Ethereum Price Prediction: ETH to $16,000 as Whales Eye PlutoChain

January 25, 2025

Ethereum (ETH) remains a major force in the digital finance space, and Binance analysts now predict it could climb to $16,000 by 2025.

As network activity and liquidity rise, ETH’s long-term trajectory looks stronger than ever.

At the same time, PlutoChain ($PLUTO) is gathering a lot of attention thanks to its Layer-2 network that could majorly improve Bitcoin’s mainnet.

This upgrade may enable integration of DeFi, NFTs, and AI-powered applications to leading crypto’s network.

Now, let’s break down Ethereum’s potential path to $16,000.

Can Ethereum (ETH) Reach $16,000 in 2025?

Ethereum (ETH) has been gaining momentum as Binance analysts set ambitious price targets and some predict it could reach $16,000 by 2025.

One of the biggest factors driving ETH’s price potential is institutional adoption.

With growing interest in ETH exchange-traded funds (ETFs) and increasing inflows from large firms, Ethereum might solidify itself as a core asset in digital finance.

Institutional transactions have also been rising, which provides price stability and strengthens ETH’s long-term market position.

As traditional finance continues integrating Ethereum-based solutions, demand for ETH could rise significantly.

Ethereum’s dominance in DeFi and NFTs also plays a crucial role in its price outlook.

The network remains the go-to platform for developers building decentralized applications, with billions locked in DeFi protocols.

NFTs continue to thrive, with major brands, gaming companies, and content creators adopting Ethereum’s infrastructure.

These applications drive real-world utility and sustain Ethereum’s network activity, which makes ETH an attractive long-term asset.

If adoption keeps growing, Ethereum’s demand could push its price higher.

Scalability remains a key challenge, but Layer-2 solutions are addressing this issue.

Networks like Arbitrum and Optimism are expanding Ethereum’s capabilities by reducing transaction fees and increasing efficiency.

These improvements enhance Ethereum’s usability and could attract more developers and businesses looking for cost-effective blockchain solutions.

As these scaling solutions evolve, they might provide a strong foundation for ETH’s next price surge.

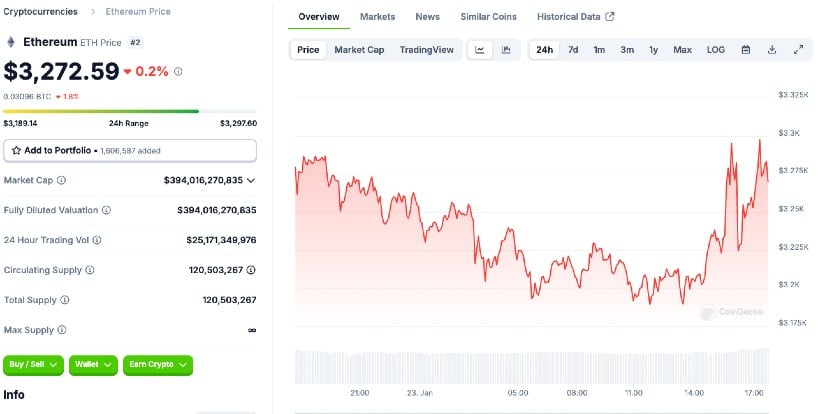

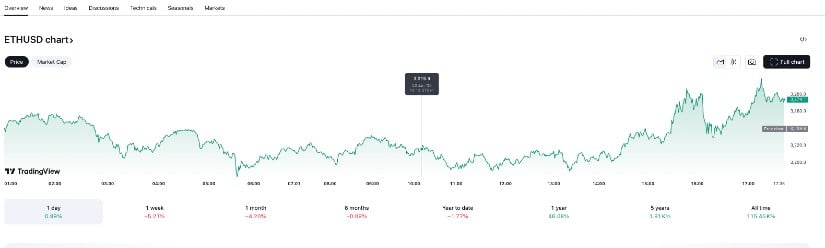

From a technical perspective, ETH’s trading volume has been climbing, with RSI indicators suggesting strong buying momentum.

Support levels are currently holding around $3,200, while resistance is forming near $3,800.

If Ethereum breaks through these resistance zones, some believe it could target $5,000 as a major milestone. A confirmed breakout could set the stage for further gains and potentially lead to a much higher valuation by 2025.

Crypto analyst Kevin highlights that ETH is forming a macro inverse head-and-shoulders pattern, with a breakout target of $5,600.

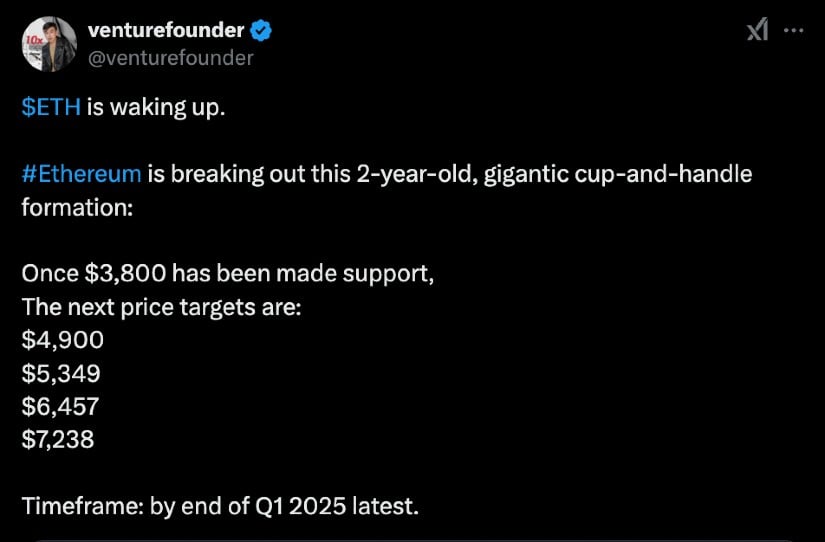

VentureFounder predicts Ethereum could hit $7,238 by the end of Q1 2025, which assumes it establishes $3,800 as a solid support level.

Whales Eye PlutoChain As a Possible Solution to Bitcoin’s Lack of Utility

Whale buyers are paying attention to PlutoChain ($PLUTO) thanks to its Layer-2 network that could expand Bitcoin’s functionality.

Unlike traditional Bitcoin scaling solutions, PlutoChain introduces decentralized finance (DeFi), NFTs, and AI-powered applications directly onto Bitcoin’s network.

This innovation might allow Bitcoin to support a broader range of financial services while maintaining its well-established security and decentralization.

As demand for more efficient and scalable blockchain solutions rises, PlutoChain could position itself as a leading platform for developers and businesses looking to build on Bitcoin.

One of its standout features is cross-chain interoperability.

PlutoChain is fully EVM-compatible, which means Ethereum-based decentralized applications (dApps) could integrate seamlessly into Bitcoin’s ecosystem.

This may allow developers to tap into Bitcoin’s liquidity and security while leveraging the smart contract functionality of Ethereum.

PlutoChain could enhance blockchain connectivity by bridging these two dominant networks and potentially create a more unified and efficient environment for decentralized applications.

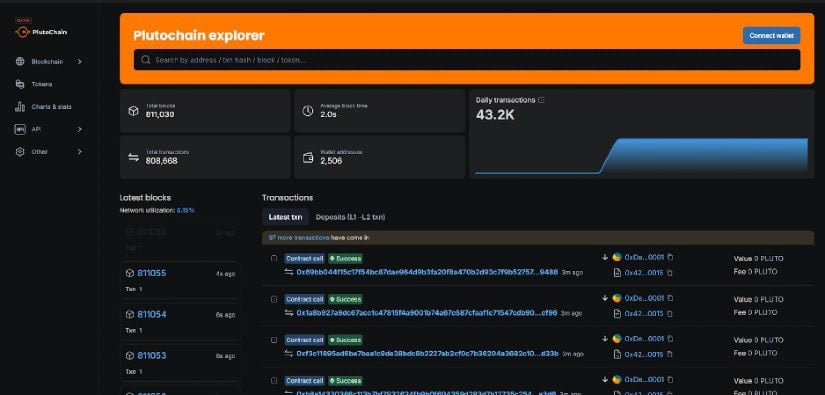

On the technical side, PlutoChain delivers impressive speed and efficiency.

The network processes 43,200 transactions per day with 2-second block times, which ensures a smooth and congestion-free experience.

This high-performance infrastructure eliminates many of the bottlenecks that affect legacy networks.

To reinforce security, PlutoChain has undergone rigorous audits from SolidProof, QuillAudits, and Assure DeFi, which confirms its resilience and ability to handle large-scale adoption.

Additionally, PlutoChain’s decentralized governance model gives stakeholders direct influence over network decisions, which could make it a more community-driven platform.

This governance, combined with its high-speed transactions and cross-chain interoperability, could make PlutoChain one of the most promising Layer-2 solutions in 2025.

Last Thoughts

Ethereum could be on track to hit $16,000 by 2025, driven by institutional adoption, growing demand for DeFi, and advancements in Layer-2 scalability.

As Ethereum continues to dominate decentralized applications and smart contracts, its increasing liquidity and strong technical foundation position it for long-term success.

Meanwhile, whales believe that PlutoChain could shape up to be a major Layer-2 player by bringing DeFi, NFTs, and AI-powered applications to Bitcoin.

With seamless cross-chain integration, rapid transactions, and a decentralized governance model, it could be interesting to watch.

Stay updated on PlutoChain’s latest developments by following it on Twitter, Discord, and Telegram.

This article does not offer financial advice. Cryptocurrencies can be unpredictable and carry risks. It is important to conduct thorough research before acquiring any crypto asset. Forward-looking statements carry risks and are not guaranteed to be updated.

This article is sponsored content. All information is provided by the sponsor and Brave New Coin (BNC) does not endorse or assume responsibility for the content presented, which is not part of BNC’s editorial. Investing in crypto assets involves significant risk, including the potential loss of principal, and readers are strongly encouraged to conduct their own due diligence before engaging with any company or product mentioned. Brave New Coin disclaims any liability for any damages or losses arising from reliance on the content provided in this article.

Search

RECENT PRESS RELEASES

Related Post