Ethereum’s POS Deposit Contract Closing In On Holding Half of Entire Supply!

January 16, 2026

@SanSights

2 min read 17.01.2026

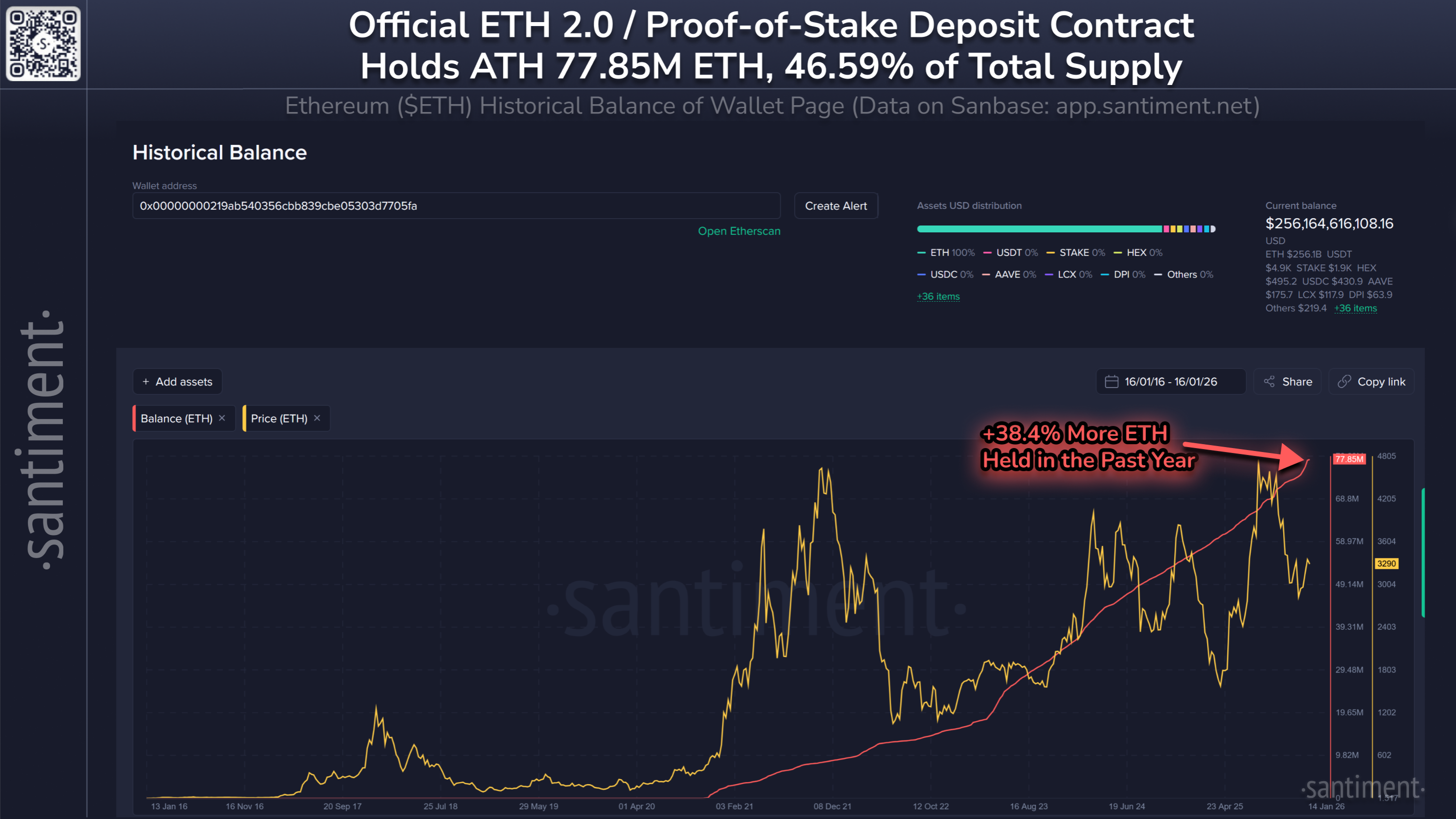

📊 The official ETH 2.0 / Proof-of-Stake deposit contract now holds 77.85M $ETH worth just over $256B, rising by 38.4% coins held in the past year.

💸 Its purpose is to hold ETH that has been staked by validators to secure the Ethereum network. There is common misinformation that occasionally spreads about this being a “whale” wallet, but the good news is that this staking wallet can’t suddenly hit exchanges. It can only be withdrawn slowly through validator exits, which are rate-limited by the protocol.

🤔 Though it may seem jarring when a coin has a whopping 46.59% of its entire supply held in one wallet, this actually signals the major increased interest in long-term staking from network users.

🫠 However, bears will often refer to the off chance that this wallet’s size can lead to liquidity risk. If $ETH’s price drops sharply and many validators want to exit in a short period of time, there can be slowed or delayed withdrawals or “pent-up supply”. Some may argue that too much ETH could be influenced by a small number of entities over time.

🤷 The glass half full argument is: “Almost half of ETH is locked by people who believe and trust in Ethereum’s network long term.”

😟 The glass half empty argument is: “So much ETH is locked into staking that if many holders decide to exit in the future, it could artificially manipulate and influence prices.”

Search

RECENT PRESS RELEASES

Related Post