Ethereum Price Prediction: Will ETF Inflows and Breakout Strength Drive ETH Price Toward t

November 27, 2025

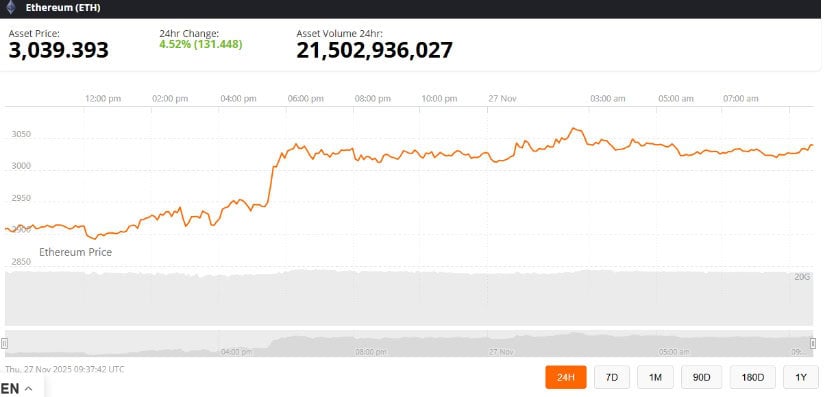

According to aggregated exchange data from TradingView, the current ETH price is hovering near $3,030, reflecting improving sentiment following recent ETF-related inflows and a confirmed breakout from a multi-week consolidation structure.

Market participants are now closely monitoring whether this early momentum can evolve into a sustained upside continuation toward higher resistance zones, including the widely discussed $6,000 Ethereum price target under favorable technical and liquidity conditions.

Key Takeaways

-

The current ETH price remains near $3,030, supported by improving technical structure and liquidity conditions, based on TradingView market data.

Ethereum has broken out of its curved consolidation pattern, and if the move holds, analysts see conditions aligning for a potential upside push toward the $6,000 area in the coming months. Source: Traderscorpion on TradingView

-

Ethereum technical analysis indicates ETH is trading above multiple short- and medium-term moving averages, signaling strengthening near-term buyer control.

-

Institutional Ethereum ETF exposure appears to be increasing based on weekly flow estimates reported by major ETF issuers and market research firms.

-

Under constructive market conditions, some late-2025 Ethereum price prediction models suggest a possible move toward the $3,900–$4,000 range, though projections remain scenario-based.

Where Will Ethereum Price Head Next?

According to multi-timeframe Ethereum price analysis derived from TradingView indicators, ETH is currently holding above its 20-day, 50-day, and 200-day exponential moving averages (EMAs). This cluster, centered near the $3,610–$3,620 region, often acts as a key trend-defining zone where trend direction becomes clearer.

Momentum indicators show the MACD remains marginally positive, signaling residual bullish pressure, while the RSI in the low 60s suggests moderate upside strength without extreme overbought conditions. Analysts note that if Ethereum maintains stability above the $3,600 level, the next resistance area between $3,650 and $3,700 could come into focus as a potential test zone.

A high-timeframe ETH/USD chart points to a possible ascending triangle breakout toward $7,000 by late 2026, marking a shift from a recent bearish outlook. Source: Jip Molenaar via X

A well-followed technical analyst, Jip Molenaar, who specializes in macro Ethereum chart structure on TradingView, stated in a recent market update:

“Ethereum has now broken out from its curved consolidation pattern. If this breakout holds, the structure favors a fresh impulse. Markets follow structure, not emotion.”

The curved consolidation pattern he referenced reflects a gradual tightening of price action with higher structural support—often associated with trend continuation attempts. Under this framework, one medium-term scenario places ETH near the $6,000 region if upside momentum remains intact, though this remains conditional on broader market participation.

ETH Price Prediction Daily

Short-term ETH price prediction models based on volatility-adjusted range projections indicate a possible 1%–2% move over the next 24 hours, provided support remains defended near the $3,600 zone. Market volume metrics suggest participation has remained stable following last week’s rebound.

While momentum indicators have cooled slightly from recent peaks, Ethereum’s price today remains positioned within a short-term bullish framework, keeping near-term directional bias moderately tilted to the upside.

ETH Price Forecast Weekly

Looking ahead, analysts expect the Ethereum price outlook to remain constructive but largely range-bound. Forecast bands based on weekly volatility profiles suggest that the price of Ethereum could gradually work toward the $3,750–$3,800 region, assuming stable equity markets and continued ETF participation.

On-chain accumulation metrics referenced by multiple blockchain analytics platforms indicate that larger ETH holders have reduced net outflows, a behavior often associated with declining sell pressure during consolidation phases.

Ethereum Price Prediction November 2025

The widely cited Ethereum price prediction 2025 scenarios place ETH in the $3,850–$3,900 zone by late November, under conditions where several structural drivers continue to unfold:

-

Expanding decentralized finance participation

-

Rising staking ratios are reducing the liquid supply

-

Continued capital inflows through Ethereum ETF vehicles

Together, these forces reinforce Ethereum’s standing as the leading settlement layer for decentralized applications and institutional blockchain adoption.

Ethereum Price Prediction (December 2025)

Analysts remain constructively positioned heading into December. Current projection ranges suggest a scenario where ETH trades between $3,980 and $4,100, assuming no sharp tightening in global liquidity or adverse regulatory developments.

Following a sharp drop from $3,658, the asset is now staging a relief rally, with a sustained break above the key $3,262 “golden pocket” needed to confirm a full bullish trend reversal. Source: hilmiyus on TradingView

Market strategists also note that ongoing regulatory clarity surrounding Ethereum ETF products, particularly institutional interest linked to major issuers such as BlackRock, continues to reinforce long-term confidence across professional investment desks.

Ethereum Fusaka Upgrade 2025

Ethereum’s upcoming Fusaka network upgrade, currently targeted for late 2025 by core developers, is viewed as a meaningful technological catalyst. Proposed enhancements include:

-

PeerDAS expansion, designed to increase data throughput capacity

-

Gas limit control mechanisms, intended to improve fee stability

-

Optimized execution efficiency for Layer-2 rollups, supporting scalable application growth

Core protocol engineers believe these upgrades could meaningfully reduce long-term Ethereum gas fee volatility, strengthening network efficiency, enterprise integration, and decentralized application scalability.

Long-Term Ethereum Outlook (2026–2030)

Long-term Ethereum forecast 2025–2030 models vary widely, reflecting different assumptions about adoption rates, regulatory policy, and macroeconomic liquidity. Some scenario-based projections place ETH between $7,000 and $15,000 by the end of the decade, contingent on sustained institutional accumulation, rising staking participation, and steady on-chain activity growth.

ETF inflows, tokenized asset infrastructure, and real-world asset settlement continue to expand Ethereum’s footprint across global financial systems, though outcomes remain inherently uncertain.

Will Ethereum Price Rise Again in 2025?

Market indicators suggest that Ethereum remains structurally positioned for higher valuation, provided broader market conditions remain supportive. Technical strength above long-term moving averages, alongside consistent demand from Ethereum exchange-traded fund products, has contributed to reduced downside volatility in recent weeks.

Ethereum was trading at around 3,039.39, up 4.52% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

If ETH sustains above its near-term support structure, analysts outline a scenario where the price gradually works toward the $4,900–$5,200 region later in 2025. However, short-term retracements remain possible if global risk sentiment weakens, liquidity tightens, or regulatory pressure intensifies.

Search

RECENT PRESS RELEASES

Related Post