Ethereum Price Struggles Near $2,800 As Co-founder Moves Funds Amid Sell-Off Concerns

May 23, 2025

- Solana traded within an ascending channel and showed potential to reach $210 if it held above $172.

- Long/short ratios on Binance and OKX showed traders strongly favored long positions.

- Short liquidations totaled $10 million in 24 hours, indicating aggressive bearish bets were wiped out.

Hedera’s HBAR token gained traction after a spike in USDC volume and new U.S. regulatory momentum. Traders now anticipate further upside as technical and macro factors align in HBAR’s favor.

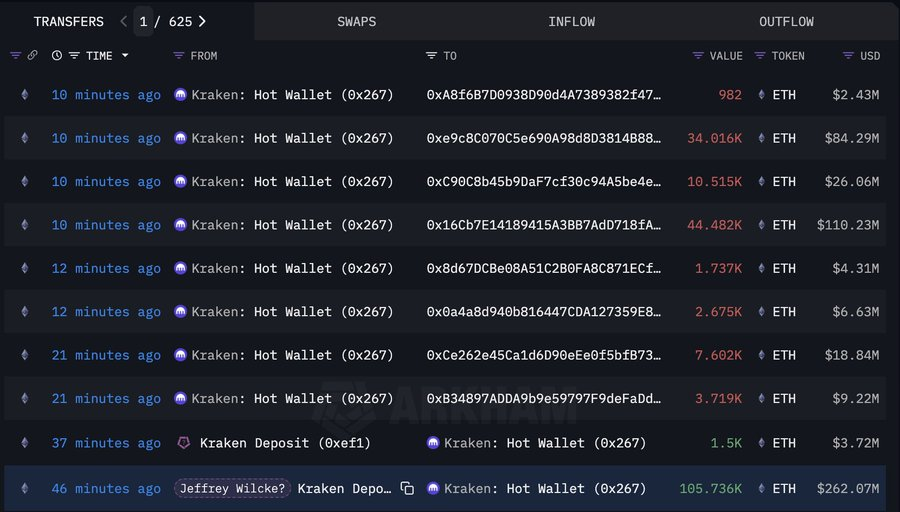

The Ethereum price continues to fluctuate, trading at $2,582.23 at the time of writing, following a transfer of 105,736 ETH (worth approximately $262 million) to Kraken by co-founder Jeffrey Wilcke.

On-chain data quickly picked up the movement, and within minutes of the transaction, the Ethereum price dipped nearly 2%. Although Wilcke has made large transfers in the past, the timing and size of this deposit have drawn fresh attention. In 2024, a similar move coincided with a sharp price drop from $3,625 to under $2,000.

Analysts at Lookonchain noted that eight newly created wallets received identical amounts of ETH shortly after the deposit, suggesting that the funds may not be destined for liquidation but possibly for custody reshuffling. However, the short-term market reaction has remained cautious.

Several technical indicators suggest the short-term outlook for the Ethereum price is weakening. The Parabolic SAR now stands at $2,722, above the current price level, which indicates the trend is no longer bullish. Ethereum has also recorded lower highs, which typically reflects declining buyer interest.

The Relative Confidence Index (RCI) indicates a bearish divergence. While long-term readings remain positive, the short-term RCI has dropped to -36.97. This divergence suggests weakening momentum, as traders turn cautious amid heightened volatility and recent whale activity.

The $2,339 support level is now a critical line for bulls to defend. It represents a previous area of strong demand and a high-volume trading zone. If Ethereum falls below this point, analysts expect selling pressure to accelerate, potentially pushing the price toward $2,100.

Ethereum derivatives data suggests mixed market conditions. Open interest in ETH futures increased by 1.72% to $30.94 billion, showing continued engagement. However, futures trading volume dropped by over 34%, suggesting that many traders are adopting a wait-and-see approach.

The options market followed a similar pattern. While open interest remained steady at nearly $7.69 billion, volume declined by 32.62%. Traders are holding current positions instead of entering new trades, reflecting uncertainty around the short-term direction of Ethereum’s price.

Liquidation activity also reveals cautious positioning. In the last 24 hours, $64.37 million in ETH positions were liquidated. Of this, $35.46 million came from long positions and $28.90 million from shorts. The most significant losses occurred in the last 12 hours, with long liquidations contributing the most, signaling elevated risk.

ETH’s active exchange supply reached a historical low point at the time of its transfer. Nearly all Ethereum’s supply, or 95.1%, is now in the hands of its users, as more ETH has been withdrawn from centralized platforms into personal wallets.

Limiting the immediate selling pressure could happen, but at the price of lower liquidity. Market uncertainty is also driven by Fed interest rate news and the SEC’s upcoming June evaluation of ETF applications from altcoins.

Ethereum is trading below $2,500, its main price barrier. Indicators still support the rise if the value stays over $2,300. Nevertheless, the prospect of selling, especially with big deals like Wilcke’s, continues to sway short-term feelings.

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Olivia Stephanie is a FinTech enthusiast with a keen understanding of financial markets. Her passion for economics and finance has led her to explore emerging blockchain technology and cryptocurrency markets.

Search

RECENT PRESS RELEASES

Related Post