Ethereum reserves plunge to 9-year low – Is a massive price rally imminent?

February 20, 2025

- Ethereum’s exchange supply has plunged to its lowest level in nine years.

- Could this supply squeeze trigger a price surge?

The supply of Ethereum [ETH] on exchanges has dropped to its lowest level since 2016, signaling a liquidity squeeze that supports a medium-term bullish outlook.

With sell-side pressure easing and accumulation rising, could ETH reclaim the critical $3.5K resistance in the near term?

Key technicals flash bullish

Despite no signs of overheating, Ethereum remains 32% below its post-election peak of $4,016, having formed four consecutive lower lows.

This time, however, the RSI has bottomed out, and a bullish MACD crossover is taking shape – suggesting ETH’s consolidation could be building momentum for a breakout.

Yet, historical patterns suggest caution. Previous recoveries failed to breach key resistance as demand struggled to absorb sell pressure.

However, Ethereum’s spot exchange supply has plunged to a 9-year low of 8.2 million ETH.

With tightening liquidity and potential demand acceleration, conditions are aligning for a supply shock – one that could fuel a breakout past key resistance levels.

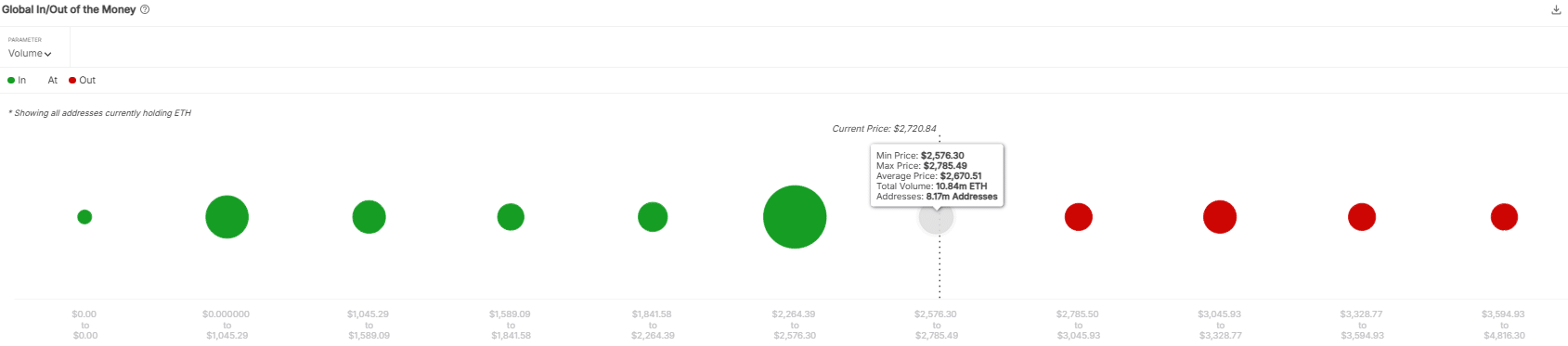

Mapping Ethereum’s next major resistance zone

Ethereum faces a critical resistance at $2,785, where 8.10 million addresses would flip profitable, exposing $20 billion to potential sell pressure.

While spot reserves hit a 9-month low, signaling accumulation, investors offloaded over 2 million ETH into exchanges in February, raising concerns about mounting sell pressure.

Weak demand from U.S. and Korean investors further threatens upside momentum, potentially trapping leveraged longs in the futures market.

If demand fails to recover, Ethereum could face a pullback toward $2,264, where 62.38 million ETH is concentrated.

Search

RECENT PRESS RELEASES

Related Post