Ethereum Price Stuck Near $2,000 as Holder Exodus Slows Recovery

February 16, 2026

Ethereum continues to trade in a narrow range near $2,000. ETH has struggled to generate sustained upside momentum in recent weeks.

While on-chain data suggests selling pressure may be nearing exhaustion, another concern is emerging. A decline in new network participation could restrict fresh capital inflows.

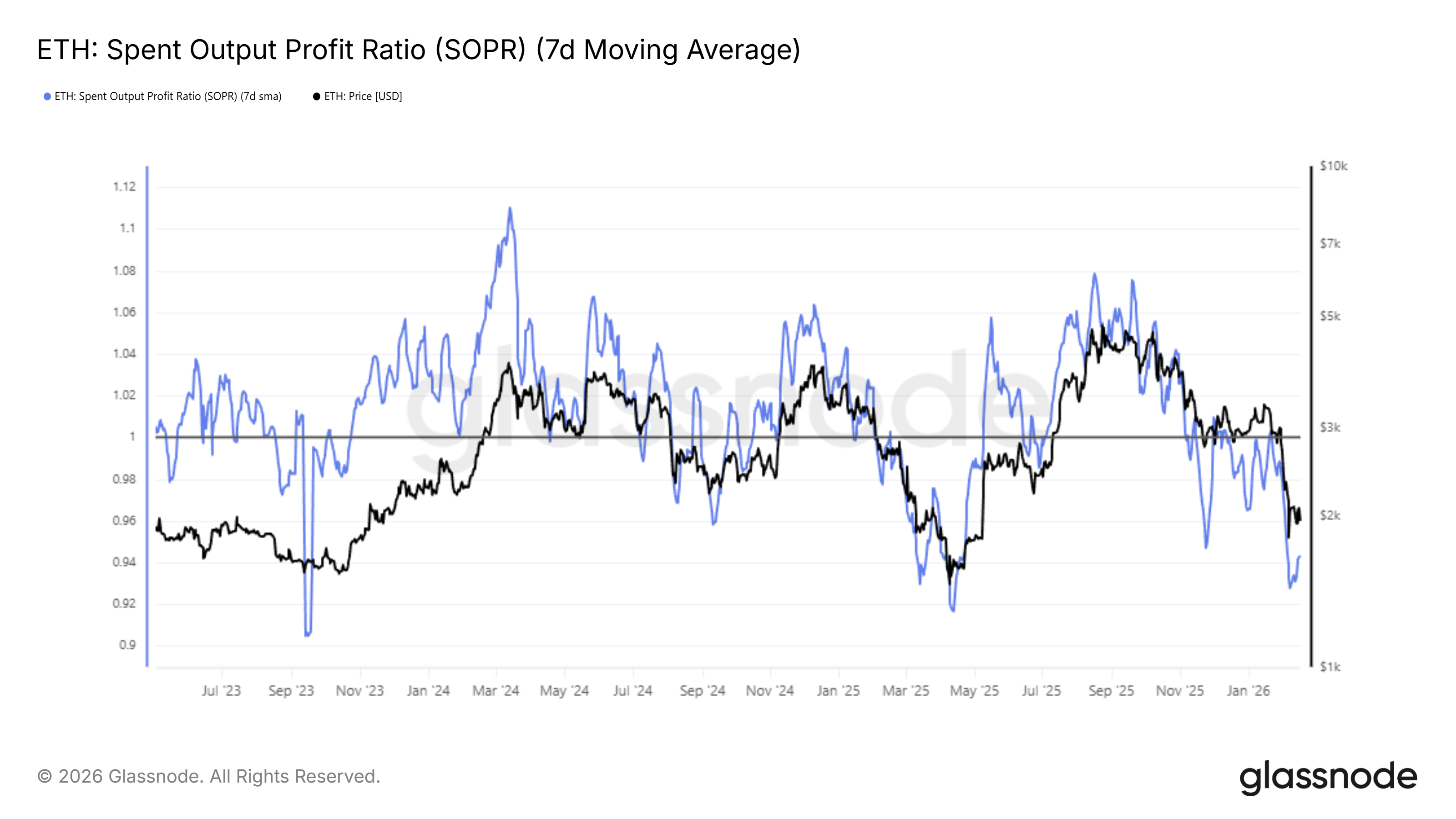

Ethereum’s Spent Output Profit Ratio, or SOPR, recently slid to 0.92. This marks the deepest level since April 2025. A reading below 1 indicates that investors are selling at a loss. Such behavior often reflects panic and fear during prolonged consolidation phases.

SponsoredSponsored

Historically, extreme lows in SOPR have preceded reversals. Selling at a loss tends to saturate at these levels. As panic fades, investors often shift to holding rather than exiting positions. Many choose to accumulate at discounted prices. Similar behavior could support ETH stabilization if confidence gradually returns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

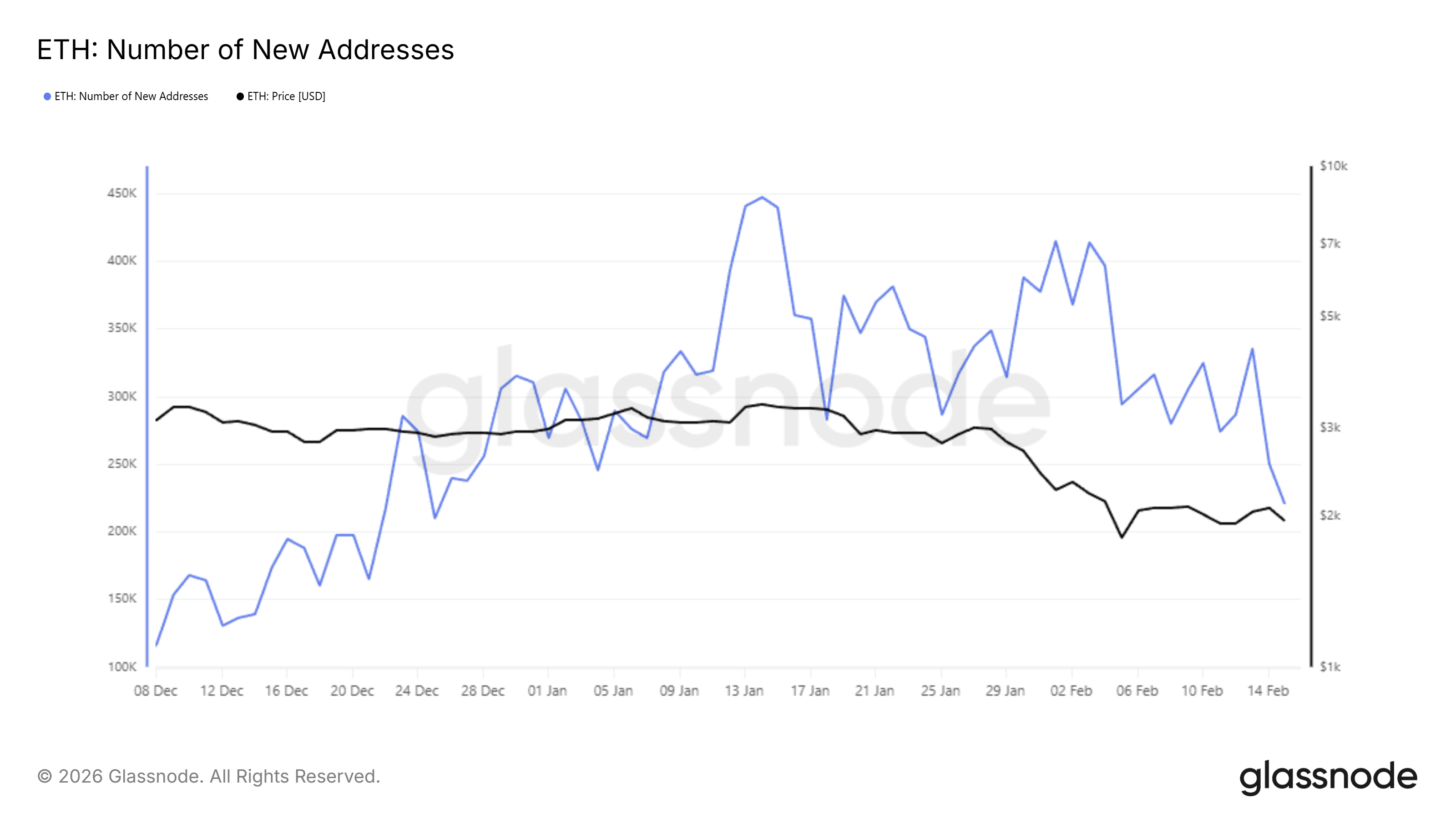

Despite potential loss exhaustion, broader network metrics raise caution. The number of new Ethereum addresses recently fell to an eight-week low. New participants typically inject fresh liquidity and support recovery phases.

Over the past 48 hours, new addresses declined by 34%. The figure dropped from 336,000 to 221,000. This sharp contraction suggests waning retail interest. Reduced onboarding can limit capital inflows, which may constrain short-term Ethereum price appreciation despite improving sentiment among existing holders.

Ethereum is trading at $1,970 at the time of writing. The asset remains above the $1,902 support level. However, it continues to struggle below the $2,051 resistance, which aligns with the 23.6% Fibonacci retracement level. Failure to reclaim this zone keeps upside limited.

Current indicators suggest continued consolidation between $1,902 and $2,241. ETH may face repeated rejection near $2,051 until stronger demand emerges. Without confirmation of this level as support, recovery attempts are likely to remain capped, reinforcing range-bound price action.

However, a decisive breakout could shift sentiment quickly. If Ethereum secures $2,051 as support and breaches the $2,241 resistance, bullish momentum may strengthen. Such a move could propel ETH toward $2,395 and higher, invalidating the prevailing bearish outlook and signaling renewed market confidence.

Search

RECENT PRESS RELEASES

Related Post