Ethereum Whales Stare Down 9 Figures in Liquidations Amid Market Crash

March 11, 2025

Crashing Ethereum price sees whales scrambling to sure up large loans.

Whales, referring to crypto investors with significantly large holdings, are typically known for preempting and driving market moves. But not even this class of investors has been spared in the recent bloodbath.

Over the past 24 hours, reports from leading on-chain trackers suggest that a number of these investors with significant Ethereum holdings have been left scrambling amid the market’s most recent retreat, which has seen the asset drop 18% from a high of around $2,150 to as low as $1,750.

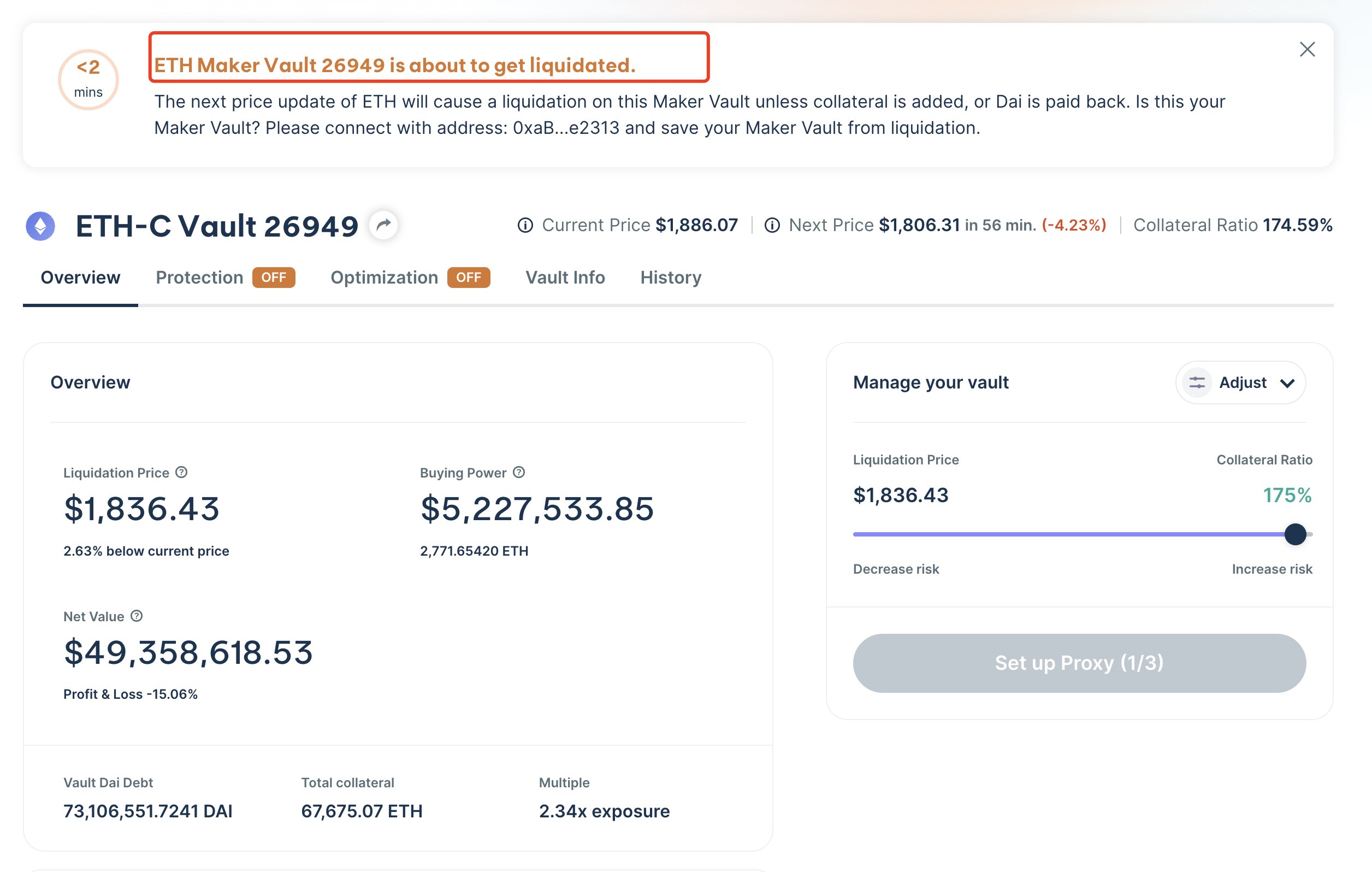

As highlighted by crypto smart money tracker Lookonchain, one whale who took out a loan of over 73 million DAI with over 67,000 ETH (nearly $122 million) in collateral on Maker should have been liquidated as ETH fell below $1800 as its liquidation price was around $1,836.

However, the whale appears to have been saved by oracle pricing inefficiencies that placed the price of ETH just below $1,900 and afforded it time to pay back some 1.53 million DAI of its debt and sell nearly 3,000 ETH of its collateral to achieve a new liquidation price of $1,781, even has ETH rebounded to $1,900 at the time of writing.

Another whale on Maker, with nearly 61,000 ETH worth $109 million in collateral and a liquidation price of $1,798.64, also appears to have been saved by oracle inefficiencies and the slight market rebound. Unlike the previous whale, this whale did not have to put up any fresh collateral or try to pay off its loan.

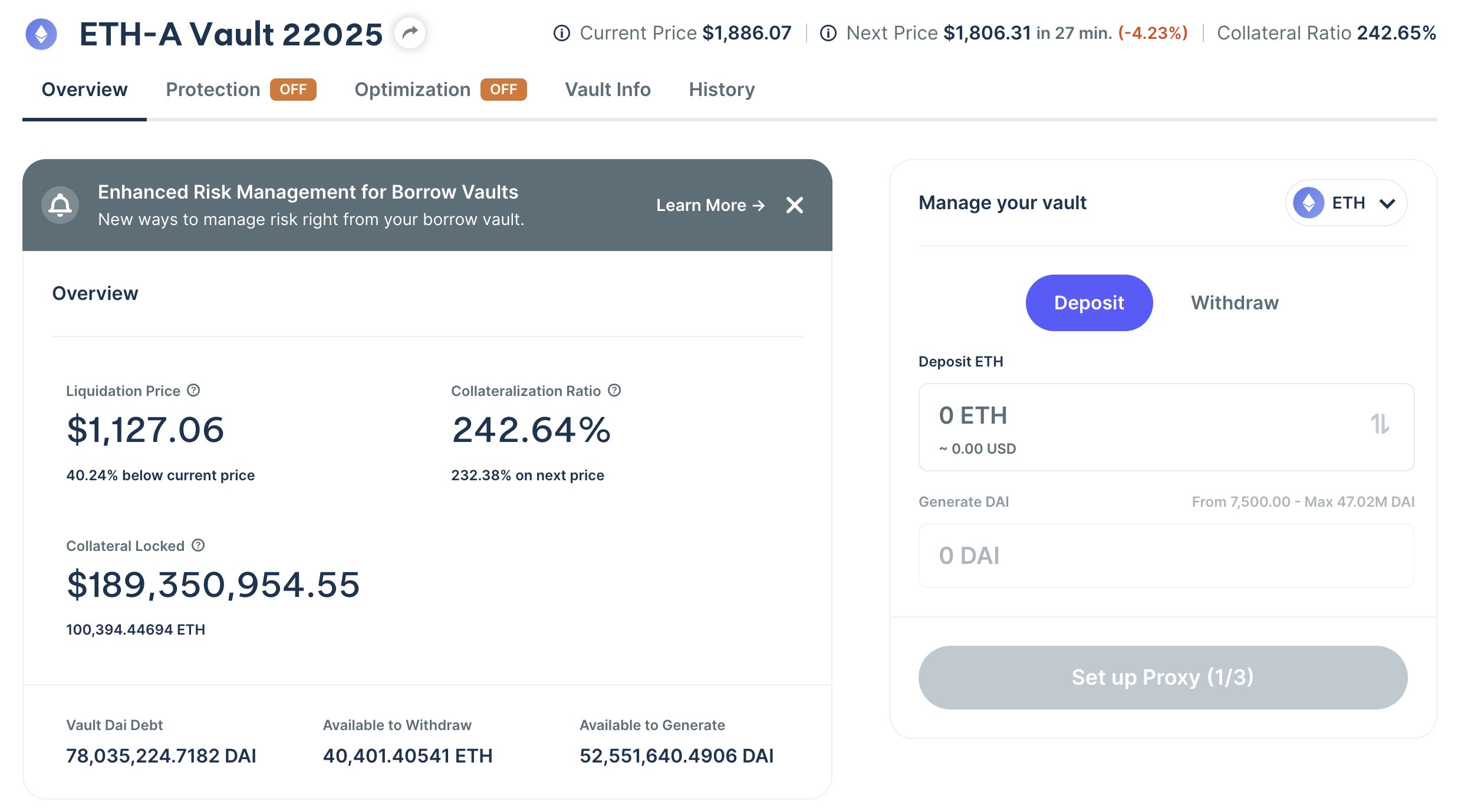

Meanwhile, a whale with ties to the Ethereum Foundation had to nearly double its risk by sending an additional 30,000 ETH worth over $56 million in collateral to Maker to bring its total collateral to over 100,000 ETH worth $182 million with a liquidation price of $1,127.06.

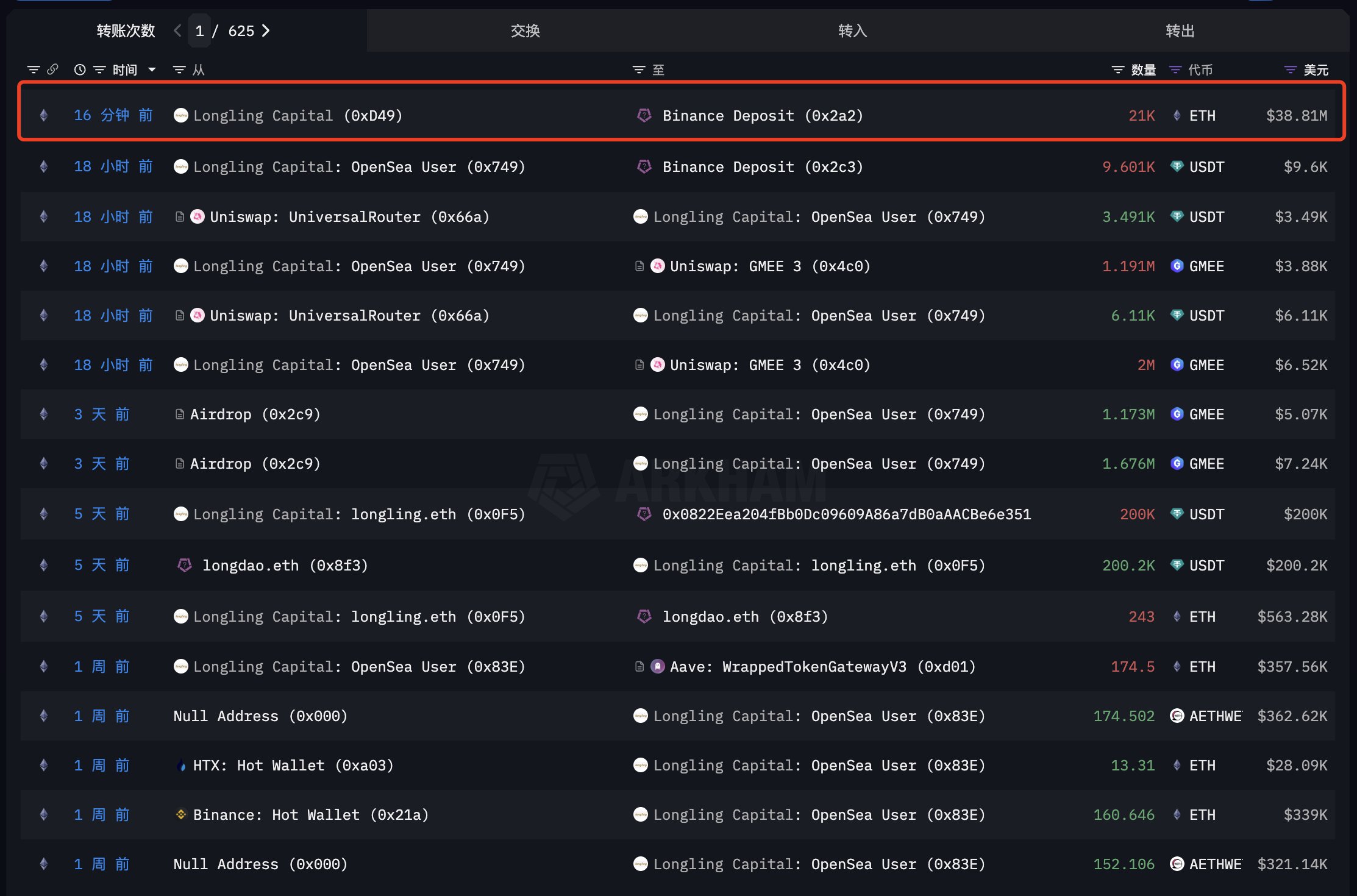

At the same time, Longling Capital, founded by Meitu founder Cai Wensheng, is also suspected to be among the whales facing liquidation risk. Over the past 24 hours, the firm has sold 21,000 ETH on Binance worth nearly $39 million and sent another 299 ETH to Aave in suspected loan rebalancing efforts.

The venture capital firm is no stranger to large Ethereum liquidations, as it had lost 94,000 ETH worth $114 million to liquidations in the 2022 bear market.

The recent market bloodbath comes as trade war concerns have quickly devolved into recession fears. Beyond crypto, the Nasdaq Composite fell 4% in its worst session since September 2022, while the S&P 500 dropped 2.7% to trade near 5-month lows.

Search

RECENT PRESS RELEASES

Related Post