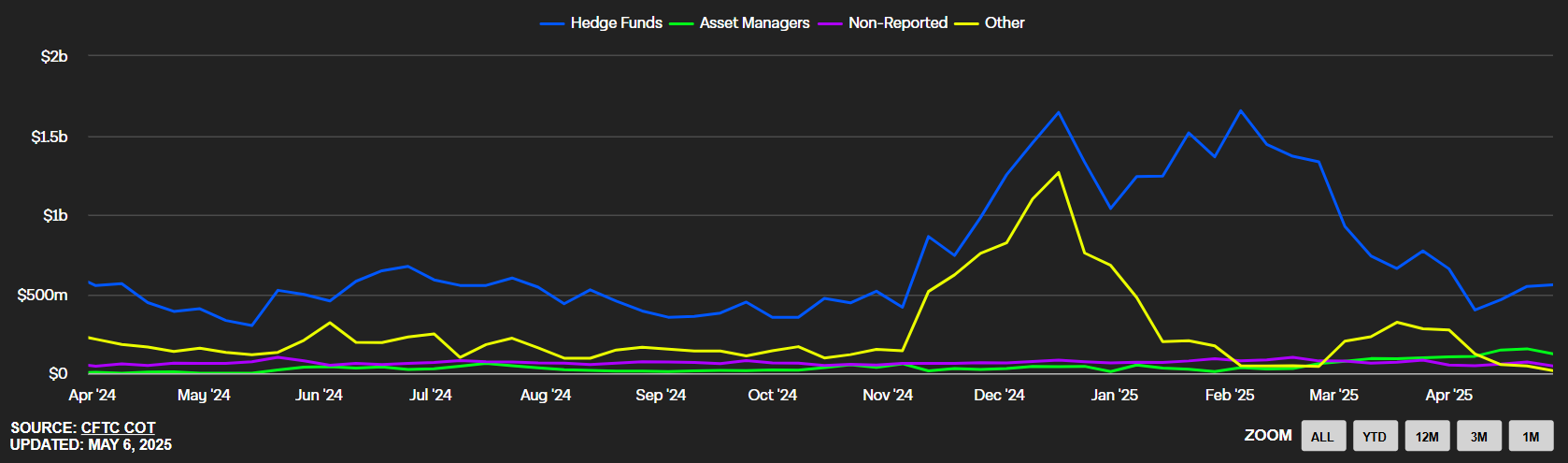

While ETH’s OI in most top exchanges rose, that of the CME dropped by over 5%, signifying most traders on the exchange closed their positions. This is visible in the decline in long positions from asset managers and retailers.

However, short positions of hedge funds on the CME have been rising again since mid-April. The rise follows sustained inflows into US spot Ethereum ETFs over the past two weeks, indicating a potential resumption of the ETH basis trade among hedge funds.

ETH CME Futures (Shorts). Source: The Block

Despite the falling prices, spot investors maintained a bullish bias, sparking an exchange net outflow of 63,690 ETH in the past 24 hours, per CryptoQuant data.

The bullish leaning from spot traders potentially stems from the Ethereum Pectra upgrade, which will go live within the next 24 hours. Pectra will introduce several features to the Ethereum Layer 1, including doubling blobspaces per block from 3 to 6 to improve data availability, increasing the staking limit from 32 ETH to 2,048 ETH and smart wallet functionality: sponsored transactions, payment of gas fees in other ERC-20 tokens, transaction batching wallet recovery, etc.

Ethereum saw $50.93 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions is $39.78 million and $11.15 million, respectively.

ETH declined below the $1,800 key level, 14-day Exponential Moving Average (EMA), 50-day Simple Moving Average (SMA) and a symmetrical triangle support, but bulls are looking to push prices back above these levels. If ETH sustains a daily candlestick close below these key indicators and the symmetrical triangle, it could find support near $1,688.

ETH/USDT daily chart

The Relative Strength Index (RSI) is testing its neutral level, while the Stochastic Oscillator (Stoch) quickly retreated from the overbought region to below its neutral level, indicating rising bearish pressure.

A daily candlestick close above the symmetrical triangle will invalidate the thesis.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post