Ethereum Price Nears $3,000 After Escaping Month-Long Consolidation

June 11, 2025

Ethereum (ETH) has recently surged, reaching a three-month high. This price movement brings the $3,000 mark within reach, but challenges lie ahead.

The long-term holders (LTHs) continue to book profits, which could prevent ETH from reaching the $3,000 threshold in the near future.

New addresses have reached a four-month high, signaling that Ethereum is gaining traction among investors. The increase in new addresses is a positive sign for the altcoin’s adoption, indicating that more investors are showing interest in Ethereum.

However, many of these new addresses could be driven by FOMO (Fear of Missing Out), making them more susceptible to volatility. These investors, while helping boost Ethereum’s price, could also sell off quickly if the market shifts, which poses a risk for sustaining any price surge.

Despite the risks of FOMO-driven behavior, the rise in new addresses is a clear indication that Ethereum is still attracting new participants. The influx of new investors could help drive ETH’s price higher.

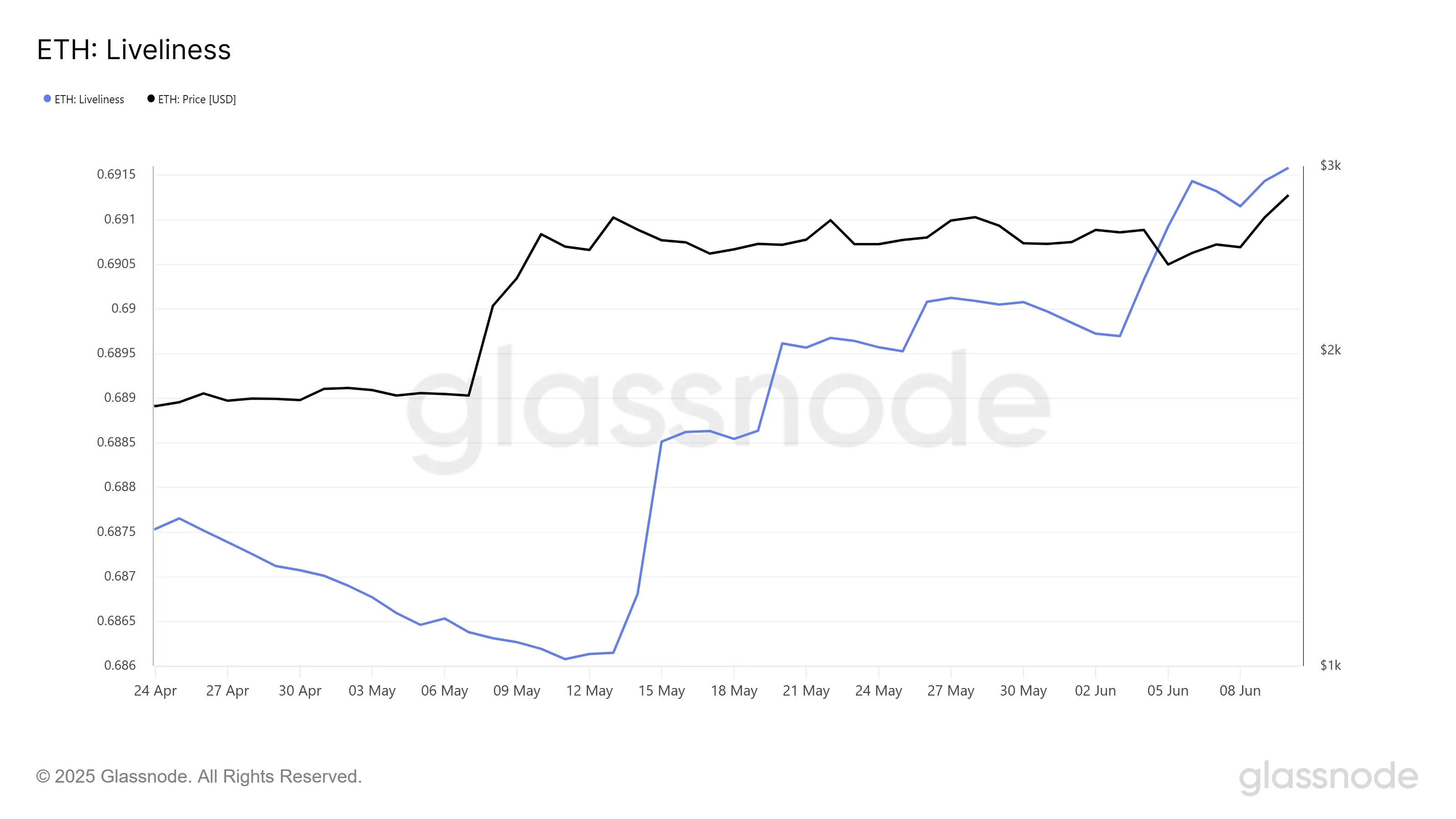

The Liveliness metric continues to climb this week, signaling that long-term holders (LTHs) are increasingly liquidating their holdings. Liveliness measures how frequently coins are moved from wallets, and a rise in this metric indicates selling pressure.

As LTHs exit the market, their selling could negatively impact Ethereum’s price. Since these investors typically hold through volatility, their decision to sell may signal a lack of confidence in ETH’s short-term outlook. This selling trend could hinder Ethereum’s efforts to breach the $3,000 mark, much like it contributed to ETH’s consolidation in May.

LTHs play a critical role in supporting the price of Ethereum, and their exit could make it harder for the altcoin to maintain a strong uptrend. If this trend continues, Ethereum may struggle to make it to $3,000.

Ethereum’s price is currently standing at $2,769, rising by 14.6% this week after escaping a month-long consolidation under $2,681. ETH is now facing resistance at $2,814.

The altcoin’s price is about 8% away from the $3,000 mark, which it last reached in February this year. If LTH selling halts and broader market cues remain bullish, Ethereum’s price could push toward $3,000.

However, if the ongoing LTH selling continues to outweigh bullish cues, Ethereum is likely to dip back to its support level at $2,681. Losing this support could trigger further declines, potentially sending ETH to $2,476. If this occurs, the bullish thesis would be invalidated, and Ethereum could enter another consolidation phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post