Ethereum Tracks Bitcoin as ETH Price Prediction Signals Further 60% Drop to April Lows

November 17, 2025

Ethereum (ETH) price has tested

the psychological $3,000 level, deepening medium-term lows and falling to the

lowest levels in over 4 months. And although the ETH price is rising today (Monday),

November 17, 2025, rebounding over 3.46% to trade at $3,199.35, my Ethereum forecasts

remain bearish.

The

cryptocurrency faces a potentially catastrophic 60% decline scenario as extreme

fear grips the market and technical signals flash warning signs of deeper

correction ahead. Let’s check together why Ethereum is falling with other

crypto and what the ETH/USDT technical chart hides.

Follow me on X for more up-to-date analysis

and forecasts on major cryptocurrencies and other financial instruments.

Bitcoin (BTC) briefly fell below

$94,000 for the first time since May 6 on Sunday, triggering a cascade across

the entire cryptocurrency market, including Ethereum. Analysts pointed to

intensifying fear among traders and flagged possible downside risks as

sentiment stayed locked in extreme fear territory. As I wrote in my previous

Bitcoin price analysis, the

oldest cryptocurrency may fall another 30% from the current levels.

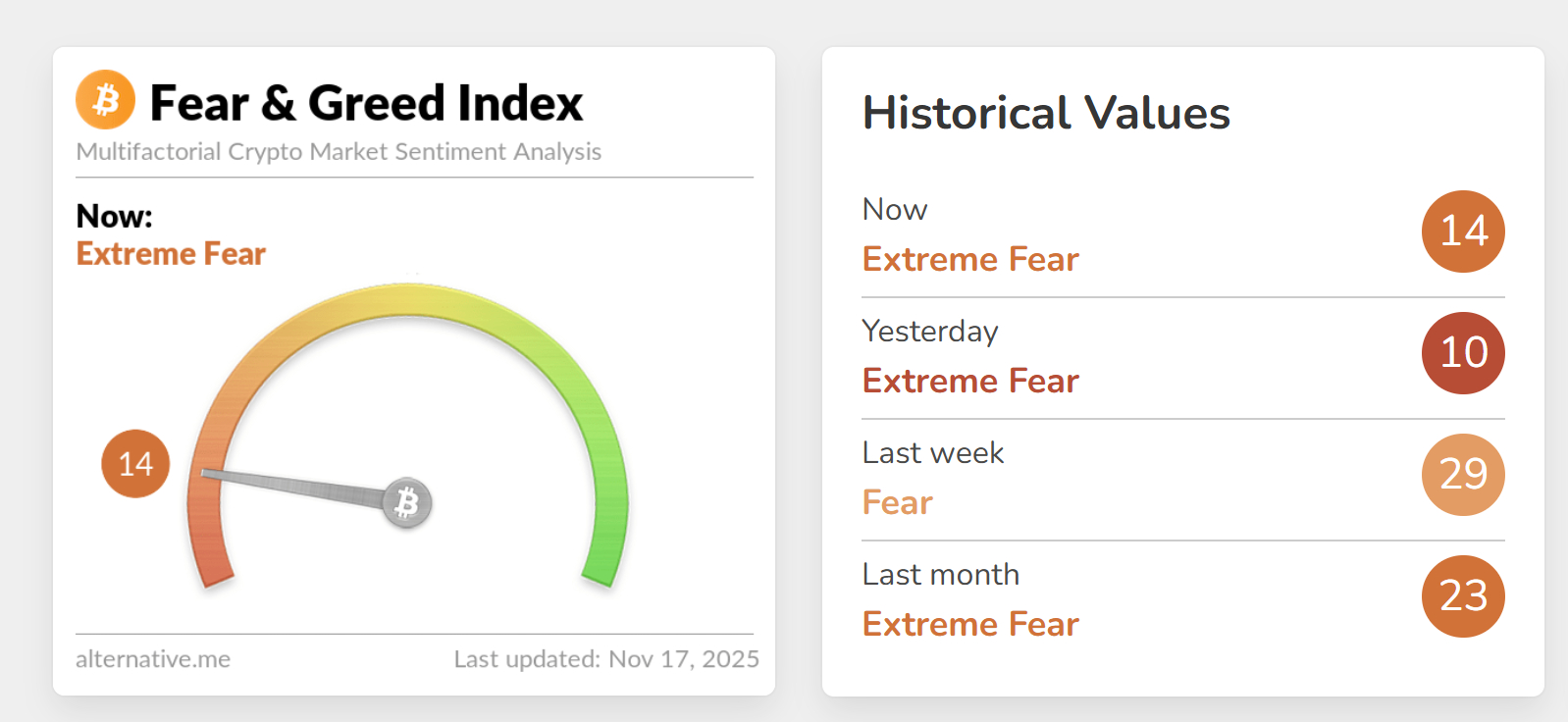

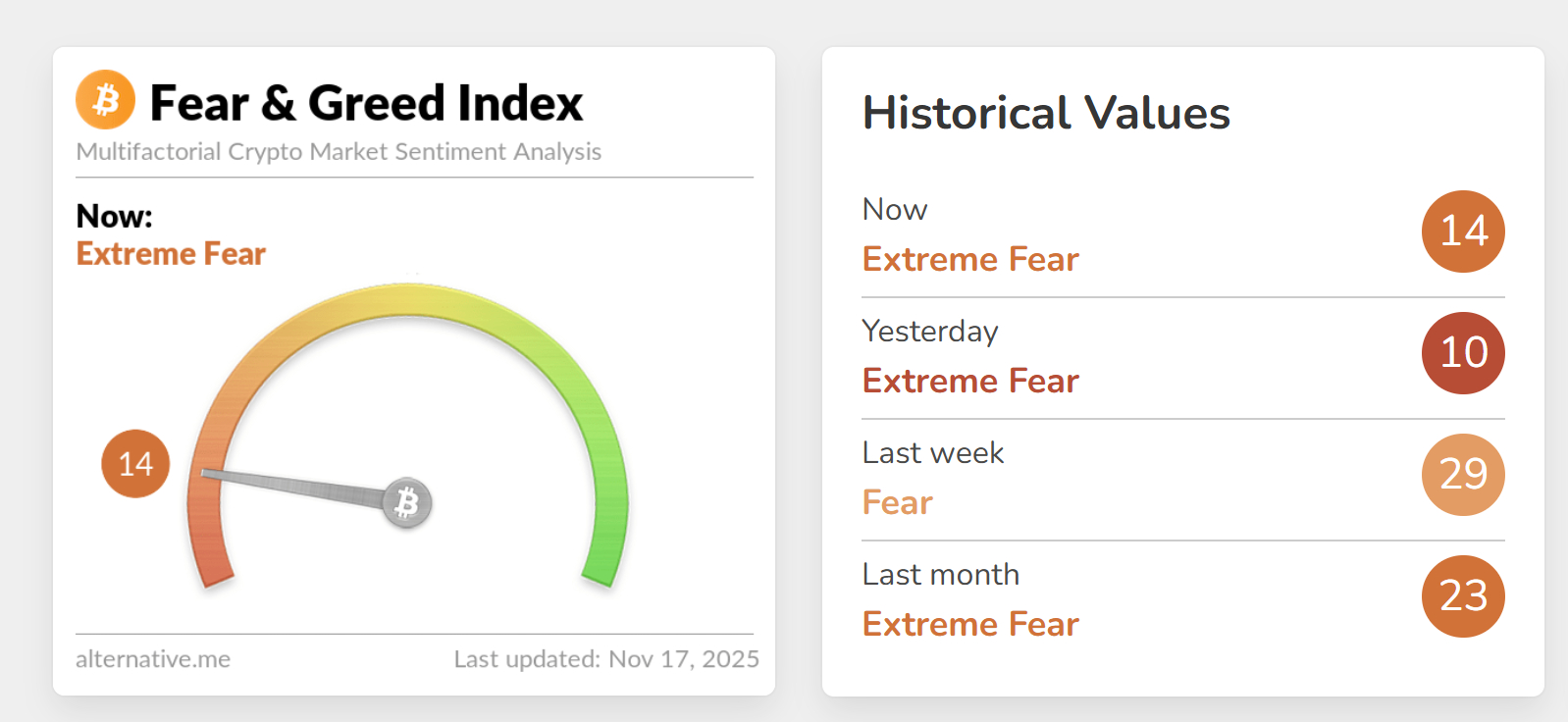

The Crypto

Fear & Greed Index stood at 10, firmly in its extreme fear band,

after already sitting at the same level on Saturday.

This

represents one of the most severe sentiment readings in 2025, reflecting

widespread panic as the crypto market experienced a $19 billion liquidation

event.

“Volatility

has not been limited to equity markets – economic uncertainty and the recent

tech sector sell-offs have had a direct and immediate impact on the price of

Bitcoin,” Hina Sattar Joshi, Director at TP ICAP Digital Assets, explained. “After

the summer’s exuberance, this month, the cryptocurrency experienced a $19

billion liquidation and continued the most sustained declines in price since

Donald Trump’s inauguration.”

Ethereum

has underperformed Bitcoin during this selloff, declining from its August year

high of $4,955.90 to current levels around $3,199.35, a decline approaching 40%

from peak levels. This underperformance signals particular weakness in the

altcoin leader as institutional and retail participants alike reduce exposure

to digital assets amid deteriorating market conditions.

Why Ethereum Is Falling

Today? Death Cross Formation Imminent

According

to my technical analysis, from this year’s highs, ETH has corrected so strongly

that, from a standard market perspective, it would mean entering a downtrend

with double force. Moreover, since the beginning of the month we’ve been moving

below the 200 EMA, which for me is a binary separation between bull trend and

bear trend.

We’ll soon

see a death cross formation on the chart as the 50 EMA is

rapidly approaching the crossover of the 200 EMA, which will be a strong sell

signal for me. Ethereum’s 50-day moving average currently sits at $3,892.98

while the 200-day moving average is at $3,467.40, a narrowing gap that suggests

the crossover could occur within days. The last time such a crossover occurred

was at the beginning of the year in February, when ETH subsequently fell 50% to

the April lows.

“This

time, the signal comes at a moment when liquidity is only starting to

stabilize, December rate-cut odds have fallen from near-certainty to ~50%, and

market risks remain unresolved, including Tom Lee’s warnings about two major

market makers facing financial deficits,” said Lacie Zhang, Research Analyst at

Bitget Wallet. “With institutional flows gradually returning, traders should

approach this cross with caution: it can reinforce a risk-off structure,

favoring defensive positioning, hedging through derivatives, or disciplined

spot accumulation.”

How Low Can Ethereum Go? -60%

Ethereum Price Prediction

How low

could Ethereum fall? According to my ETH price forecasts, if current

psychological support doesn’t hold, then price will head toward the support

zone determined by local highs from May and June this year around $2,700-$2,750,

additionally strengthened by the 61.8% Fibonacci retracement.

The next

target is $2,150, the June lows coinciding with the intraday

minimum on February 3 and the lows from August 2024. This level represents a

33% decline from current $3,199 prices and would mark a significant

psychological breakdown for Ethereum holders who accumulated during the summer

rally.

The

ultimate level of decline for me is the zone between $1,500 (September

2023 lows) and $1,370 (April 2025 minimums). If Ethereum were

heading in that direction, it could lose almost 60% from current levels. This

catastrophic scenario would take ETH back to year-low territory at $1,383.26,

essentially erasing all gains achieved since the spring bottom.

Institutional Outflows and

Macro Headwinds Are Not Helping

Linh Tran,

Market Analyst at XS.com, emphasized that the selling pressure extends beyond

retail panic: “Bitcoin fell below the USD 93,000 mark this weekend, which

is the lowest level in nearly six months. This decline marks one of the

strongest corrections since the beginning of the year. It also reflects a shift

in overall market sentiment from the risk-on optimism at the beginning of Q4 to

a more cautious and defensive risk-off tone.”

Tran

continued: “From the peak near USD 125,000 in early October, Bitcoin has

lost nearly 25% of its value, showing that the current selling pressure

does not come only from retail investors but also from institutional flows,

which are highly sensitive to macroeconomic signals.”

The $19

billion Bitcoin liquidation event described by Hina Joshi represents forced

selling that cascaded across all digital assets. When Bitcoin experiences such

massive liquidations, altcoins like Ethereum typically suffer amplified losses

as leveraged positions unwind and traders flee to cash or stablecoins for

safety.

What Would Invalidate Ethereum

Bearish Scenario?

What would

need to happen for me to start looking at the ETH/USD chart bullishly again?

First of all, we would need to return above the grid of 50 and 200 EMAs,

simultaneously at the 38.2% Fibonacci retracement. In my opinion, this would

open the way to looking again at a test of this year’s historical highs, and

earlier a return to the round level of $4,000.

Technically,

Ethereum would need to reclaim the $3,600-$3,900 zone decisively, ideally on

strong volume, to negate the death cross signal before it fully forms. This

would require approximately 12-22% gains from current $3,199 levels—a

significant move that would necessitate major positive catalysts.

Potential

catalysts for reversal include:

- Aggressive Fed easing: If December rate cut

materializes and guidance signals continued easing into 2026 - Ethereum network upgrades: The upcoming Fusaka

upgrade delivering performance improvements - Institutional ETF inflows: Resumption of flows into

Ethereum ETFs after recent outflows - Bitcoin stabilization: BTC holding above $90,000

and reclaiming $100,000 psychological level - Liquidity injection: Resolution of market

maker concerns and return of risk appetite

Ethereum Price Analysis,

FAQ

Why is Ethereum going

down?

Ethereum is

declining due to multiple converging factors: the imminent death cross

formation (50 EMA approaching crossover below 200 EMA), Crypto Fear & Greed

Index at 10 (Extreme Fear), and the $19 billion Bitcoin liquidation event

triggering cascade selling across altcoins.

Why is crypto going down?

The

cryptocurrency market is experiencing one of its strongest corrections since

the beginning of 2025, driven by a $19 billion Bitcoin liquidation event,

extreme fear sentiment (Fear & Greed Index at 10), and a shift from Q4

risk-on optimism to defensive positioning.

How low can Ethereum go?

According

to my ETH price forecasts, Ethereum faces a potential 60% decline from current

levels around $3,199 to the ultimate downside zone between $1,370-$1,500

matching April 2025 and September 2023 lows.

How much will Ethereum be

worth in 2025?

If the

imminent death cross confirms (50 EMA crossing below 200 EMA) and $3,000

support fails, my forecast shows Ethereum could decline through multiple

levels: first to $2,700-$2,750 (May/June local highs strengthened by 61.8%

Fibonacci retracement), then $2,150 (June lows coinciding with February

intraday minimum), and ultimately to $1,370-$1,500 matching April 2025 lows and

September 2023 levels.

Ethereum (ETH) price has tested

the psychological $3,000 level, deepening medium-term lows and falling to the

lowest levels in over 4 months. And although the ETH price is rising today (Monday),

November 17, 2025, rebounding over 3.46% to trade at $3,199.35, my Ethereum forecasts

remain bearish.

The

cryptocurrency faces a potentially catastrophic 60% decline scenario as extreme

fear grips the market and technical signals flash warning signs of deeper

correction ahead. Let’s check together why Ethereum is falling with other

crypto and what the ETH/USDT technical chart hides.

Follow me on X for more up-to-date analysis

and forecasts on major cryptocurrencies and other financial instruments.

Bitcoin (BTC) briefly fell below

$94,000 for the first time since May 6 on Sunday, triggering a cascade across

the entire cryptocurrency market, including Ethereum. Analysts pointed to

intensifying fear among traders and flagged possible downside risks as

sentiment stayed locked in extreme fear territory. As I wrote in my previous

Bitcoin price analysis, the

oldest cryptocurrency may fall another 30% from the current levels.

The Crypto

Fear & Greed Index stood at 10, firmly in its extreme fear band,

after already sitting at the same level on Saturday.

This

represents one of the most severe sentiment readings in 2025, reflecting

widespread panic as the crypto market experienced a $19 billion liquidation

event.

“Volatility

has not been limited to equity markets – economic uncertainty and the recent

tech sector sell-offs have had a direct and immediate impact on the price of

Bitcoin,” Hina Sattar Joshi, Director at TP ICAP Digital Assets, explained. “After

the summer’s exuberance, this month, the cryptocurrency experienced a $19

billion liquidation and continued the most sustained declines in price since

Donald Trump’s inauguration.”

Ethereum

has underperformed Bitcoin during this selloff, declining from its August year

high of $4,955.90 to current levels around $3,199.35, a decline approaching 40%

from peak levels. This underperformance signals particular weakness in the

altcoin leader as institutional and retail participants alike reduce exposure

to digital assets amid deteriorating market conditions.

Why Ethereum Is Falling

Today? Death Cross Formation Imminent

According

to my technical analysis, from this year’s highs, ETH has corrected so strongly

that, from a standard market perspective, it would mean entering a downtrend

with double force. Moreover, since the beginning of the month we’ve been moving

below the 200 EMA, which for me is a binary separation between bull trend and

bear trend.

We’ll soon

see a death cross formation on the chart as the 50 EMA is

rapidly approaching the crossover of the 200 EMA, which will be a strong sell

signal for me. Ethereum’s 50-day moving average currently sits at $3,892.98

while the 200-day moving average is at $3,467.40, a narrowing gap that suggests

the crossover could occur within days. The last time such a crossover occurred

was at the beginning of the year in February, when ETH subsequently fell 50% to

the April lows.

“This

time, the signal comes at a moment when liquidity is only starting to

stabilize, December rate-cut odds have fallen from near-certainty to ~50%, and

market risks remain unresolved, including Tom Lee’s warnings about two major

market makers facing financial deficits,” said Lacie Zhang, Research Analyst at

Bitget Wallet. “With institutional flows gradually returning, traders should

approach this cross with caution: it can reinforce a risk-off structure,

favoring defensive positioning, hedging through derivatives, or disciplined

spot accumulation.”

How Low Can Ethereum Go? -60%

Ethereum Price Prediction

How low

could Ethereum fall? According to my ETH price forecasts, if current

psychological support doesn’t hold, then price will head toward the support

zone determined by local highs from May and June this year around $2,700-$2,750,

additionally strengthened by the 61.8% Fibonacci retracement.

The next

target is $2,150, the June lows coinciding with the intraday

minimum on February 3 and the lows from August 2024. This level represents a

33% decline from current $3,199 prices and would mark a significant

psychological breakdown for Ethereum holders who accumulated during the summer

rally.

The

ultimate level of decline for me is the zone between $1,500 (September

2023 lows) and $1,370 (April 2025 minimums). If Ethereum were

heading in that direction, it could lose almost 60% from current levels. This

catastrophic scenario would take ETH back to year-low territory at $1,383.26,

essentially erasing all gains achieved since the spring bottom.

Institutional Outflows and

Macro Headwinds Are Not Helping

Linh Tran,

Market Analyst at XS.com, emphasized that the selling pressure extends beyond

retail panic: “Bitcoin fell below the USD 93,000 mark this weekend, which

is the lowest level in nearly six months. This decline marks one of the

strongest corrections since the beginning of the year. It also reflects a shift

in overall market sentiment from the risk-on optimism at the beginning of Q4 to

a more cautious and defensive risk-off tone.”

Tran

continued: “From the peak near USD 125,000 in early October, Bitcoin has

lost nearly 25% of its value, showing that the current selling pressure

does not come only from retail investors but also from institutional flows,

which are highly sensitive to macroeconomic signals.”

The $19

billion Bitcoin liquidation event described by Hina Joshi represents forced

selling that cascaded across all digital assets. When Bitcoin experiences such

massive liquidations, altcoins like Ethereum typically suffer amplified losses

as leveraged positions unwind and traders flee to cash or stablecoins for

safety.

What Would Invalidate Ethereum

Bearish Scenario?

What would

need to happen for me to start looking at the ETH/USD chart bullishly again?

First of all, we would need to return above the grid of 50 and 200 EMAs,

simultaneously at the 38.2% Fibonacci retracement. In my opinion, this would

open the way to looking again at a test of this year’s historical highs, and

earlier a return to the round level of $4,000.

Technically,

Ethereum would need to reclaim the $3,600-$3,900 zone decisively, ideally on

strong volume, to negate the death cross signal before it fully forms. This

would require approximately 12-22% gains from current $3,199 levels—a

significant move that would necessitate major positive catalysts.

Potential

catalysts for reversal include:

- Aggressive Fed easing: If December rate cut

materializes and guidance signals continued easing into 2026 - Ethereum network upgrades: The upcoming Fusaka

upgrade delivering performance improvements - Institutional ETF inflows: Resumption of flows into

Ethereum ETFs after recent outflows - Bitcoin stabilization: BTC holding above $90,000

and reclaiming $100,000 psychological level - Liquidity injection: Resolution of market

maker concerns and return of risk appetite

Ethereum Price Analysis,

FAQ

Why is Ethereum going

down?

Ethereum is

declining due to multiple converging factors: the imminent death cross

formation (50 EMA approaching crossover below 200 EMA), Crypto Fear & Greed

Index at 10 (Extreme Fear), and the $19 billion Bitcoin liquidation event

triggering cascade selling across altcoins.

Why is crypto going down?

The

cryptocurrency market is experiencing one of its strongest corrections since

the beginning of 2025, driven by a $19 billion Bitcoin liquidation event,

extreme fear sentiment (Fear & Greed Index at 10), and a shift from Q4

risk-on optimism to defensive positioning.

How low can Ethereum go?

According

to my ETH price forecasts, Ethereum faces a potential 60% decline from current

levels around $3,199 to the ultimate downside zone between $1,370-$1,500

matching April 2025 and September 2023 lows.

How much will Ethereum be

worth in 2025?

If the

imminent death cross confirms (50 EMA crossing below 200 EMA) and $3,000

support fails, my forecast shows Ethereum could decline through multiple

levels: first to $2,700-$2,750 (May/June local highs strengthened by 61.8%

Fibonacci retracement), then $2,150 (June lows coinciding with February

intraday minimum), and ultimately to $1,370-$1,500 matching April 2025 lows and

September 2023 levels.

Search

RECENT PRESS RELEASES

What Europe needs to scale renewable energy in agriculture

SWI Editorial Staff2025-11-17T09:08:16-08:00November 17, 2025|

India power regulator warns renewable projects of disconnection for grid violations

SWI Editorial Staff2025-11-17T09:07:53-08:00November 17, 2025|

Jeff Bezos reportedly returns to the trenches as co-CEO of new AI startup, Project Prometh

SWI Editorial Staff2025-11-17T09:07:27-08:00November 17, 2025|

Amazon launches $12 billion bond sale as AI boom fuels need for capital

SWI Editorial Staff2025-11-17T09:07:00-08:00November 17, 2025|

Jeff Bezos returns as co-CEO of $6.2B AI startup Prometheus

SWI Editorial Staff2025-11-17T09:06:36-08:00November 17, 2025|

Investors Are Sick of Amazon

SWI Editorial Staff2025-11-17T09:06:09-08:00November 17, 2025|

Related Post