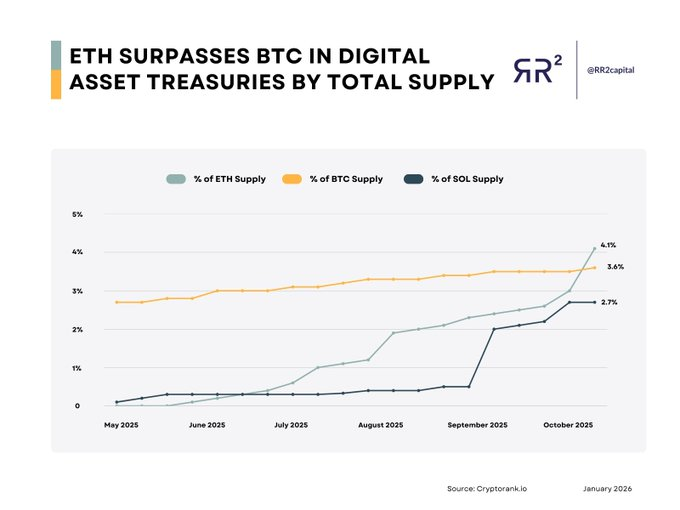

Ethereum Steals Bitcoin’s Crown in Digital Treasuries

January 12, 2026

Advertisement

Ethereum (ETH) has surpassed Bitcoin (BTC) in corporate treasury holdings, marking a notable shift in corporate crypto allocation.

Crypto trader Rand reports ETH now makes up 4.1% of digital asset supply in company treasuries, ahead of BTC at 3.6%, with Solana (SOL) at 2.7%.

Notably, Ethereum is expanding its appeal beyond traditional crypto circles, challenging Bitcoin’s long-held dominance as “digital gold” on corporate balance sheets.

While Bitcoin’s first-mover advantage, global recognition, and capped 21 million supply made it the default treasury asset, Ethereum’s versatility, driven by its smart contract ecosystem and DeFi capabilities, is increasingly attracting institutional interest.

Jan van Eck, CEO of global investment firm VanEck, recently reinforced this trend, calling Ethereum “the Wall Street token” and underscoring its pivotal role in bridging traditional finance with blockchain innovation.

Why does this matter? Well, the data reflects a shift in corporate crypto strategies. While Bitcoin remains a key treasury asset, Ethereum’s growing share signals rising confidence in its long-term utility.

Companies are increasingly seeking digital assets that combine store-of-value potential with programmable capabilities, enabling blockchain solutions, tokenized products, and enterprise-grade decentralized applications.

Ethereum’s growing share in corporate treasuries is fueled by its network evolution. Upgrades like Ethereum 2.0 and the transition to proof-of-stake (PoS) have boosted scalability, energy efficiency, and institutional appeal for sustainable, future-ready digital assets.

Solana, holding 2.7% of the treasury supply, is making inroads in high-speed transactions and NFTs but remains far behind the leaders. Ethereum co-founder Vitalik Buterin highlighted the network’s technical progress over the past year, while noting that its ultimate challenge remains achieving its vision as the “world computer.”

Therefore, Ethereum overtaking Bitcoin in corporate treasury holdings signals a shift in corporate crypto strategies. Firms are increasingly valuing Ethereum not just as an investment, but as a versatile platform for blockchain-driven business solutions. The focus is moving from market-cap dominance to utility, reliability, and long-term corporate trust.

Search

RECENT PRESS RELEASES

Related Post