Ethereum Resists Major Correction, Targets $3K Breakout

May 30, 2025

Ethereum is trading above $2,600 despite the Bitcoin dip. ETF inflows top $91 million as ETH eyes a breakout toward $3,000.

Despite a steep correction in Bitcoin, Ethereum continues to hold its ground above $2,600. As Ethereum’s price trend diverges from Bitcoin’s, the market is anticipating the start of a new altcoin season.

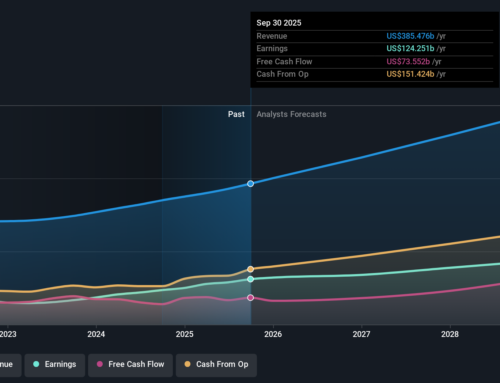

Ethereum Price Analysis

On the daily chart, Ethereum maintains a sideways trend, testing its upper ceiling near the 50% Fibonacci retracement level at $2,699. Currently, Ethereum is trading at $2,625 after a pullback of nearly 1.88% on Thursday.

As Ethereum hints at a potential range breakout, the Fibonacci levels indicate immediate resistance at the 61.8% level, close to the psychological barrier of $3,000.

Supporting the upside potential, the Supertrend indicator signals a continuing uptrend, while the RSI hovers near the overbought zone, suggesting strong bullish momentum.

On the downside, key support remains at the 38.2% Fibonacci level, around $2,395.

Institutional Support Grows for Ethereum

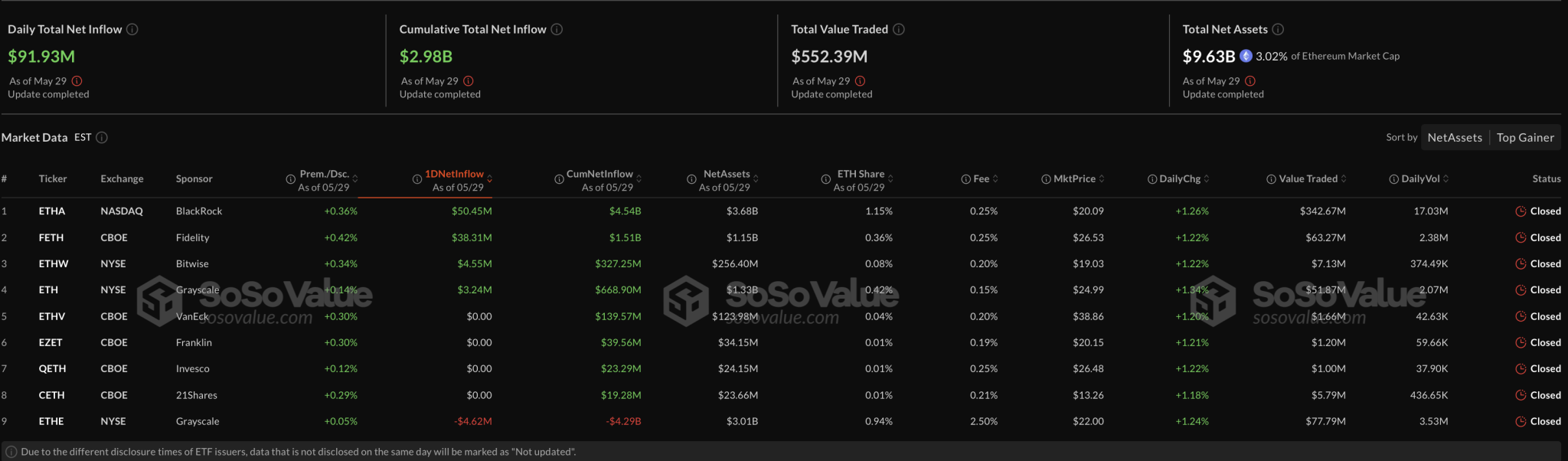

Amid the increasing likelihood of a bullish recovery, institutional support for Ethereum is growing. On May 29, Ethereum ETFs recorded a total daily net inflow of $91.93 million.

This marks the ninth consecutive day of positive inflows, bringing total net assets to $9.63 billion. On May 29, BlackRock led the inflows with $50.45 million, followed by Fidelity with $38.31 million.

Analyst Shares $3,000 Price Target

Sharing an optimistic outlook, Income Sharks recently tweeted about Ethereum’s strong upside potential. The analyst noted that a slight pullback was expected following the breakout of key resistance near $2,400.

As Ethereum fluctuates below the $2,700 level, the analyst maintains an upside target of $3,000, with a longer-term estimate extending to $4,000 as the bull run continues.

Bullish Sentiment Holds in Derivatives Market

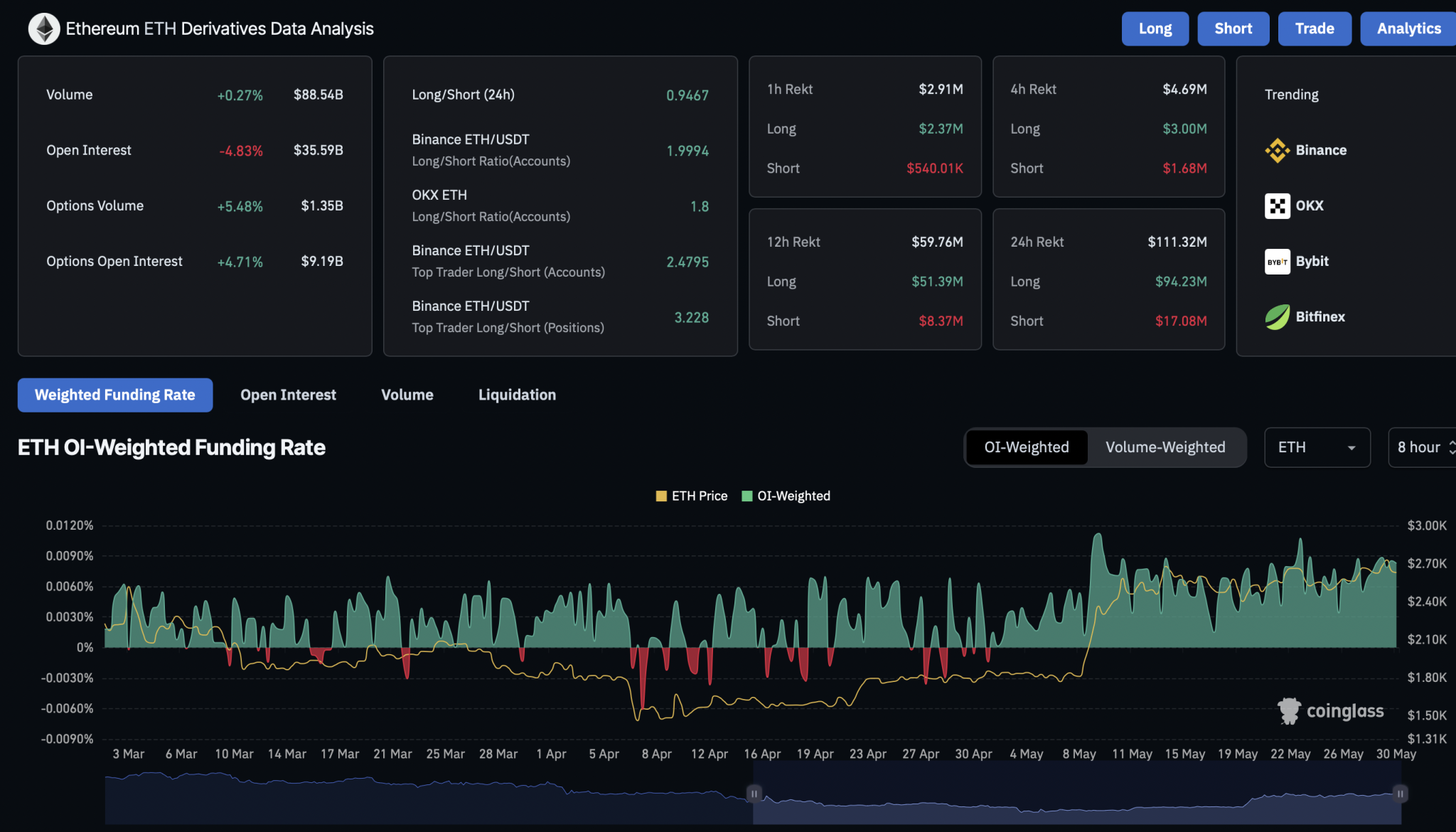

As Ethereum sustains the potential for a breakout, short-term volatility has triggered a spike in bearish sentiment within the derivatives market. Ethereum’s open interest is down 4.83% over the past 24 hours, reaching $35.59 billion.

In the same period, long liquidations surged to $94.23 million, significantly outweighing short liquidations of $17.08 million. Despite this large-scale unwinding of bullish positions, the funding rate remains elevated at 0.0083%.

Search

RECENT PRESS RELEASES

Related Post