Ethereum Price Prediction: Top Reasons Why ETH is Set to Rebound

February 5, 2026

Ethereum price continued its strong downward trend this week, reaching its lowest level in nearly a year. ETH was trading at $2,160, down by nearly 60% from its all-time high. This article explores some of the top reasons why the ETH price may rebound soon.

The primary reason the ETH price may rebound soon is that the coin has moved into the oversold zone this year. Data shows that the Relative Strength Index (RSI) has slumped to 24, its lowest level since April last year. Similarly, the two lines of the Stochastic Oscillator have moved to the extreme oversold level.

The last time that Ethereum got this oversold, it rebounded from $1,386 to a record high of nearly $5,000. Therefore, there is a likelihood that the coin will resume bouncing in the coming days.

Oversold conditions are also present on the three-day timeframe chart. At the same time, this chart shows that the coin has formed an inverted head-and-shoulders pattern. The current price aligns with the level at which it formed the left shoulder in August last year.

READ MORE: Stock Market Today: Here’s Why the Nasdaq 100 Index, QQQ, and JEPQ ETFs Are Tanking

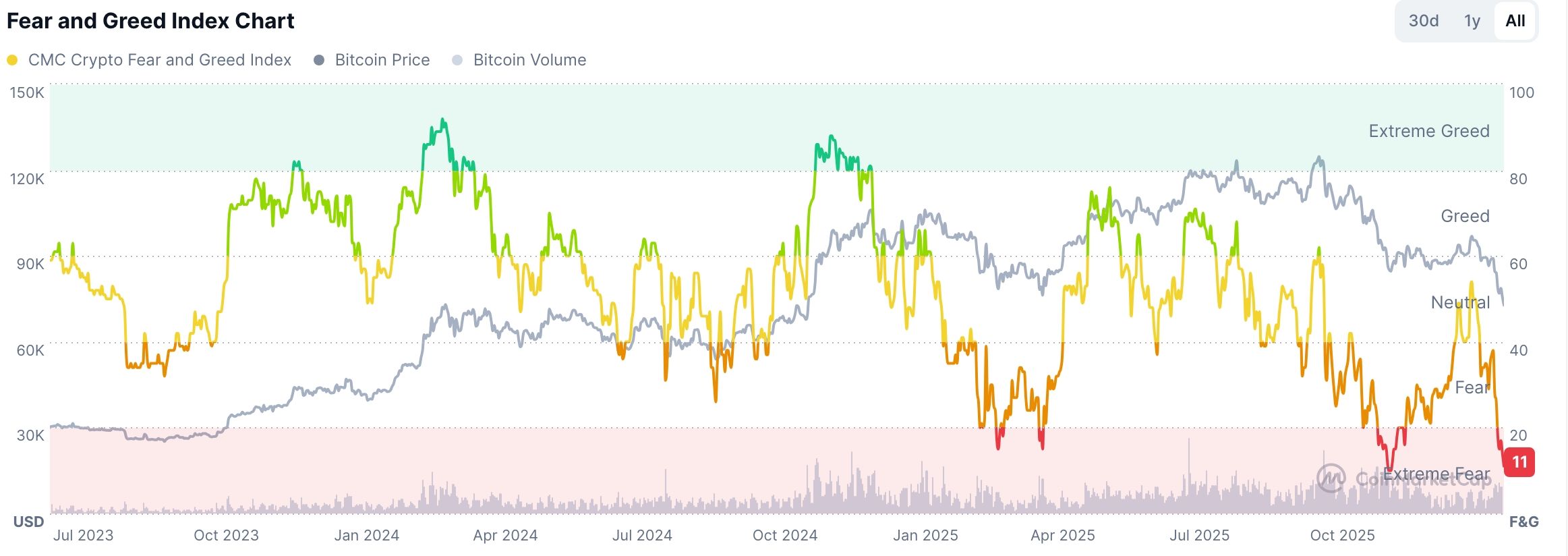

Another potential reason the Ethereum price may rebound soon is that the Crypto Fear and Greed Index has slipped to 11, slightly below the December low of 10.

This is a closely watched index that examines several factors, such as activity in the derivatives market and price action. Historically, crypto prices typically begin to rebound when the index moves into the extreme fear zone.

A closer look at the index shows that it has formed a double-bottom pattern as it did in April last year. A double-bottom pattern is associated with a strong rebound. Therefore, there is a likelihood that the index will begin to rebound soon. It normally rebounds when Ethereum and other coins are rising.

The other bullish catalyst for the ETH price is that the network is thriving despite the ongoing crypto market crash. Data compiled by Nansen shows that the number of transactions has increased by 40% over the past 30 days to nearly 70 million. This growth makes it the third-fastest-growing network in the crypto industry, after Linea and Solana, which grew by 110% and 43%, respectively.

Ethereum’s active addresses rose by 45% to over 15 million, while its fees soared by 46% to over $15 million. At the same time, the supply of ETH tokens on exchanges has dropped to its lowest level in years, while staking inflows have continued to rise.

Ethereum has also become the dominant player in the crypto industry, with a leading market share in DeFi and RWA. This growth will likely accelerate as the developers plan more upgrades in the near term. Additionally, the role of layer-2 networks may become more limited now that Ethereum is scaling, reducing transaction costs, and achieving higher throughput.

READ MORE: IREN Stock Price Forecast Ahead of Earnings: Buy the Dip?

Search

RECENT PRESS RELEASES

Related Post