Ethereum Price in USD: A Volatile Metric with Vital Implications for Investors

May 28, 2025

For decades, investors in stocks and bonds have known the importance of tracking an investment’s relative value. The financial market can often be unpredictable, but by keeping a keen eye on investments, one can better prepare for the inevitable fluctuations. When it comes to the modern crypto market, tracking the value of a given coin is not just valuable but flat-out essential. Volatility, while risky, can also present opportunity when monitored and understood within a broader economic and technological context.

Tracking the Ethereum price USD exchange offers invaluable insight into the performance of the world’s second-largest cryptocurrency and the evolving utility of its blockchain technology. Investors, developers, and institutions alike widely track the Ethereum price in USD.

History of Ethereum

People are also reading…

When cryptocurrency was first introduced in 2009, with the establishment of Bitcoin, it was far from the enormously popular juggernaut of modern finance that it has become. However, even at this early stage, the technology was experiencing growing pains. Bitcoin faced initial challenges due to the influx of investors. To address these issues, Vitalik Buterin created Ethereum in 2013. Consequently, when cryptocurrency surged in popularity in 2020, Ethereum was well-positioned to capitalize on this growth.

Understanding Ethereum Price

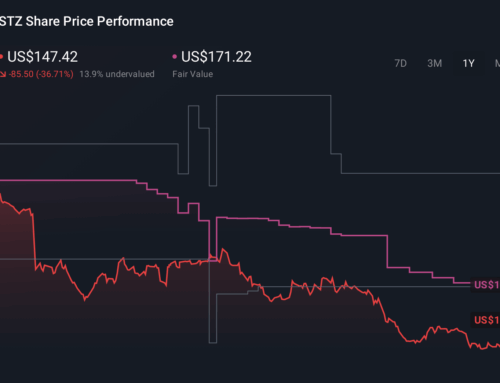

Market trends, technological advancements, macroeconomic conditions, and regulatory changes influence the Ethereum price in USD. Therefore, traders and investors must track its real-time value. Supply and demand play a critical role in determining market prices.

While other cryptocurrencies, such as Bitcoin, have a fixed supply cap of a finite amount of coins, Ethereum has a semi-elastic supply. Consequently, more Ethereum can be generated based on market conditions. This provides the cryptocurrency with greater flexibility, enabling it to adjust its supply better to meet demand.

The Potential Danger of Oversaturation

While there isn’t a finite amount of the coin made, Ethereum doesn’t want to oversaturate the market because that would decrease its value. If an endless amount of a product exists, then the supply will far outweigh the demand, leading to a decrease in its value. Therefore, Ethereum is able to strike a balance between the two.

Key Factors Affecting Ethereum Price in USD

Market Demand & Supply

Staking on Ethereum, along with institutional investments and transaction volumes, significantly influences its demand and availability.

Ethereum Network Upgrades

The impact of Ethereum 2.0, The Merge, and upcoming developments also play integral roles in the currency’s value. New updates generate renewed interest, resulting in increased demand. Consequently, the coin’s value rises, enabling Ethereum to engage with the market delicately through its semi-elastic supply.

Macroeconomic Influences

External factors, such as the strength of the US dollar, inflation, and Federal Reserve policies, significantly influence the cryptocurrency market, often more than people assume. Once considered marginal, cryptocurrencies like Ethereum gained considerable acceptance and popularity by 2025, indicating that their connection to the broader market is now much more intricate and complex.

Regulatory Landscape

Outside the borders of the U.S., global regulations also affect Ethereum’s price stability.

Final Thoughts

Much more than traditional stocks and bonds, the value of a cryptocurrency can change substantially in a very short time. While conventional investments may experience significant fluctuations over several days, the value of a cryptocurrency can vary significantly over just a few hours.

Although many view this volatility as a reason to deem cryptocurrency unreliable, it actually signifies the currency’s success. Cryptocurrencies like Ethereum were designed to be highly responsive to external market factors, which makes tracking the Ethereum price in USD essential. The rapid fluctuations that some critics attribute as drawbacks of the technology are, in fact, not a bug but rather a feature of this innovative technology.

This content is for educational purposes only and is not to be used as investment advice. As with all investments, there is risk, and the past performance of a particular asset class does not guarantee any future performance. Please consult a finance professional for financial advice. The views, thoughts and opinions expressed in this contributor content belong solely to the contributor and do not represent the views of Lee Enterprises.

Lee Enterprises newsroom and editorial were not involved in the creation of this content.

Search

RECENT PRESS RELEASES

Related Post