EXL and InsureMO’s Digital Partnership Might Change the Case for Investing in ExlService H

September 21, 2025

- EXL recently announced a teaming agreement with InsureMO to provide insurers worldwide with an accelerated and flexible path to core system modernization, AI integration, and digital transformation by combining EXL’s insurance expertise and InsureMO’s digital infrastructure.

- This collaboration has already enabled insurers to quickly launch new products while achieving significant operational cost savings, suggesting immediate and practical benefits for insurance businesses adopting the integrated solution.

- We’ll examine how this partnership, which promises faster AI-enabled product launches for insurers, could shape ExlService’s investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Advertisement

ExlService Holdings Investment Narrative Recap

To own shares in ExlService Holdings, you need to believe that accelerating adoption of AI and digital transformation in insurance and regulated industries will drive meaningful, sustainable earnings and revenue growth. The new partnership with InsureMO may strengthen ExlService’s access to larger modernization projects and reinforce a key short-term catalyst, expansion of higher-value AI-driven services, but does not immediately offset the persistent risk of rising talent costs linked to wage inflation in outsourcing hubs.

Of recent company developments, the August 2025 opening of ExlService’s international headquarters in Dublin most closely complements the InsureMO collaboration. Establishing a dedicated AI Innovation Lab and hiring local tech talent reinforces ExlService’s broader push to scale leading-edge solutions globally, in turn enabling faster delivery of complex modernization projects that are central to near-term growth drivers.

But on the other hand, investors should also be aware of the ongoing challenge posed by rising wage inflation and…

Read the full narrative on ExlService Holdings (it’s free!)

ExlService Holdings’ narrative projects $2.7 billion revenue and $326.3 million earnings by 2028. This requires 10.9% yearly revenue growth and a $90 million earnings increase from $236.3 million.

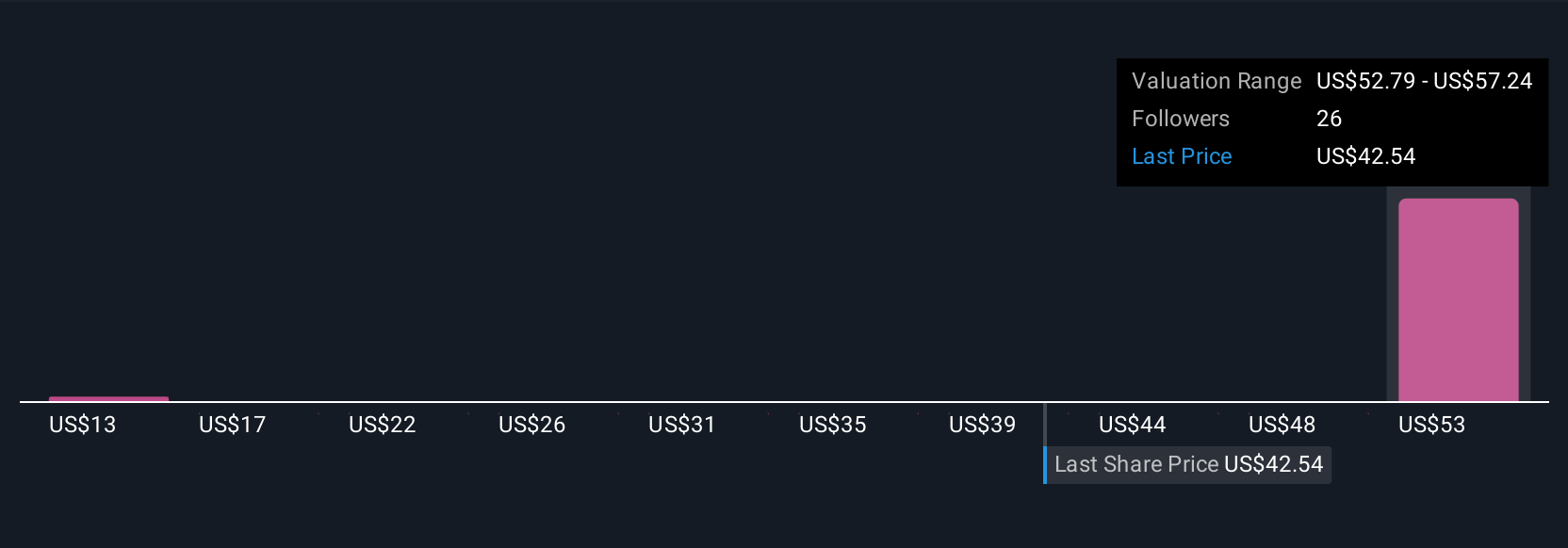

Uncover how ExlService Holdings’ forecasts yield a $54.14 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three members of the Simply Wall St Community range widely from US$12.70 to US$54.71 per share. While opinions differ, ongoing expansion into AI-driven modernization projects may affect how future performance measures up against these diverse expectations.

Explore 3 other fair value estimates on ExlService Holdings – why the stock might be worth less than half the current price!

Build Your Own ExlService Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ExlService Holdings research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate ExlService Holdings’ overall financial health at a glance.

No Opportunity In ExlService Holdings?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post