Ethereum’s road map to $6000+ is still intact.

June 11, 2025

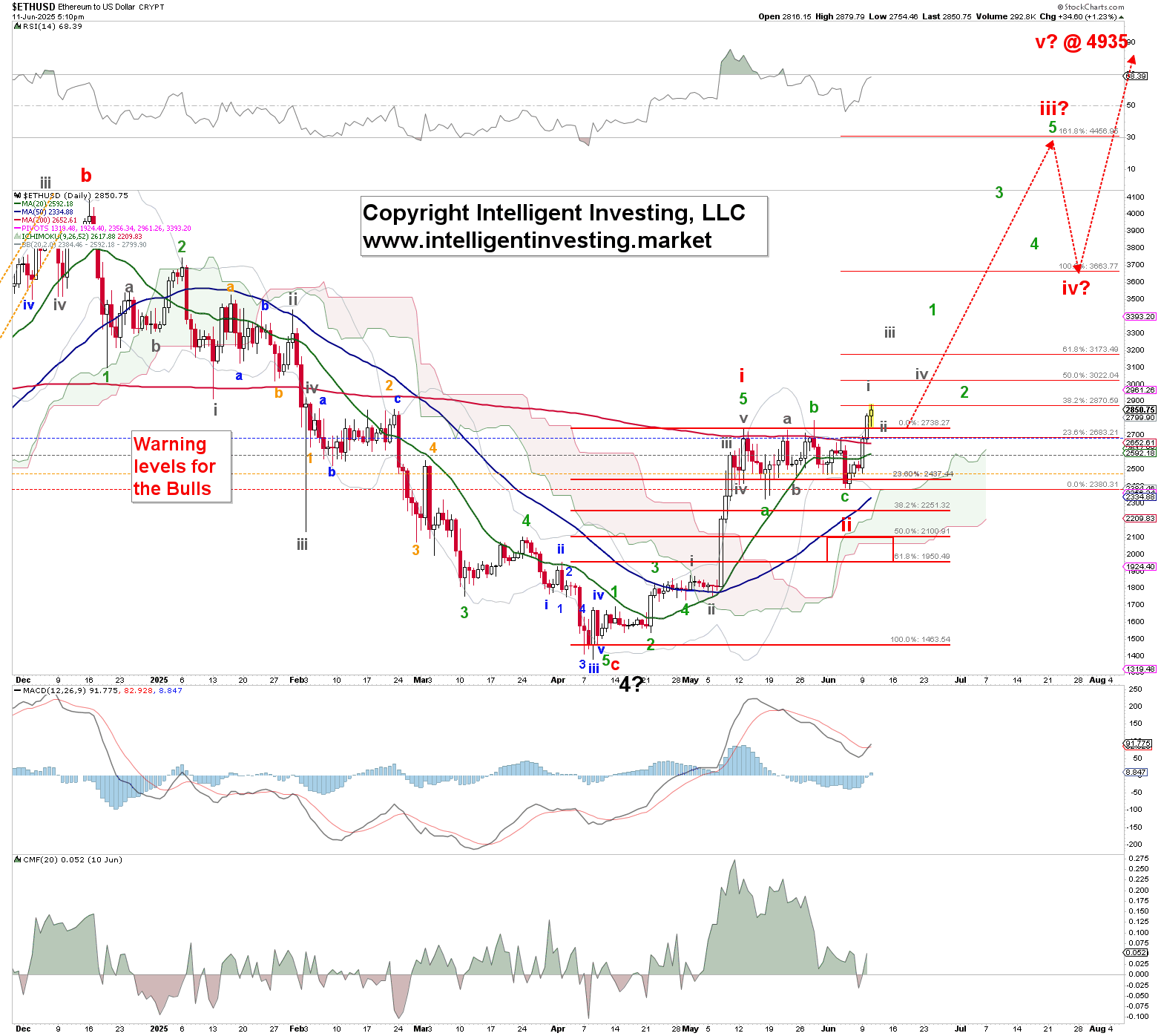

Our previous update indicated that, according to the Elliott Wave (EW) Principle, for Ethereum (ETH)

“…. [Alternatively], if the Bulls can’t clear the 200-day SMA and the price falls below last week’s low, then

the red W-i of the new bull run to $6100+ has already peaked. In that scenario, we can expect Ether to

reach around $2100 a bit sooner, before the rally to approximately $5000 begins.”

Fast forward three weeks, and Ether had been unable to break above the (Red) 200-d SMA until

Monday, thereby following our alternative path. However, it stalled at approximately $2380, resulting in

just a ~23.8% retracement instead of the more typical 50-61.8% retracement for a second wave (Red w-

ii). More about that in a moment. See Figure 1 below.

Figure 1. Our preferred short-term EW count for Ethereum.

Although its shallow, the red W-ii is acceptable and the red W-iii is starting, as ETH is finally breaking

through its (Red) 200d SMA. Therefore, the red W-iii should now be underway and will subdivide into

five smaller (green) waves. Those, in turn, will further subdivide into five even smaller (gray) waves, etc.

Consequently, the gray W-i of the green W-1 of the red W-iii should now be underway. The ideal Fib-

based targets for the red W-iii, iv, and v are minimums since we still expect at least $6100+ to be

reached based on the bullish pennant pattern we’ve shared before.

Although the retracement for the red W-ii was not as deep as expected, its important to note that

markets do not have to follow textbook retracements (50-62%) as corrections. The purpose of

correcting, from a technical perspective, is to eliminate overbought conditions. This can be achieved

either through time (sideways) or price (deep). Therefore, given the sideways price action, our

alternative now is that the current rally from Friday’s low represents the green W-5 of the red W-i. See

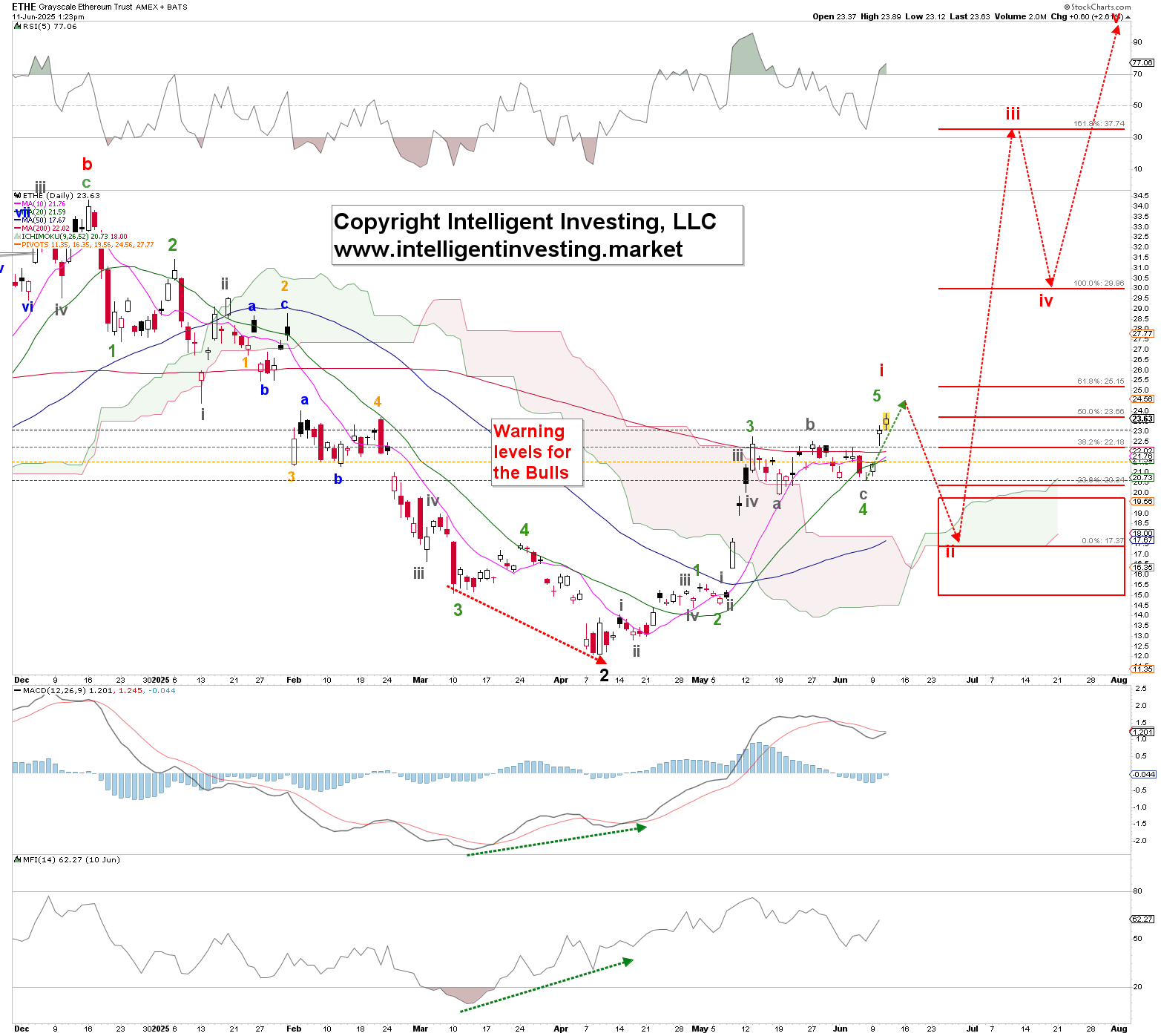

Figure 2 below.

Figure 2. Our alternative, short-term EWP count for Ethereum.

Here, we use the Grayscale Ethereum Trust (ETHE) Exchange-Traded Fund (ETF) to illustrate what that

would look like. In this case, we anticipate the red W-i to peak at around $25 for ETHE and

approximately $ 3,000 for ETH. From there, we can still expect a deeper red W-ii to ideally be around $

2,250 +/- $ 75 for Ethereum and $ 17.50 +/- $ 2.50 for ETHE, before the red W-iii kicks in. However, the

bears will need to push the price back below last Friday’s low (ETHE $20.60, ETH $2385) to initiate this

alternative. Therefore, we have, thanks to the EW, an excellent stop level, i.e., risk/reward, to work with

if desired.

Regardless, both paths lead to Rome, so to speak, and we must not lose sight of what truly matters: the

third wave to ~$5000+ for ETH. See the forest for the trees, because “big gains come from big time

frames,” as the short term is always more variable and uncertain than the long term. We present these

two options not to confuse, but to clarify our expectations. We’re simply thinking ahead, and neither

price movement will catch us off guard, allowing us to be prepared. While we update our analysis and

insights daily for our Premium Newsletter members, we’ll check in with you again here in a few weeks.

The analysis is derived from data believed to be accurate, but such accuracy or completeness cannot be guaranteed. It should not be assumed that such analysis, past or future, will be profitable, equal past performance, or guarantee future performance or trends. All trading and investment decisions are the sole responsibility of the reader. The inclusion of information about positions and other information is not intended to be any type of recommendation or solicitation.

Search

RECENT PRESS RELEASES

Related Post